- BOE November Meeting

- Thursday November 5th, 1200GMT

- Current rate 0.5%, expected unchanged

- September CPI dropped back into negative territory printing -0.1%

- GDP QoQ fell to 0.5% from 0.7% prior

- Unemployment rate fell to 5.4% from 5.5% (though data referenced the three months prior to August)

- Retail sales data showed considerable strength posting 5.9% against 3.2% previous

- Net lending continued to increase posting 3.6bln against 3.4bln previous

- Public Sector Net Borrowing for September fell to .6bln from 10.8bln previous

- Average weekly earnings for the three months prior to August increased to 3.0% from 2,9%

- Manufacturing PMIs (October) unexpectedly jumped to 55.5 from 51.8

- Slack in the economy – How much slack does the MPC see in the UK economy?

- Rate language – any change to the phrase “ the decision as to when to start such process of adjustment will likely come into sharper relief around the turn of the year”

- Growth forecasts – Look for any changes to the growth forecast, particularly to the end of the forecast horizon

- Inflation – watch for any changes to the 2-3 year forward CPI forecast – August forecasts saw CPI breaching 2% between Q2 & Q3 2017

- Oil prices – How do the MPC see the path of oil prices over the next year. August saw forecasts of 15% lower for 2015 and 10% lower for 2016/17

- If the BOE deliver a Hawkish statement on Thursday, expect GBP to start trading higher once more on the crosses.

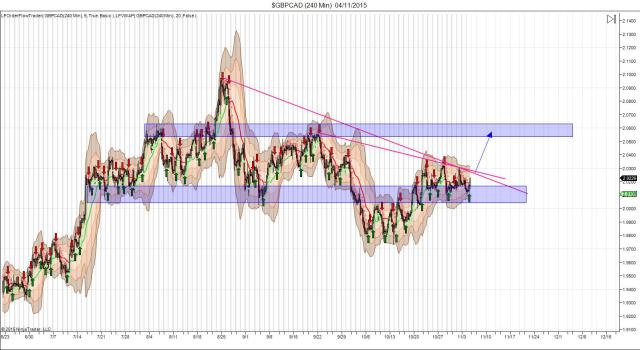

- GBP/CAD has potentially completed it’s correction of the broad uptrend its been in since late 2012 and this could prove to be the catalyst for a return to higher ground

- Look to buy a break of the potential bull-flag trend line resistance, targeting a move up into key near-term resistance at around 2.05/06

- If the BOE’s “super-Thursday” leaves markets unenthusiastic about the likely proximity of an upward adjustment in UK rates, expect Sterling to unwind against the Japanese yen.

- GBP/JPY has come up against some pretty key near-term resistance which capped the initial rebound higher from the September lows against the 50% retracement from the August highs.

- A reversal beneath the local rising trend line opens up a retest of key horizontal support at around mid 184 as the initial target.

October Meeting

Last month’s BOE meeting saw the Central Bank delivering a rather Dovish message to the markets. Notably, the BOE stepped outside of their standard view that inflation will pick up into the year end, instead stating that they see the likelihood of inflation remaining below 1% until spring 2016 as “increases in labour costs remain lower than would be consistent with meeting the inflation target in the medium term”.

Sterling strength was noted for its “dampening influence” on inflation which was subdued also by “restrained labour cost growth” and “muted import cost growth”. Reference was also made to the global growth outlook which the Bank noted had “continued at below average rates” with its outlook threatened by “persisting external disinflationary pressures”.

Domestic economic assessment declared that data at the time was that data was “consistent with a gentle deceleration in UK output growth since its peak at the beginning of 2014” but that “slowdown in the pace of the expansion and employment growth” was expected as the economy approaches equilibrium”.

The statement concluded with the summary that all members agreed that when the Bank Rate does increase it will be more gradual and at a lower level than previous tightening cycles due to “the likely persistence of the headwinds restraining economic growth following the financial crisis” although the “path that the Bank Rate will actually follow over the next few years will depend on economic circumstances”

Market reaction saw GBP sharply lower upon the release of the meeting’s statement.

What’s Happened Since

Despite the immediate selling pressure applied to GBP, price recovered quickly to trade higher over October. Data since the last meeting has been largely positive though a few key prints displayed weakness.

Alongside the data releases we’ve also had various Bank Of England officials’ comments hitting the wires. BOE’s Forbes declared her feelings that the “next move in UK interest rates will be up” adding also that the move will come “sooner rather than later” and “news on the international economy has not cause me to adjust my prior expectations”. BOE’s McCafferty also joined in in support of a rate rise saying that he regarded disinflationary pressures in the UK as “transitory” whilst labelling the risks posed to the UK economy from emerging markets as “no critical threat”. We also heard McCafferty extolling the need for Britain to avoid getting “behind the curve” on a rate rise “so as to minimise the disruption to households and businesses”.

Comments made against a UK “lift-off” were made by BOE’s Broadbent, who confirmed that he wasn’t close to voting for a rate hike, and Vlieghe whose own lack of confidence in the inflationary environment was made clear as he noted that “We (BOE) can cut rates again if necessary”

The Global Picture

The global factors affecting the UK economy, its path towards the BOE’s inflation target and chances of a UK rate hike, have not materially changed since the September meeting.

Risks posed by China have certainly stabilised somewhat in the face of persistent speculation surrounding Chinese stimulus, alongside a further rate cut by the PBOC and a lack of any significant data weakness.

Alongside a stabilisation in risks posed by China both commodity and energy prices are trading around the same levels they were at the BOE’s October meeting, despite intra-month fluctuations.

Since the BOE’s October meeting we have also seen the passing of the FOMC’s October meeting which, as expected, passed without a rate cut but delivered a more Hawkish message than perhaps was expected with the Fed keeping the chance of a December rate rise very much alive.

Expectations For This Meeting

With a US lift-off appearing closer it seems reasonable to expect the BOE to provide a similar message as declining unemployment and building wage pressure supports a medium-term rebound in inflation, though challenged in the short term by weaker oil prices.

Market has been very swift to push out expectations of a UK rate-hike on any negative news and whilst the weak GDP print and weak Inflation print pose immediate threats to any UK bulls, the BOE themselves have stated their willingness to look through periods of weak inflation, which they expect to remain weak until spring 2016. The BOE seem committed to raising rates and whilst recent data weakness will likely keep the short-term rate outlook flat, the medium term picture, supported by the labour market, remains encouraging

Alongside the statement and the following press-conference, of particular importance will be the BOE’s inflation report, which could see the Bank citing lowered short-term inflation forecasts as downward energy price pressures persist.

Points to look out for

It seems reasonable to expect a fairly well balanced statement with the BOE acknowledging the current and likely near-term weakness of the UK’s inflationary environment whilst paving the way for an early to mid 2016 rate rise.

Trade Ideas

Hawkish BOE – BUY GBP/CAD

Dovish BOE – SELL GBP/JPY