- Agriculture commodities comprise large part of 2014 commodity gains

- Momentum remains positive as extreme weather supports

- A possible return of El Niño causing concern

- Hedge funds very active buyers the past five weeks

Much has been written about the return of positive performances in commodities so far this quarter. From Q2 in 2011 up until the past quarter commodities posted non-stop negative quarterly performances apart from two occasions, the most notable of which was during Q3 2012 when grain prices rallied hard as the US plains dried up. Once again it is the agriculture sector which has been providing much of the gains as extreme weather across some of the major growing regions has caused havoc, most noticeably in North and South America during recent months. According to an article from the Financial Times there could be more trouble ahead after a third official warning in a week from the southern hemisphere is pointing towards a return of the El Niño weather phenomenon.

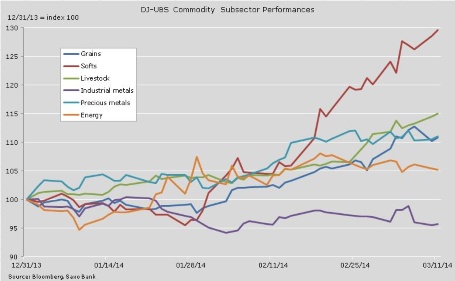

Using the broad based DJ Commodity sector indices we can see below how the overall positive performance has been driven by the three agriculture commodities with precious metals being the only other sector putting in a double-digit return. The two big growth dependent sectors of energy, and especially industrial metals,have been struggling as recent news from China has put into doubt whether the country accounting for a major share of global commodity demand will be able continue.

Source: Bloomberg and Saxo Bank

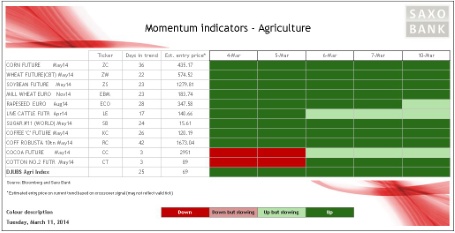

Momentum remains positive across the whole of the agriculture sector and a majority has seen this trend now for more than a month and this has provided handsome returns to trend following strategies. A slowdown in cocoa and cotton last week has now been reversed and both futures are trading at new highs.

Source: Bloomberg and Saxo Bank

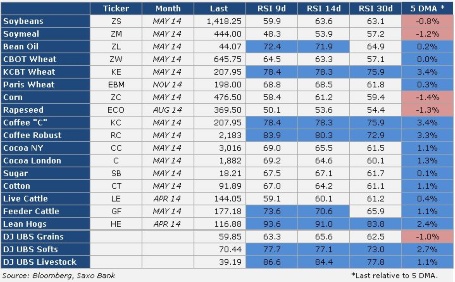

The sector is still showing signs of being overstretched with RSI readings being very high, especially on coffee and livestock futures. "The trend is your friend" goes the old saying and at the moment there are still no signs of a reversal while fundamental news continue to support.

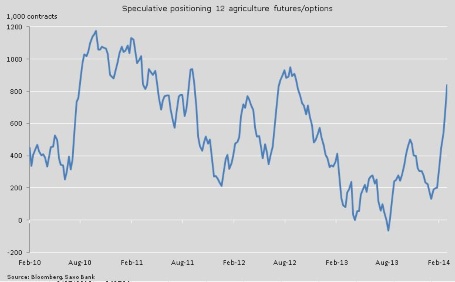

Hedge funds and other large money managers have increased their net-long exposure to the sector during the past five weeks as each new high triggered another signal to buy. A rise in the net-long from 200,517 contracts to 841,188 contracts in just five weeks may look excessive but we are still some distance from the highs last summer and the aforementioned spike in 2012. One thing however to consider is the risk of bottlenecks occurring should the fundamental outlook change as traders may begin to liquidate some of their recently established longs. This could create more selling pressure than some of these markets can handle. But until such time, if it occurs at all, momentum remains positive and the chart below gives 841,188 reasons to defend that trend.

Source: Bloomberg and Saxo Bank