Agilent Technologies, Inc. (NYSE:A) has witnessed significant growth in Europe and continues to boost its presence there with expanded use of its diagnostic assay, PD-L1 (programmed death-ligand).

The diagnostic assay, PD-L1 IHC 28-8 pharmDx, helps in assessing the survival benefit for non-squamous, non-small cell lung cancer (NSCLC), squamous cell carcinoma of head and neck and melanoma in Europe. It will now help physicians to also assess the survival benefits of patients suffering from Urothelial Cancer (UC). This makes Europe the first region to launch a PD-L1 CE-IVD test for UC globally.

OPDIVO (nivolumab) is an immunotherapy indicated to treat metastatic UC in adults. This therapy was developed by Bristol-Myers Squibb. Reportedly, OPDIVO (nivolumab) therapy demonstrates higher overall chances of survival than chemotherapy in such patients.

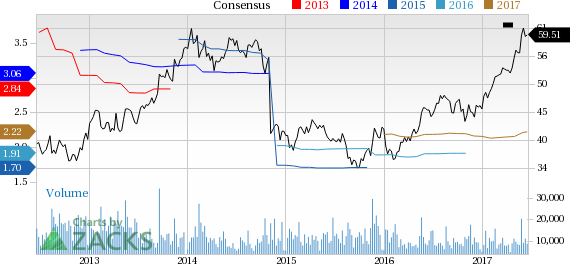

Coming to the price performance, in the last one year, shares of Agilent Technologies underperformed the Zacks categorized Electronic Testing Equipment industry. While the industry gained 50.2%, the stock returned 29%.

Healthcare Sector

Currently, the healthcare sector is witnessing a revolution. Personalized medicine is taking center stage as it can provide improved patient care and better manage costs by administering the most appropriate treatment to individuals. It has been found that not all treatments are suitable for patients suffering from a specific disease as some require more specialized tests.

The advancements in personalized medicines could have far-reaching effects on the entire healthcare system as these medicines considerably improve patient care while reducing medical bills.

Agilent has signed several collaborative agreements with pharma and biotech companies including Pfizer (NYSE:PFE), AstraZeneca (AZN), Bristol-MyersSquibb, Merck (NYSE:MRK) & Co., Amgen (NASDAQ:AMGN) and Eli Lilly for the treatment of cancer and other diseases.

Bottom Line

Agilent is an original equipment manufacturer (OEM) of a broad-based portfolio of test and measurement products, serving multiple end markets. We remain positive on Agilent’s broad-based portfolio and increased focus on segments with higher growth potential.

Given increasing health awareness among people all over the world, the emergence of cell-based technologies and personalized medicine further increase opportunities for Agilent.

Zacks Rank and Stocks to Consider

Agilent carries a Zacks Rank #2 (Buy). A few other favorably placed stocks in the broader technology sector include KLA-Tencor (NASDAQ:KLAC) and Applied Materials (NASDAQ:AMAT) , each sporting a Zacks Rank #1 (Strong Buy), while Advanced Energy Industries, Inc. (NASDAQ:AEIS) , carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

KLA-Tencor delivered a positive earnings surprise of 11.55%, on average, in the last four quarters.

Applied Materials delivered a positive earnings surprise of 3.35%, on average, in the trailing four quarters.

Advanced Energy Industries, Inc. delivered a positive earnings surprise of 10.46%, on average, in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

KLA-Tencor Corporation (KLAC): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS): Free Stock Analysis Report

Agilent Technologies, Inc. (A): Free Stock Analysis Report

Original post

Zacks Investment Research