AGNC Investment Corp. (NASDAQ:AGNC) reported first-quarter 2018 net spread and dollar roll income (excluding estimated catch-up premium amortization benefit) of 60 cents per share, missing the Zacks Consensus Estimate of 61 cents. Nonetheless, the figure came in higher than the prior-quarter tally of 63 cents per share.

Further, the company reported the first-quarter comprehensive loss per common share of 53 cents, way below the 44 cents of comprehensive income recorded in the prior quarter.

Also, as of Mar 31, 2018, the company’s tangible net book value per share came in at $18.63, down from $19.69 as of Dec 31, 2017.

The economic return on tangible common equity for the company during the reported quarter was -2.6%. This included dividend per share of 54 cents and a decrease of $1.06 in tangible net book value per share.

Net interest income (NII) of $225 million improved from the prior-quarter figure of $212 million.

Inside the Headlines

As of Mar 31, 2018, the company’s investment portfolio aggregated $69.3 billion. This included 68.4 billion of agency mortgage backed securities (MBS)and to-be-announced (TBA) securities, and $0.9 billion of credit risk transfer (CRT) and non-agency securities.

Inclusive of its net TBA position and net payable/ (receivable) for unsettled securities, AGNC Investment’s tangible net book value "at risk" leverage ratio was 8.2x as of Mar 31, 2018, against 8.1x as of Dec 31, 2017.

For the Jan-Mar quarter, the company's investment portfolio bore a weighted average constant repayment rate (CPR) of 8.6%, down from 10.1% reported in the last-reported quarter.

Excluding net TBA position, AGNC Investment's average asset yield came in at 3.05% for the reported quarter, up from 2.84% recorded in the previous quarter.

For the first quarter, combined average cost of funds inclusive of interest rate swap costs, came in at 1.68%, an increase from 1.52% witnessed in the prior quarter.

Annualized net interest margin, including TBA dollar roll income (excluding estimated catch- up premium amortization benefit), for the quarter came in at 1.26%, down from 1.36% reported in the last quarter.

Also, as of Mar 31, 2018, AGNC Investment’s cash and cash equivalents totaled around $972 billion, down from $1.05 billion as of Dec 31, 2017.

Dividend Update

In the first quarter, AGNC Investment announced monthly dividends of 18 cents per share for January, February and March. Notably, the company had announced a total of $7.8 billion in common stock dividends or $37.70 per common share, since its initial public offering in May 2008 through first-quarter 2018.

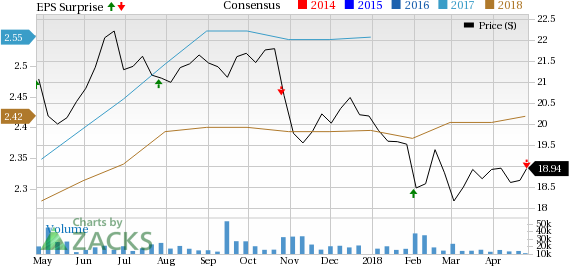

AGNC Investment Corp. Price, Consensus and EPS Surprise

AGNC Investment currently carries a Zacks Rank #2 (Buy).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

We now look forward to the earnings releases of other REITs like Alexandria Real Estate Equities, Inc. (NYSE:ARE) , Regency Centers Corporation (NYSE:REG) and Welltower Inc. (NYSE:WELL) . Alexandria and Regency Centers are scheduled to release results on Apr 30, while WELL is slated to report its numbers on May 1.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks’ has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

AGNC Investment Corp. (AGNC): Free Stock Analysis Report

Regency Centers Corporation (REG): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

Welltower Inc. (WELL): Free Stock Analysis Report

Original post