The hottest investment of 2017 has been the worst one in 2018 so far. Bitcoin, still the largest cryptocurrency by market cap out there, is down by over 50% from its $19 666 all-time high in December, after losing more than 30% in January alone. February starts in a similar fashion – with a 750-dollar decline to as low as $9350 as of this writing. The bulls simply cannot catch a break and now even Facebook (NASDAQ:FB) is against them as the biggest social media said it will no longer tolerate crypto-related ads on its network.

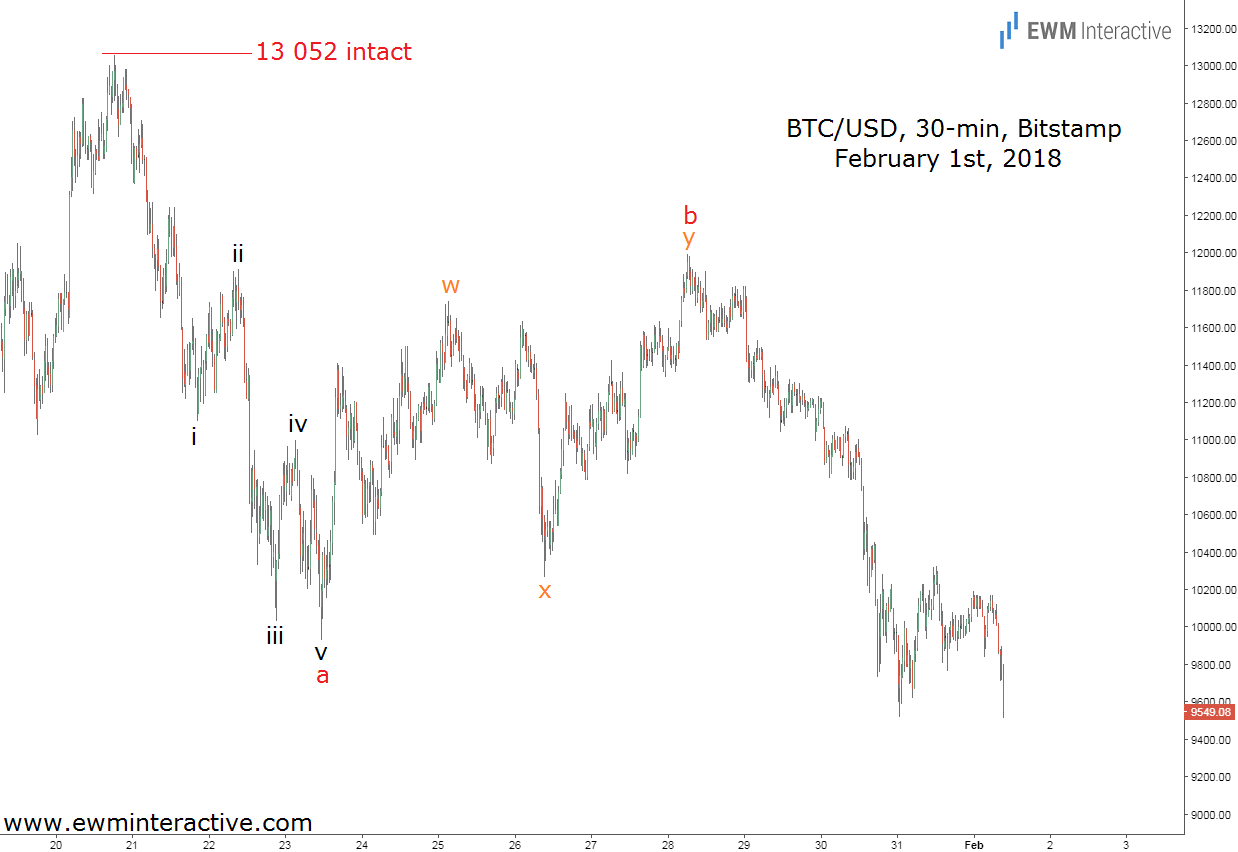

The good news is that with the help of the Elliott Wave Principle the current selloff could have been anticipated. On January 28th, while BTC/USD was hovering around $11 750, a textbook Elliott Wave pattern suggested a bearish reversal should be expected. Take a look at it on the chart below, sent to clients last Sunday.

The pattern that warned us about the current plunge in the price of Bitcoin consists of two parts. The first is a five-wave impulse to the south between $13 052 and $9927, marked as wave “a”. The second is the three-wave recovery in wave “b” up to $11 989, which completed the entire 5-3 wave cycle. According to the theory, as long as BTC/USD was trading below $13 052 – the starting point of the impulsive sequence – the bears were still in charge. Apparently, it was not a good time nor price to join the bulls. Four days later, the updated price chart of Bitcoin below shows how the situation developed.

The invalidation level at $13 052 was never threatened. BTCUSD started falling right away and lost another $2400 very quickly. Bitcoin enthusiasts argue that Facebook’s ban on crypto-related ads is the main reason for the plunge. It makes sense, but think about this: Facebook announced its ban two days ago – one January 30th. The bearish pattern was complete on January 28th, two days before that announcement. As Ralph Nelson Elliott once said, “news is the tardy recognition of forces that have already been at work for some time and is startling only to those unaware of the trend.” So do not blame it on Facebook.