Agrium Inc. (NYSE:AGU) has announced a purchase agreement whereby its Crop Production Services ("CPS") agreed to acquire Cargill AgHorizons’ 18 Ag-retail locations in the U.S. with annual revenues of more than $150 million. The outlets are located in the states of Nebraska, South Dakota, Minnesota, Wisconsin, Michigan and Indiana. The transaction does not involve Cargill's Canadian crop input retail business.

With these acquisitions, Agrium aims at growing its North-American Ag-retail business, mainly in the highly desirable U.S. Corn Belt. The locations are in regions where Agrium has limited presence. The acquisition will enable Agrium to unveil its products and services, and leverage its extensive distribution network.

Cargill will aim at being the world's leading merchant of grain and oilseeds and will enable the farmers to succeed by ensuring they remain competitive in the global market and be highly efficient in getting products from origins to destinations.

The transaction is expected to close by the end of third-quarter 2016 and is subject to customary closing conditions, and regulatory clearances.

Agrium, which is among the prominent fertilizer companies, along with Mosaic (NYSE:MOS) , Potash Corp. (NYSE:POT) and CF Industries (NYSE:CF) , posted net earnings (attributable to its equity holders) of $2 million or 2 cents per share in first-quarter 2016, roughly an 83% plunge from $12 million or 8 cents per share recorded a year ago. The bottom line was affected by weaker selling prices across all nutrients.

Barring one-time items other than stock-based payment expense (post-tax) of 2 cents per share, Agrium’s adjusted earnings came in at 3 cents per share. Analysts polled by Zacks were expecting a loss of 7 cents on an average.

Revenues decreased 5.1% year over year to $2,725 million in the reported quarter. The top line also missed the Zacks Consensus Estimate of $2,752 million.

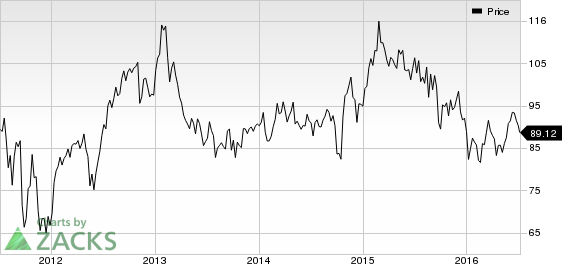

Agrium currently holds a Zacks Rank #3 (Hold).

POTASH SASK (POT): Free Stock Analysis Report

CF INDUS HLDGS (CF): Free Stock Analysis Report

AGRIUM INC (AGU): Free Stock Analysis Report

MOSAIC CO/THE (MOS): Free Stock Analysis Report

Original post

Zacks Investment Research