Deere (NYSE:DE) & Co.'s Strong Q2 Performance

Deere & Co. reported Q2 earnings per share (EPS) of $8.53, surpassing analyst estimates of $7.87. The company also exceeded revenue expectations, posting $15.24 billion compared to the consensus estimate of $13.3 billion.

Revised Full-Year Net Income Forecast

Despite the strong quarterly results, Deere revised its full-year net income forecast downward to around $7.0 billion from the previous range of $7.5 to $7.75 billion. This revision led to a 5% drop in Deere's stock price on Wednesday, negatively impacting the agricultural sector.

Factors Behind the Downgrade

- Declining Crop Prices: Lower prices for crops like corn and soybeans have reduced farmers' purchasing power.

- Reduced Equipment Demand: Decreased demand for tractors and combine harvesters.

- High Interest Rates: Increased borrowing costs for farmers, resulting in higher equipment inventories.

- USDA Projections: The U.S. Department of Agriculture projects a 25.5% decline in net farm income to $116.1 billion for the year.

Market Implications for Agricultural ETFs

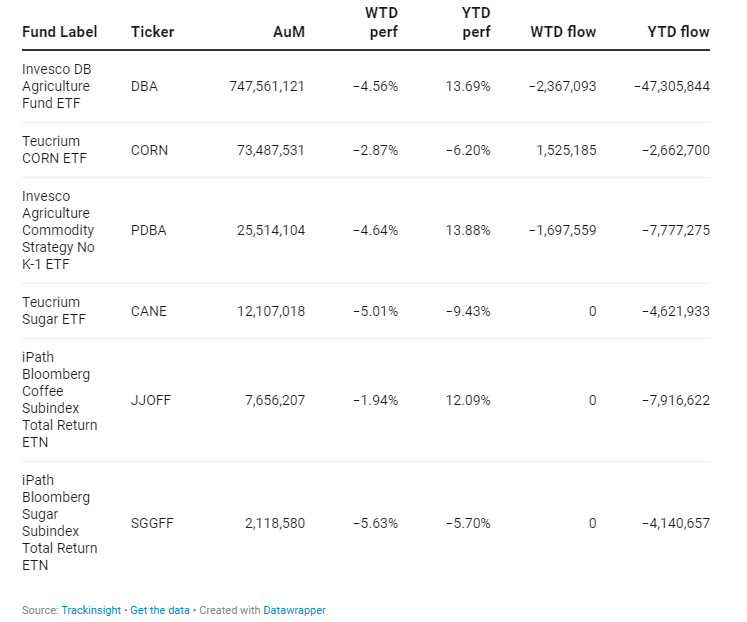

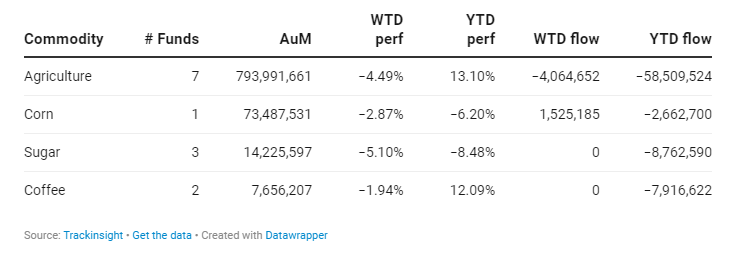

The downgrade in Deere's forecast has had a ripple effect across agricultural ETFs, highlighting the interconnectedness of equipment manufacturers and broader market performance. Agriculture funds lost 4.49% over the week. More specifically, the Invesco DB Agriculture Fund ETF DBA+0.17% was down 4.56% and registered $2.3 million of outflow over the same period, bringing its year-to-date performance to 13.69%.

Group Data

Funds Specific Data: DBA, CORN, PDBA, CANE, JJOFF, SGGFF