I screened my database by stocks which have raised their dividend payments over more than 25 consecutive years in order to find the next pick for my Dividend Yield Passive Income Portfolio (DYPI). I’m still locking stock stocks with a yield above the 3 percent mark.

After the recent earnings announcements, it could be possible to get some new interesting picks.

The earnings season started mixed. Some of the great dividend stocks announced better than expected results and the stock price exploded. Others reported bad results and the stock price plunged. I noticed a higher volatility in my trading segment. I personally think that the 10 percent gain on major indices within only 3 month was definitely too much and without value. With the current earnings reports and the ongoing Euro crisis, some investors come back to normal.

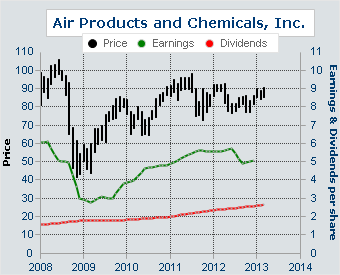

What does my screen delivered? One stock that is not yet in my DYPI-Portfolio is Air Products & Chemicals (APD). The company was often subject of my research and highly discussed by my readers. I called APD a Dividend Champion with a higher volatility because in recessions, the earnings could decrease by 50 percent with bad influence to the stock price.

So, my ideas getting rare and I need to find solutions. As a long-term investor, you are not interested in current market situations; you buy a structure with long-term growth potential. Only a growing business is a good business. A company that generates in 10 years the twice amount of sales and 150 percent more earnings should have a higher valuation if further growth is expected.

APD fulfill these criteria, despite the fact that they are more cyclic like my loving companies McDonalds, Coca Cola or even Procter & Gamble. APD raised its dividends over a period of 31 consecutive years and is a good dividend growth stock. Its current yield amounts to 3.31 percent and the P/E is at 17.49. The forward P/E is still cheap with a ratio of 13.41.

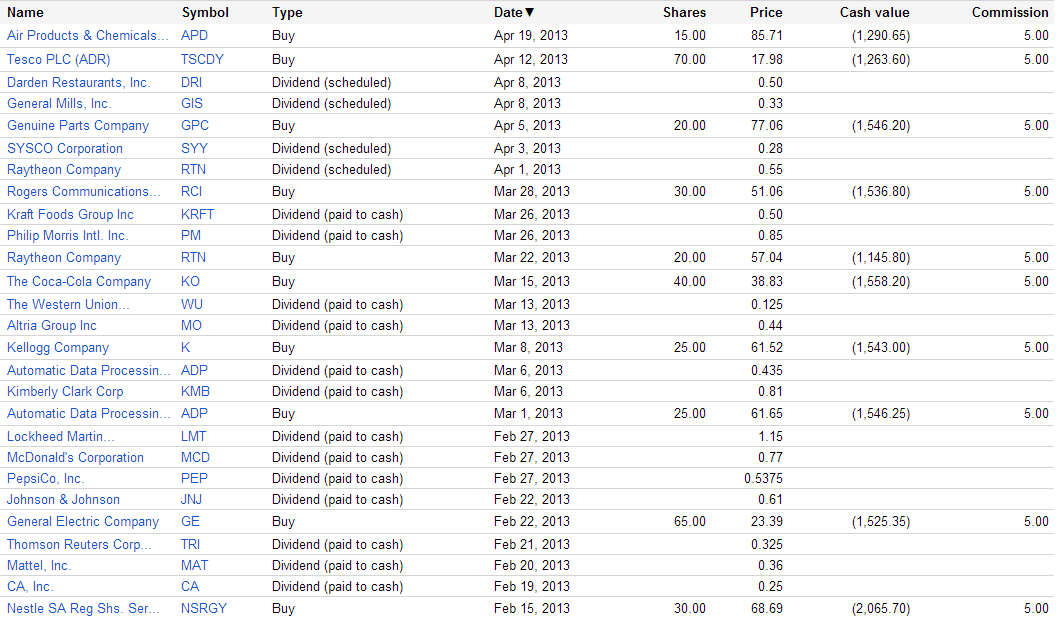

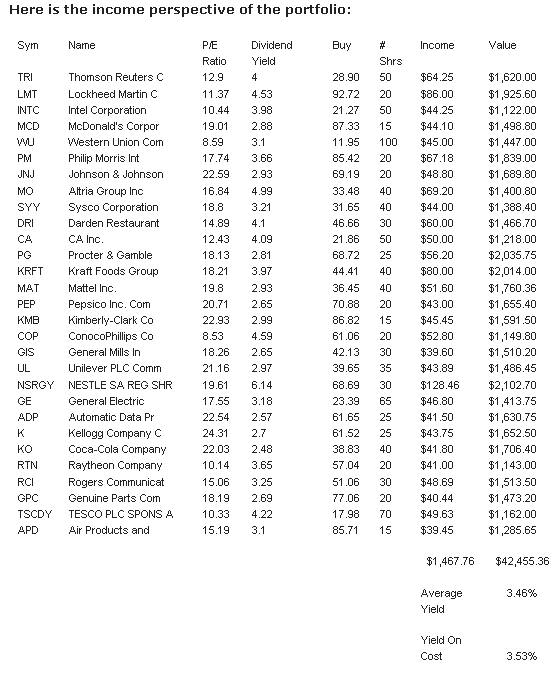

I purchased 15 shares at $85.71. The total amount was $1,285.65 and represents roughly 1.24 percent of the full portfolio market value. The DYPI-Portfolio was funded on October 04, 2012 with $100,000 virtual. The strategy is to buy the best dividend paying growth stocks and hold them for the long-term.

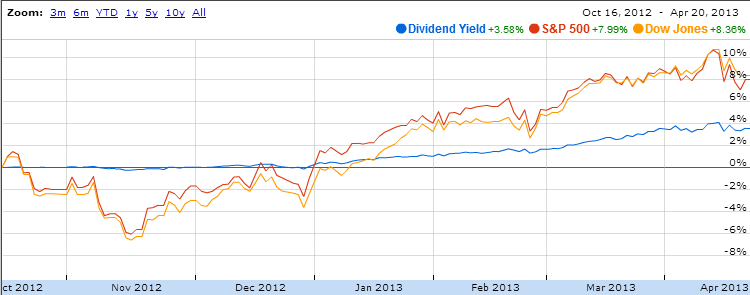

As of now, the current stock holdings produced a gain of 7.63%, a value in-line with the current market developments. Because of the high cash amount of $58,975.02, the full portfolio has only a performance of 3.58 percent.

The new stake will give me around $40 bucks in additional dividends per year. The full year dividend income of the complete portfolio is now estimated at $1,467.76. I plan to boost the income to a total income of $3,000 to $4,000. All I need to do is to buy stocks with a yield of more than 3 percent.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Air Products & Chemicals Is New In My Passive Income Portfolio

Published 04/22/2013, 02:04 AM

Updated 07/09/2023, 06:31 AM

Air Products & Chemicals Is New In My Passive Income Portfolio

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.