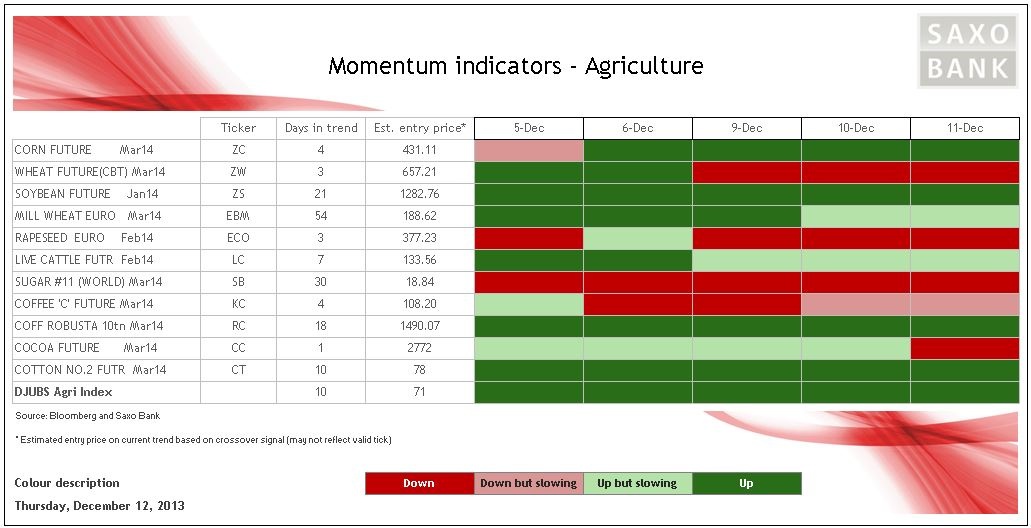

Momentum across some of the key agriculture commodities are showing very different trends and performances as year-end approaches. Some of the strong performers lately such as Paris milling wheat and cocoa are currently exposed to some year-end selling as speculative positions are being reduced.

CBOT Wheat futures fell to a near four-month low on Tuesday after a US government report estimated that global inventories would rise to a near record the coming season, not least due to bigger crops in Canada and Australia. Momentum has turned negative this week not least after the price of the march future dropped below previous support at USD 6.50 per bushel. Even Paris milling wheat which has seen non-stop positive momentum since September has begun to show signs of weakness with momentum now slowing.

CBOT corn has joined soybeans in showing improved sentiment. For corn, this has been driven by news of strong demand both from home and abroad not least after the price reached a four-year low which triggered extra demand for animal feed and from ethanol producers. The subsequent downgrade in ending stocks from rising demand will lend some near-term support but we should not forget that supplies for use until the end of the current 2013/14 marketing year which runs until next August will be the largest in eight years. Attention from here will continue to focus on demand and the outlook for the South American crop which is now entering into a critical growing period.

Live cattle remains rangebound within an uptrend that has lasted since May. The price of the most traded month of February 2014 is currently within a relatively tight range within 131.25 and 134.5 cents per pound. Speculative investors held a net-long of 91,142 as of December 3, so any surprise weakness at this stage could signal a deeper correction. especially with the holiday season which could become a bit thin on the liquidity front.

The sharp sell-off in sugar since October seems to have slowed but after seeing the RSI recover a bit from the oversold levels recently, the risk is still that the downtrend will continue. Since the end of October, sugar has only seen higher daily finishes on a handful of occasions which gives an indication of how unloved the sweetener has become among the speculative community. Abundant near-term supplies will continue to weigh on the price so for now a major reversal in the downtrend seems unlikely.

Cocoa has moved to the bottom of its current trading range as consolidation continues after the flow of price-friendly news began to dry out. This recent move has triggered a return to negative momentum raising the prospect of some additional long liquidation by funds as year-end approaches. A clear break below USD 2,740/mt could signal further weakness towards USD 2,710/mt followed by USD 2,680/mt.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Agriculture Commodities Mixed As Year-End Approaches

Published 12/12/2013, 07:05 AM

Updated 03/19/2019, 04:00 AM

Agriculture Commodities Mixed As Year-End Approaches

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.