The technical aspect of DeepSeek is not new. The reaction to it though, is new.

What this could mean is that unlike the internet explosion which included 100’s of companies, the AI explosion is much narrower in impact thus far than what has been hyperbolized by mainstream media.

AI has enormously affected only a few companies.

So, if the AI movement is indeed narrower than what pretty much everyone was led to believe, yesterday’s sell-off could be only the beginning.

The good news is that folks like me, waiting patiently for a rotation into other sectors, could finally be reaping some rewards.

Yields relaxed, the dollar declined, and money flowed into healthcare (NYSE:XLV) and consumer staples (NYSE:XLP).

Is this the beginning of a recession or a more convincing next stage of stagflation?

This is a good day to look at our Economic Modern Family.

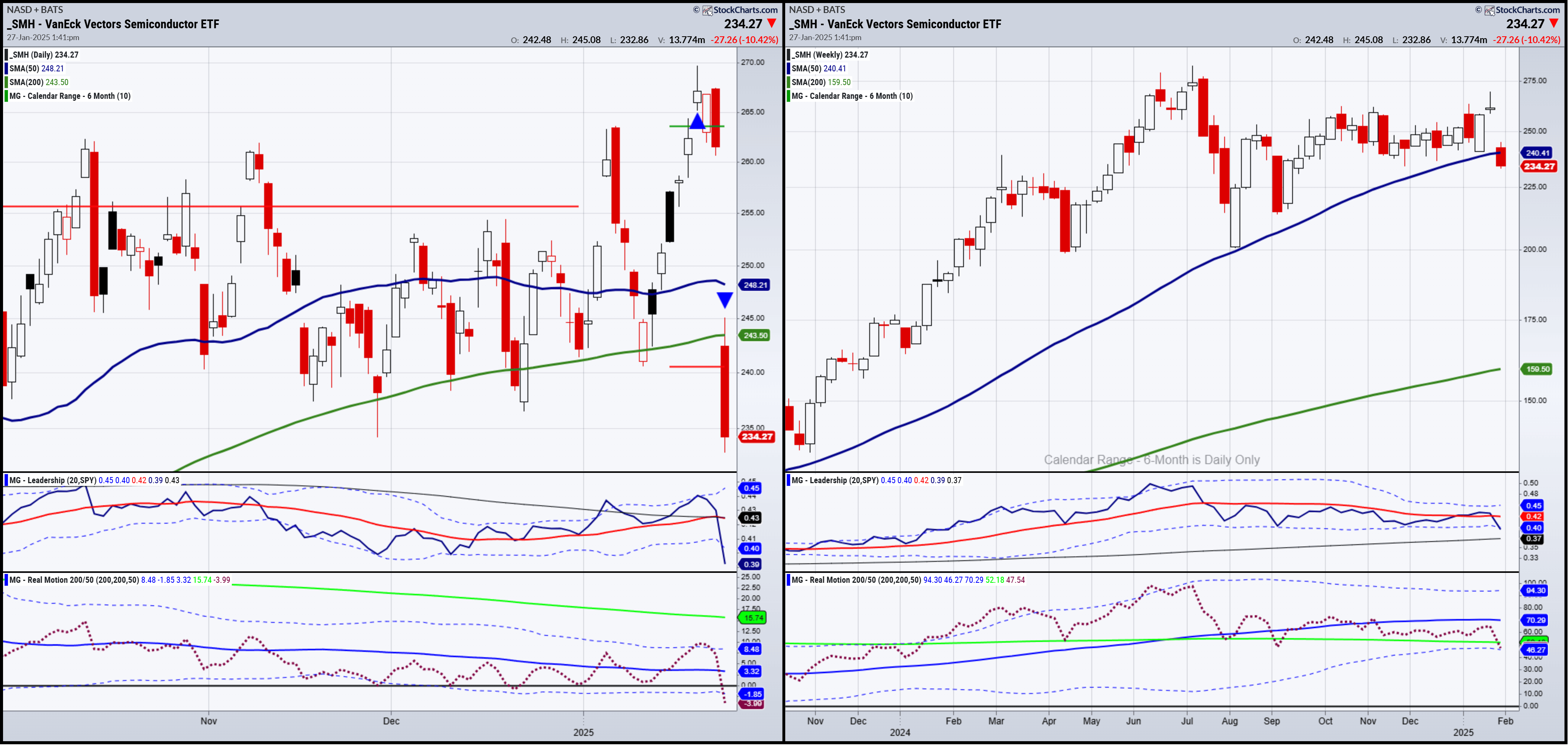

The chart of Sister Semiconductors is sobering.

On the Daily chart, the gap down is ginormous. SMH is below the January 6-month calendar range. It is way underperforming SPY and momentum (which was in a bearish diversion even at the highs), is now maybe a bit oversold.

The weekly chart is worse. This is the first time SMH has traded below the 50-week moving average since January 2023.

As a weekly chart though, we do have time to see how it closes on Friday. A close back above could be a great low-risk opportunity.

As for the rest of the Family:

- Granny Retail XRT still needs to clear $81. However, yesterday’s action considering was not too bad.

- Gramps Russell 2000 (IWM) as an index got hit a bit. $227 is our pivotal point. yesterday’s action though was more indecisive than negative.

- Biotech looks like it’s trying. Through $140 would be a great sign.

- Transportation IYT is yesterday’s star. If goods are moving, the economy is not flashing recession.

- Regional Banks KRE also did ok. Through the calendar range, we can see upside there.

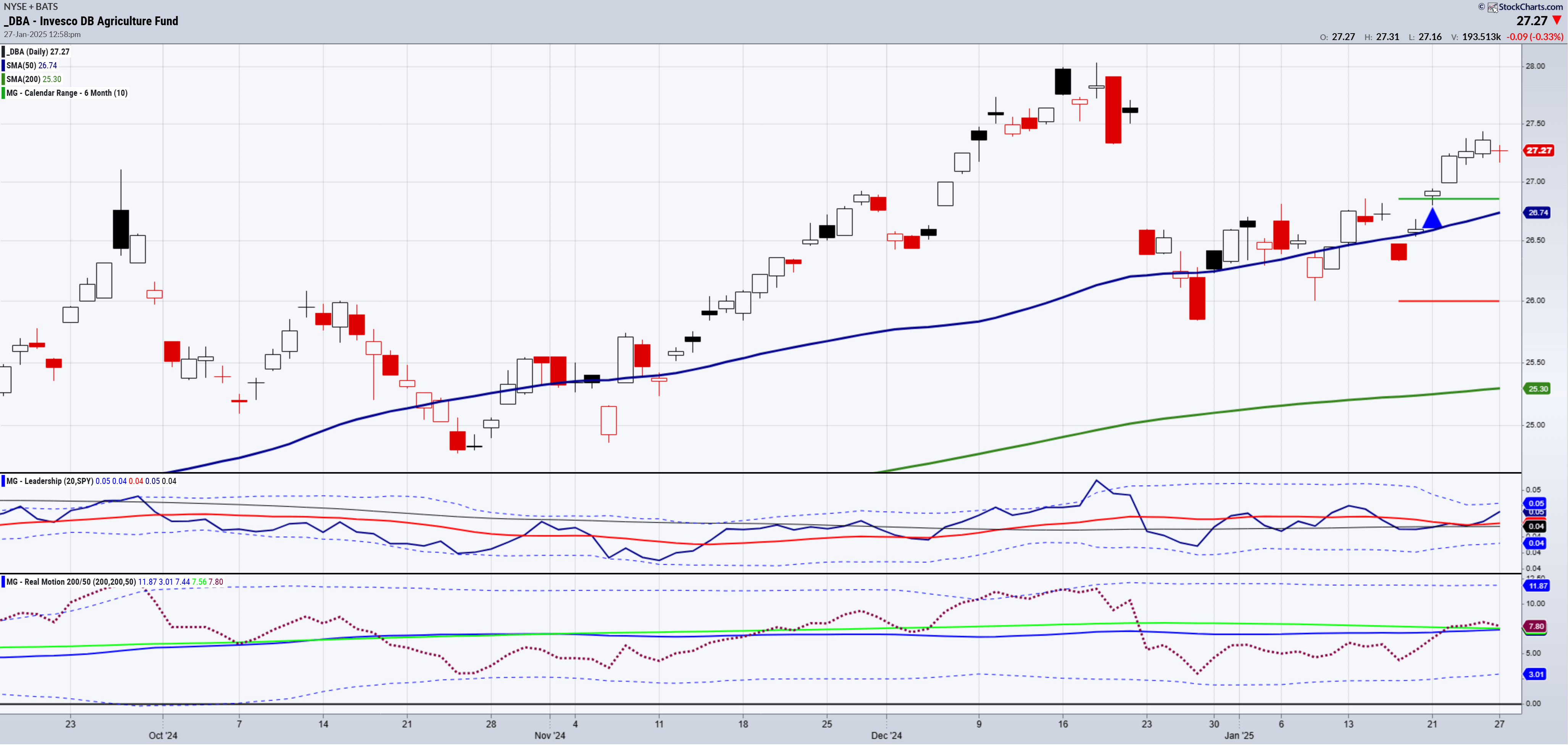

And once again, we must end with a look at DBA-the Agriculture ETF.

DBA cleared the January calendar range last week. That is bullish.

It filled the gap from December 19th. That is bullish.

A move over 28.00 will blow the doors off inflation and in the worst possible way-food prices.

The bottom line, this rotation yesterday is fine. SMH must find some footing.

And certain commodities are flashing their own warning.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) A move back over 600 good, under 590 not so much

- Russell 2000 (IWM) 225-227 is key as an area to hold up

- Dow (DIA) Defense stocks rules

- Nasdaq (QQQ) 500 major support now

- Regional banks (KRE) Over 64 this looks better

- Semiconductors (SMH) 237 is now the area for this to get back over

- Transportation (IYT) 71.40 important to hold

- Biotechnology (IBB) 137 support 140 next place to clear

- Retail (XRT) 81 must clear 78 must hold

- iShares iBoxx Hi Yd Cor Bond ETF (HYG) 79.40 the calendar range support