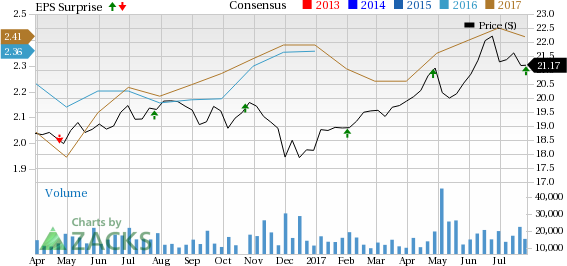

AGNC Investment Corp. (NASDAQ:AGNC) reported second-quarter 2017 net spread and dollar roll income of 67 cents per share (excluding estimated "catch-up" premium amortization cost), comfortably beating the Zacks Consensus Estimate of 59 cents. The prior-quarter figure was 64 cents per share.

Moreover, second-quarter comprehensive income per common share came at 40 cents, ahead of 35 cents recorded in the prior quarter.

The economic return on tangible common equity for the company during the quarter was 2.5%. This included dividend per share of 54 cents and a fall of 6 cents in tangible net book value per share.

However, as of Jun 30, 2017, the company’s tangible net book value per share was $19.25, down from $19.31 as of Mar 31, 2017.

Also, net interest income (NII) of $181 million was lower than the prior-quarter figure of $198 million.

Inside the Headlines

As of Jun 30, 2017, the company’s investment portfolio aggregated $63.8 billion. This included $63.2 billion of Agency MBS and to-be-announced (TBA) securities and $0.6 billion of credit risk transfer (CRT) and non-agency securities.

Inclusive of its net TBA position and net payable/(receivable) for unsettled securities, AGNC Investment’s tangible net book value "at risk" leverage ratio was 8.1x as of Jun 30, 2017, against 8.0x as of Mar 31, 2017.

For the second quarter, the company's investment portfolio bore a weighted average constant repayment rate (CPR) of 10.9%, up from 10.7% in the prior quarter.

Excluding "catch-up" premium amortization, AGNC Investment's average asset yield was 2.78% for the second quarter, up from 2.76% for the prior quarter.

Average cost of funds, excluding the net TBA position, was 1.51% in the second quarter, denoting an increase from 1.48% in the prior quarter. The rise was mainly because of higher repo rates, which were mostly offset by an uptick in the average floating rate received on AGNC Investment’s interest rate swaps.

Excluding "catch-up" premium amortization, combined annualized net interest rate spread for the quarter was 1.55%, an increase from 1.51% in the prior quarter.

Notably, the combined annualized net interest rate spread on its balance sheet and dollar roll funded assets in the quarter gained from a larger dollar roll position as well as favorable funding dynamics in the dollar roll market.

Also, as of Jun 30, 2017, AGNC Investment’s cash and cash equivalents totaled around $1.12 billion, up from $1.07 billion as of Mar 31, 2017.

Dividend Update

In the second quarter, AGNC Investment declared monthly dividends of 18 cents per share for April, May and June. Notably, the company had declared a total of $7.1 billion in common stock dividends or $36.08 per common share, since its initial public offering in May 2008 through the second quarter of 2017.

AGNC Investment currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We now look forward to the earnings releases of Annaly Capital Management, Inc. (NYSE:NLY) , Vornado Realty Trust (NYSE:VNO) and HCP, Inc. (NYSE:HCP) , which are expected next week.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

American Capital Agency Corp. (AGNC): Free Stock Analysis Report

Annaly Capital Management Inc (NLY): Free Stock Analysis Report

HCP, Inc. (HCP): Free Stock Analysis Report

Vornado Realty Trust (VNO): Free Stock Analysis Report

Original post

Zacks Investment Research