Precious metals and miners made the right choice and moved higher this past week strongly.

That’s about the only sector doing well right now as we’re seeing missiles volleyed, Russian relations cooling and the mother of all non-nuclear bombs being thrown around.

Markets and stocks are not taking these actions in stride and are showing weakness.

I’m about half in, and only in mining stocks with the rest cash.

There are times to be in cash and this looks to be one of them.

Gold gained a nice 2.48% on the week.

We were treated to a solid breakout above the 200 day average from gold on heavy volume, which is key.

Friday, April 7th saw gold breakout in overseas action, only to fail once we began trading in North America but this week we saw that diverge.

Tuesday saw strong action from North America and the strength continued.

From this, my take is to be weary of overseas strength, which gives us in North America a gap open, but to pile in if the action is strong on this side of the pond.

Of course, this can change but it is definitely something to take note of and take advantage of.

This game is all about making money, nothing more, so use every advantage you can.

It’s not about being right, it’s about making money.

Silver rose 1.98% this past week and looks good for more.

If we can move past $18.50 on volume I may just get into another mining position or two.

Above $18.50 I see resistance at $19, $19.25, $19.70 then $20.15 so let’s see how silver reacts at those levels.

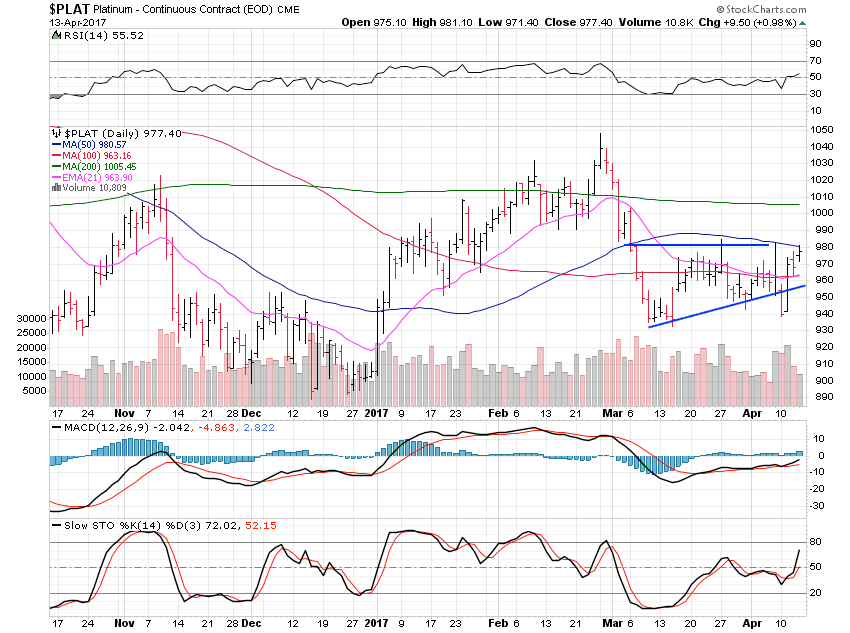

Platinum moved 1.54% higher this past week and is trying for more.

A break above the 50 day moving average and horizontal resistance at $980 should quickly see a move to the 200 day average at $1,005 and likely above that to $1,020 where resistance sits.

As always, platinum needs to see gold and silver holding or moving higher in order to breakout itself, but it looks good.

Palladium was the sole loser, slipping 0.96% this past holiday shortened week.

This chart looks great for a move higher with $820 the breakout area.

This little flat channel is positive and should see a breakout in the week to come.

All good.

So, while stocks remain under pressure, miners are doing great for now so that is where my focus is.

Have a great long weekend that is well deserved and remember, cash is a position until buy signals form.

Half the battle is keeping your cash until new setups and easy money comes back around.