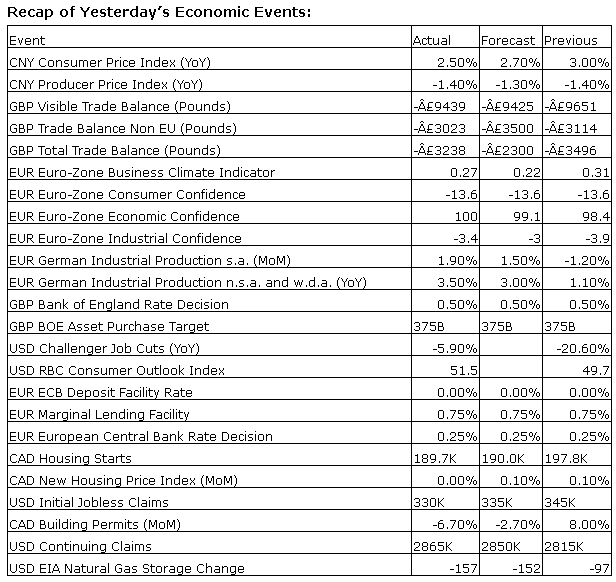

Upcoming US Events for Today:

- The Employment Situation Report for December will be released at 8:30am EST. The market expects Non-Farm Payrolls to increase by 200,000 versus an increase of 203,000 previous. Private Payrolls are expected to rise by 189,000 versus 196,000 previous. The Unemployment Rate is expected to remain steady at 7.0%.

- Wholesale Trade for November will be released at 10:00am EST. The market expects a month-over-month increase of 0.5% versus an increase of 1.4% previous.

Upcoming International Events for Today:

- Great Britain Industrial Production for November will be released at 4:30am EST. The market expects a year-over-year increase of 3.0% versus an increase of 3.2% previous.

- Canadian Net Change in Employment for December will be released at 8:30am EST. The market expects a increase of 14,100, versus 21,600 previous. The Unemployment Rate is expected to remain steady at 6.9%.

The Markets

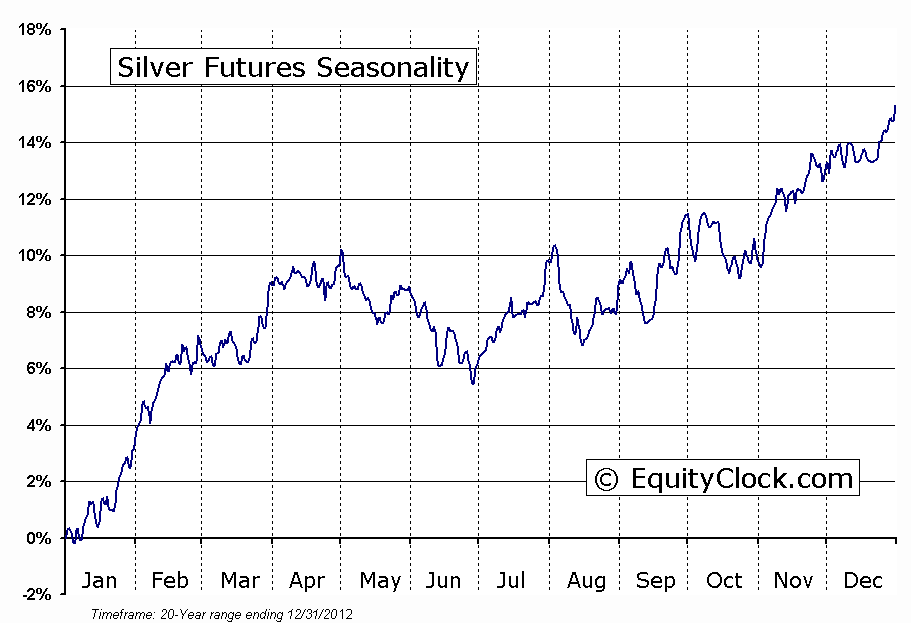

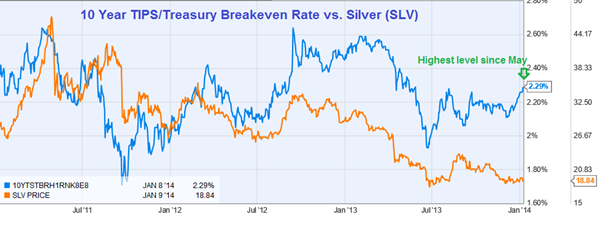

Stocks ended mixed on Thursday, just one day before the always important employment report due to be released this morning at 8:30am. Estimates continue to call for an increase in payrolls of 200,000 following a report from ADP on Wednesday that provided a similar read. The reaction to the report, whether it is a miss or a beat, always remains questionable as investors come to a consensus as to how the number will impact future Fed decisions. Inflation expectations, as gauged by the 10 Year TIPS/Treasury Breakeven Rate, ticked up on the session to the highest level since May as investors start to believe that the Fed will remain accommodative until inflation moves back towards its long-term target. Silver, which is currently within its period of seasonal strength, has shown a positive correlation to inflation expectations over recent years; some catch-up in the price of silver to the recent uptick in inflation expectations may be in order. Silver is currently attempting to bottom around $19, holding a low that was charted in the summer of this year. How investors interpret the Feds reaction to Friday’s employment report will determine the success of the seasonal silver trade, which runs through February.

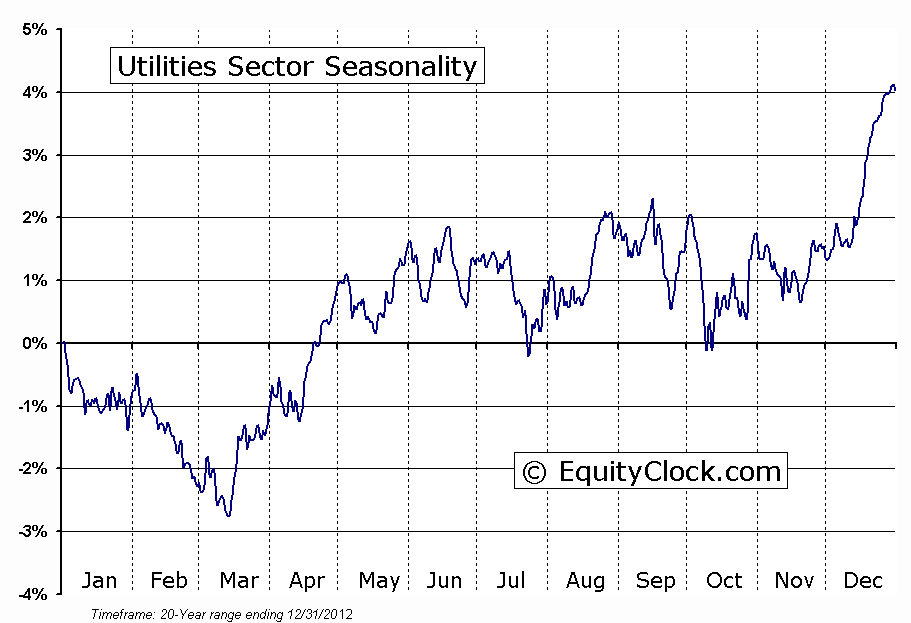

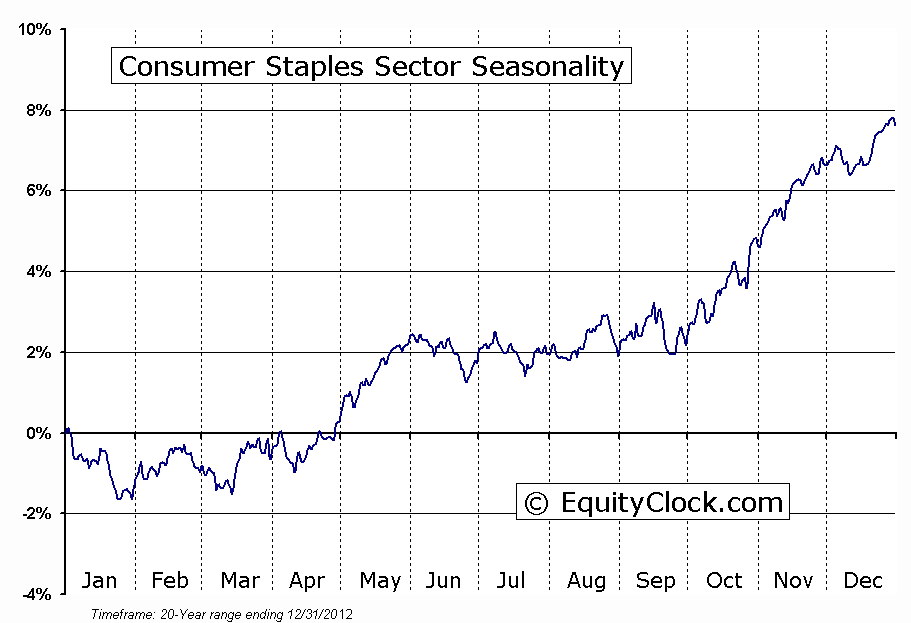

Thursday’s session offered a very defensive tone, despite the mixed trading activity. Health Care, Utilities, and Consumer Staples all topped the leaderboard as investors sought defensive, low beta allocations. As reported yesterday, some health care stocks, such as medical equipment and biotechnology, seasonally perform well into February. Consumer Staples and Utilities, however, are seasonally the weakest sectors during the first quarter. When investors become defensive during periods when seasonal tendencies favour cyclical sectors, a warning signal is provided: equity market weakness typically follows. Intermediate relative trends continue to favour cyclical assets, particularly Industrials and Financials. A number of Industrial and Financial companies report earnings next week, which will either confirm or deny the strength realized recently.

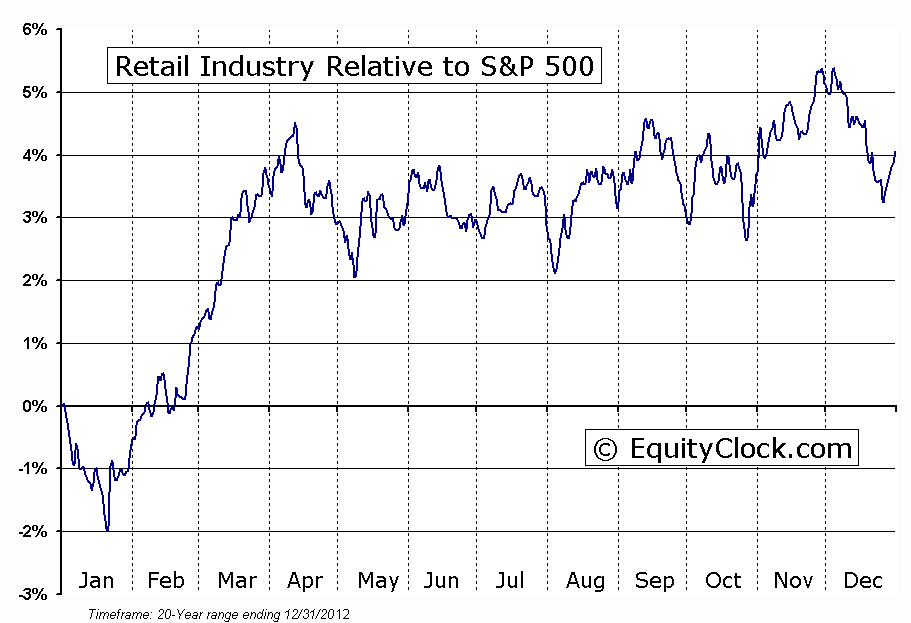

Retailers had a tough battle on Thursday as chain store sales and a few earnings results were released. Sears Holding, Family Dollar, Limited Brands, and Bed Bath & Beyond all provided lowered earnings forecasts, leading to declines in the shares of each stock. Investors remain concerned about compressed margins following excessive promotions during the holiday season, which failed to draw the desired sales. The relative trend of the S&P Retail Index is showing signs of trending lower for the first time in over a year. The index peaked just after the US Thanksgiving holiday, a typical scenario from a seasonal perspective. A lower intermediate high is now apparent, suggesting a change of trend from positive to negative. The next period of seasonal strength for the retail industry runs from around the end of January through to mid-April. However, recent weakness is presently not encouraging for the seasonal trend ahead.

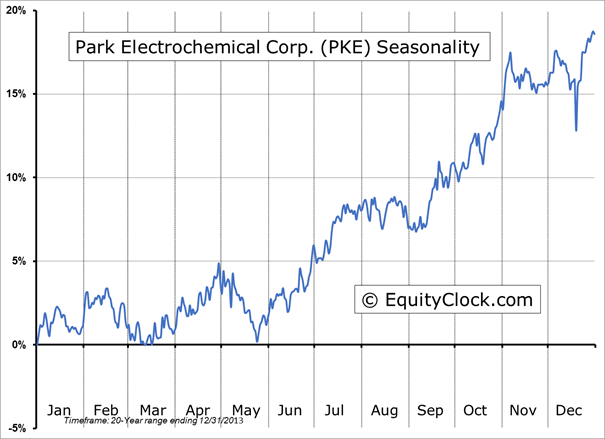

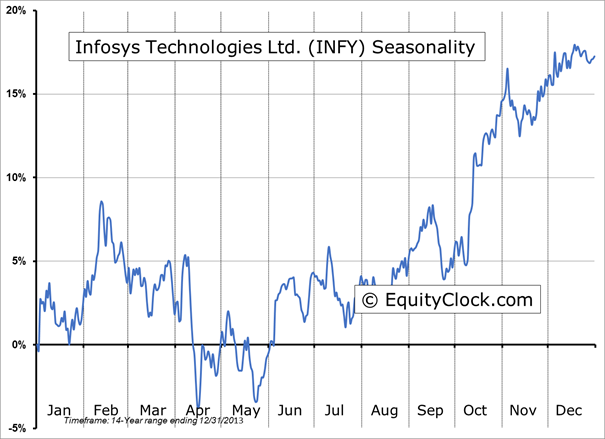

Seasonal charts of companies reporting earnings today:

Sentiment on Thursday, as gauged by the put-call ratio, ended bullish at 0.72.

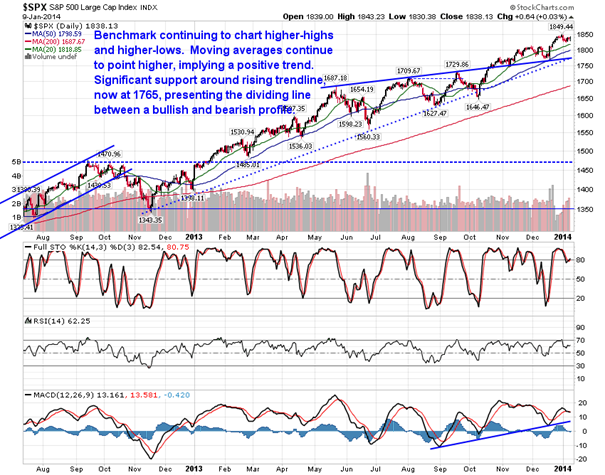

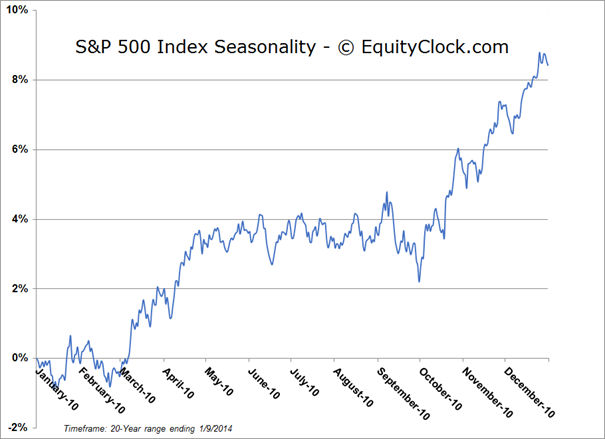

S&P 500 Index

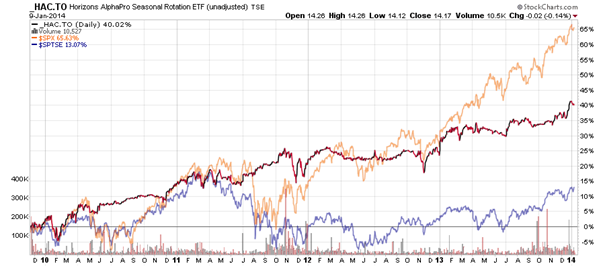

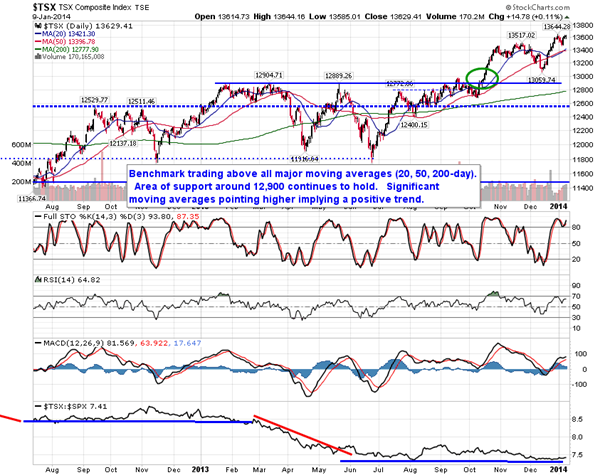

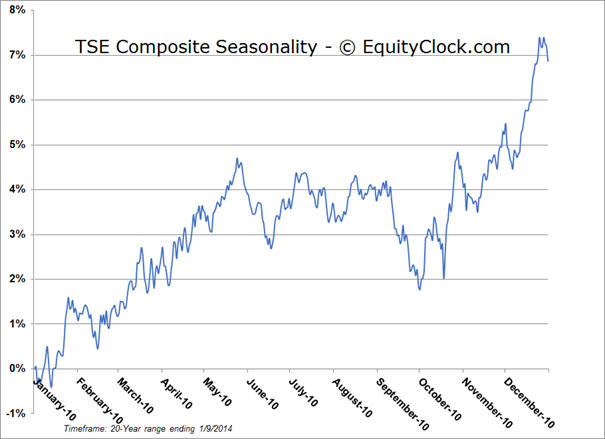

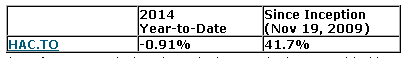

Horizons Seasonal Rotation ETF (TSX:HAC)

- Closing Market Value: $14.17 (down 0.14%)

- Closing NAV/Unit: $14.17 (down 0.26%)

Performance*

* performance calculated on Closing NAV/Unit as provided by custodian