Air Products (NYSE:APD) has expanded the capabilities of its patented Mobile Cryogenic Hydrogen Compressor (CHC) to meet the growing needs of urgent and cyclical gas supply. The improved CHC system can not only directly connect to a customer's house-line to supply gaseous hydrogen to its operation, but can also serve as a mobile transfill system by filling gas tube trailers at a customer's site.

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

The Mobile CHC is part of the company's Air Products Express Services (APEX), which provides safe, reliable and fast temporary gas supply. Additionally, it offers higher pressure and flow capabilities than other systems available in the market. The system also provides significant operational efficiencies, including improved site safety management, use of existing infrastructure and utilities, zero capital investment, lower distribution costs, and increased reliability of supply.

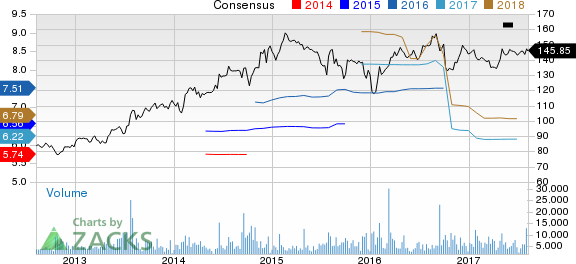

Air Products has underperformed the industry over the last six months. The company’s shares have moved up around 4.1% over this period, compared with roughly 7% gain recorded by the industry.

The company has increased its adjusted earnings per share guidance for fiscal 2017. For the full year, Air Products expects adjusted earnings per share of $6.20–$6.25 (up from $6.00–$6.25 expected earlier), which at midpoint, represents a 10% increase over last year. For the fourth-quarter fiscal 2017, Air Products anticipates adjusted earnings per share from continuing operations of $1.65–$1.70 per share, which at midpoint, also represents a 12% increase over last year.

Air Products is well placed to leverage the cyclical recovery in core industrial end-markets. The company has built a strong project backlog. These projects are expected to be accretive to earnings and cash flow over the next few years. Acquisitions and new business wins are expected to continue to drive results. The company is also progressing well with its $600 million cost-cutting program.

Air Products also has significant amount of cash to invest in its core industrial gases business. The company expects to have roughly $8 billion to deploy in strategic, high-return opportunities to create shareholders value over the next three years.

Air Products and Chemicals, Inc. Price and Consensus

Air Products and Chemicals, Inc. (APD): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Arkema SA (ARKAY): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post