American International Group Inc. (NYSE:AIG) reported second-quarter 2017 operating income of $1.53 per share that surpassed the Zacks Consensus Estimate by a good 27.5%. Earnings were up 33% year over year.

Better-than-expected earnings were driven by strong performance by the company’s consumer business, partially offset by losses incurred by its commercial business. Also, cost-control efforts and shares bought back during the quarter aided the bottom line.

The company is getting along well with its expense reduction program (taken up in Jan 2016 to reduce cost base by $1.4 billion by the end of 2017) as evident by a 15.6% decline in general operating and other expenses (GOE) to $2.2 billion.

Quarterly Segment Highlights

Commercial Insurance

Net premiums written were down 15% (or 9% on a constant dollar basis) year over year to $3.8 billion due to strategic portfolio actions and an unfavorable market.

Combined ratio of 102.7% deteriorated 440 basis points year over year, primarily due to an increase in loss ratio.

The segment’s pre-tax operating income of $716 million increased 24% year over year.

Consumer Insurance

Premium and fees of $3.9 billion remained unchanged year over year. Operating revenues declined 2% year over year to 696 million, due to a decline in revenues from Group Retirement and Individual Retirement sub-segments partly offset by growth in the Life Insurance sub-segment.

Pre-tax operating income increased 33% year over year to $1.3 billion, primarily driven by a decline in benefits and expenses.

Financial Position

At the end of the second quarter, the insurer’s adjusted book value per share (excluding AOCI) was $76.12, up 0.9% year over year.

Core adjusted return on equity (ROE) was 10.5%, up 90 basis points year over year. The improvement in return came on the back of active capital management and expense efficiencies.

In the second quarter, AIG spent $2.4 billion on share repurchase.

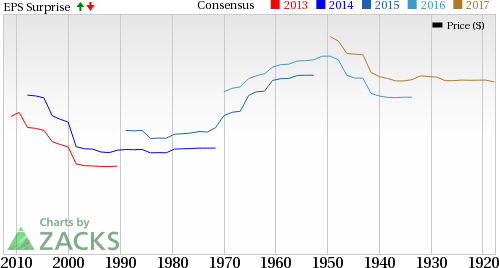

American International Group, Inc. Price, Consensus and EPS Surprise

Our Take

AIG’s results reflect good progress on efforts taken to return to profitability. The company’s new CEO Brian Duperreault, who was appointed during the quarter, is expected to improve operations at the insurance giant, by completing the restructuring initiatives already underway and making further changes. Nevertheless its underperforming commercial lines business, and exposure to catastrophe continue to bother.

Zacks Rank and Other Players

AIG carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among the other players in the same space, the bottom line at MetLife Inc. (NYSE:MET) and Aflac Inc. (NYSE:AFL) beat second-quarter estimates by 1.6% and 12.27%, respectively. Prudential Financial Inc. (NYSE:PRU) , however, missed the same by 23%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Aflac Incorporated (AFL): Free Stock Analysis Report

American International Group, Inc. (AIG): Free Stock Analysis Report

MetLife, Inc. (MET): Free Stock Analysis Report

Prudential Financial, Inc. (PRU): Free Stock Analysis Report

Original post

Zacks Investment Research