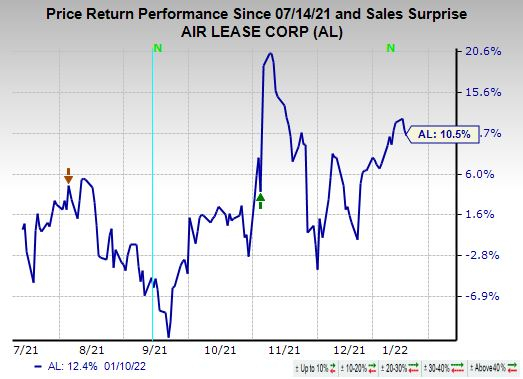

Shares of Air Lease (NYSE:AL) Corporation AL have increased 10.5% in the past six months primarily due to strong liquidity and dividend hikes.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Reasons for Upside

We are impressed by Air Lease’s endeavors to reward shareholders. The company has an impressive dividend payment history. In November, the company’s board approved a dividend hike of approximately 15.6% to 18.5 cents per share (annually: 74 cents). This marks the company’s 9th dividend increase since February 2013, when it began distributing dividends. Such moves boost shareholder’s confidence.

At the end of the third quarter, Air Lease had a strong liquidity position of $8.4 billion, which should help the company tackle coronavirus-induced challenges efficiently. The carrier's current ratio (a measure of liquidity) at the end of the same period was 3.49, well above 2.32 recorded at the end of second-quarter 2021.

Favorable Estimate Revisions

Driven by the above tailwinds, the Zacks Consensus Estimate for its current-year earnings has increased 4.2% to $4.47 per share in the past 60 days.

Zacks Rank & Other Stocks to Consider

Air Lease currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Investors interested in the broader Zacks Transportation sector can also consider stocks like J.B. Hunt Transport Services JBHT, FedEx Corporation (NYSE:FDX) FDX and Schneider National (NYSE:SNDR) SNDR.

The long-term expected earnings per share (three to five years) growth rate for J.B. Hunt is pegged at 15%. J.B. Hunt is benefiting from strong performances by all its segments. The Dedicated Contract Services (DCS) unit is being aided by fleet-productivity improvement and a rise in average revenue-producing trucks. The Integrated Capacity Solutions (ICS) unit is gaining from a favorable customer freight mix as well as higher contractual and spot rates.

JBHT’s measures to reward its shareholders are encouraging. Driven by the tailwinds, the stock has rallied 33.5% in the past year. J.B. Hunt currently carries a Zacks Rank #2 (Buy).

The long-term expected earnings per share (three to five years) growth rate for FedEx is pegged at 12%. FedEx is benefitting from a surge in e-commerce demand amid the pandemic.

FDX exited first-quarter fiscal 2022 with cash and equivalents of $6,853 million, much higher than its current debt of $125 million. Driven by the tailwinds, the stock has moved up 7% in the past month. FedEx currently carries a Zacks Rank #2.

The long-term expected earnings per share (three to five years) growth rate for Schneider is pegged at 20.7%. Schneider benefits from a strong performance by the Intermodal and Logistics units.

SNDR’s third-quarter cash balance is also encouraging. Driven by the tailwinds, the stock has moved up 15.3% in the past year. Schneider currently carries a Zacks Rank #2.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix (NASDAQ:NFLX) did to Blockbuster and Amazon (NASDAQ:AMZN) did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

J.B. Hunt Transport Services, Inc. (JBHT): Free Stock Analysis Report

FedEx Corporation (FDX): Free Stock Analysis Report

Air Lease Corporation (AL): Free Stock Analysis Report

Schneider National, Inc. (SNDR): Free Stock Analysis Report

To read this article on Zacks.com click here.