Air Products (NYSE:APD) announced the commencement of its integrated oxy-fuel solution’s supply to Chengdu Jin Gu Pharmaceutical Packaging Co., Ltd. in Sichuan Province, western China, for the production of pharmaceutical glass containers.

One of China's leading pharmaceutical glass packaging companies – Jin Gu’s manufacturing process involves advanced technologies that include Air Products' cutting-edge offering. The company has set an industry benchmark for the pharmaceutical glass market in China with proven results of successful oxy-fuel conversion. These credentials will further help other glass manufacturers in the western region to address the increasingly stringent environmental regulations through innovative oxy-fuel technology.

Oxy-fuel technology provides several benefits. It is instrumental in lowering over 50% nitrogen oxide emissions. Other benefits include 10–20% in energy savings, about 25% production augmentation, reduction of capital, and improvement in efficiency and glass quality.

In order to support Jin Gu in converting furnaces to oxy-fuel, Air Products has customized an integrated solution that encompasses the company's Cleanfire mini HRi oxy-fuel burners, liquid oxygen, technical support on glass formulation improvement, and computational fluid dynamics simulations of the glass melting furnace to ensure smooth conversion under a tight schedule.

Air Products is known for its leadership and worldwide track record in oxy-fuel technology within the pharmaceutical and overall glass industry. This strengthens the company’s commitment to support the sustainable development of China's glass industry. In addition to Jin Gu, Air Products also provides its integrated oxy-fuel solution to other types of glass makers, including fiberglass, glass containers for food and drink, and heat resistant glass for home appliances.

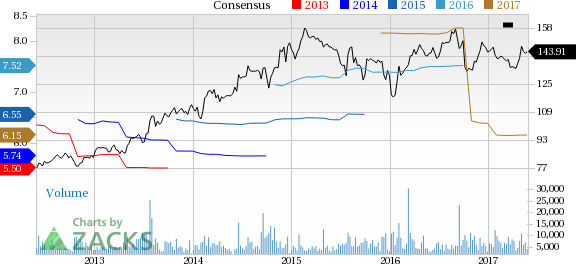

Air Products has underperformed the Zacks categorized Chemicals-Diversified industry over the past six months. The company’s shares have dipped around 0.4% over this period, compared with roughly 7.2% gain recorded by the industry.

Air Products’ second-quarter fiscal 2017 adjusted earnings topped the Zacks Consensus Estimate. Sales rose by double-digits year over year, and beat expectations.

For fiscal 2017, Air Products expects adjusted earnings per share of $6.00 to $6.25, which at midpoint, represents a 9% increase over last year. For third-quarter fiscal 2017, Air Products anticipates adjusted earnings per share from continuing operations of $1.55 to $1.60 per share, which at midpoint, also represents a 9% increase over last year.

Air Products is well placed to leverage the cyclical recovery in core industrial end-markets. The company has built a strong project backlog. These projects are expected to be accretive to earnings and cash flow over the next few years. Acquisitions and new business wins are expected to continue to drive results in the near term. The company is also progressing well with its $600 million cost-cutting program.

Air Products also has significant amount of cash to invest in its core industrial gases business. The company expects to have roughly $8 billion to deploy in strategic, high-return opportunities to create shareholders value over the next three years.

However, the company’s industrial gases business in the EMEA region is seeing pressure from a weak operating environment. The company is also seeing lower volumes in Latin America due to weak demand. Moreover, volumes in packaged gases continue to be weak while LNG sales remain under pressure due to low project activity. The company is also exposed to currency headwinds.

Air Products and Chemicals, Inc. Price and Consensus

Air Products currently carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some better-ranked companies in the chemical space include BASF SE (OTC:BASFY) , The Chemours Company (NYSE:CC) and Kronos Worldwide Inc (NYSE:KRO) . All the three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

BASF has expected long-term growth of 8.6%.

Chemours has expected long-term growth of 15.5%.

Kronos has expected long-term growth of 5%.

Looking for Ideas with Even Greater Upside?

Today's investment ideas are short-term, directly based on our proven 1 to 3 month indicator. In addition, I invite you to consider our long-term opportunities. These rare trades look to start fast with strong Zacks Ranks, but carry through with double and triple-digit profit potential. Starting now, you can look inside our home run, value, and stocks under $10 portfolios, plus more.

Click here for a peek at this private information >>

BASF SE (BASFY): Free Stock Analysis Report

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post