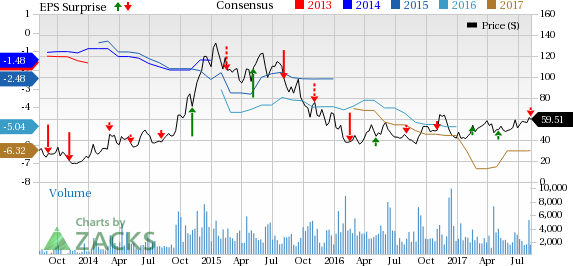

Agios Pharmaceuticals, Inc. (NASDAQ:AGIO) posted second-quarter 2017 loss of $1.78 per share, wider than both the Zacks Consensus Estimate of a loss of $1.52 and the year-ago loss of $1.47.

Agios’ shares have significantly outperformed the industry so far this year. The company’s shares have surged 43.3% compared with the industry’s increase of 18%.

Earlier this month, the FDA has granted an approval to its lead candidate, Idhifa, (enasidenib) for treatment of patients with relapsed or refractory acute myeloid leukemia (AML). However, apart from Idhifa, Agios does not have any sanctioned product in its portfolio yet. Hence, the company’s top line mainly comprises collaboration revenues and milestone payments.

Total collaboration revenue in the second quarter amounted to $11.3 million, which marginally missed the Zacks Consensus Estimate of $12 million. However, revenues substantially surged 61.4% from the year-ago figure of $7 million. This swell in revenues is partially attributable to reimbursement from Celgene Corporation (NASDAQ:CELG) for Idhifa commercialization efforts in the U.S.

Research & development expenses jumped almost 57% year over year to $79.8 million. The increase was largely driven by increased costs associated with the ivosidenib program.

General and administrative expenses climbed 28% year over year to $16.1 million due to a higher headcount and other professional costs to support the expansion of operations.

Pipeline Updates

Agios has several candidates in its pipeline, including an IDH1 mutant inhibitor, ivosidenib (AG-120) and pan-IDH mutant inhibitor, AG-881.

In June, Agios presented positive data from the dose-escalation and expansion cohorts of the phase I study, evaluating single agent ivosidenib in mutant-positive cholangiocarcinoma at the American Society of Clinical Oncology (ASCO) Annual Meeting.

During the second quarter, Agios initiated a phase III study to evaluate ivosidenib in front-line AML patients with an IDH1 mutant-positive advanced cholangiocarcinoma. Subsequently, in April, the FDA granted an orphan drug designation to ivosidenib for treatment of cholangiocarcinoma. The company plans to submit an NDA to the FDA for ivosidenib by this year-end.

Additionally, Agios is conducting phase I studies on another pipeline candidate, AG-881, for treatment of patients with advanced IDH1 or IDH2 mutant-positive solid tumors, including glioma. The company completed enrollment for the study during the quarter.

Zacks Rank & Key Picks

Agios currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the pharma sector include Aduro Biotech, Inc. (NASDAQ:ADRO) and Enzo Biochem, Inc. (NYSE:ENZ) . All the three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates narrowed from $1.46 to $1.36 for 2017 over the last 30 days. The company delivered a positive surprise in two of the four trailing quarters with an average beat of 2.53%. The stock is up 7.9% so far this year.

Enzo Biochem’s loss estimates narrowed from 12 cents to 7 cents for 2017 over the last 60 days. The company came up with a positive earnings surprise in all the four trailing quarters with an average beat of 55.83%. The stock is up 62.7% so far this year.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Agios Pharmaceuticals, Inc. (AGIO): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post