Last week’s price action for the Ag commodities could best be described as a pause, following the long decline of the last few months, as the primary markets of corn, soybeans and wheat, finally found some support, moving sideways but with a mildly bullish tone. The catalyst was primarily twofold. First was a change in the weather in the US with the recent benign conditions giving way to rain and as a result, a possible slowing of the crop harvests. The second, was bargain hunting with all three commodities looking increasingly oversold with the markets having now factored in the expectation of a record crops this year.

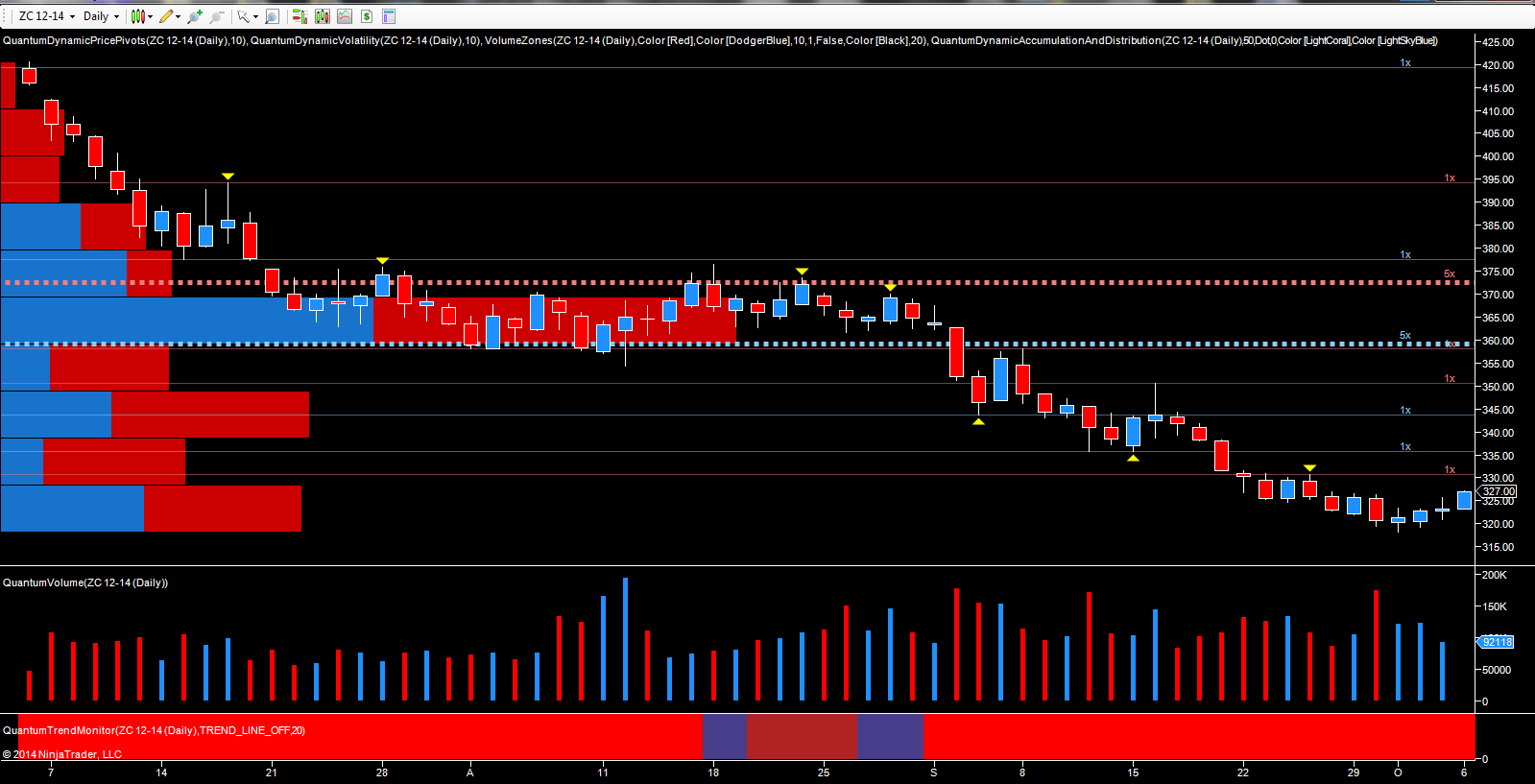

The price action for corn last week was representative of both wheat and soybeans, with the market initially moving lower early in the week, to close back near the open on modest volume. The key action for corn occurred on Tuesday, with the narrow spread down candle associated with high volume, a clear anomaly in volume and price, and signalling potential buyers moving into the market at this level. The following day then delivered a doji candle, with the commodity recovering to close back near the open of the week at 323.50 per bushel for the December contract.

This mildly positive tone has continued in early trading with corn moving to 326 per bushel in the electronic market. Whilst the volumes do not suggest a longer term change in sentiment or trend just yet, the change in weather has certainly had an impact, with the commodity now looking to test the minor resistance level currently in place in the 330 per bushel region.

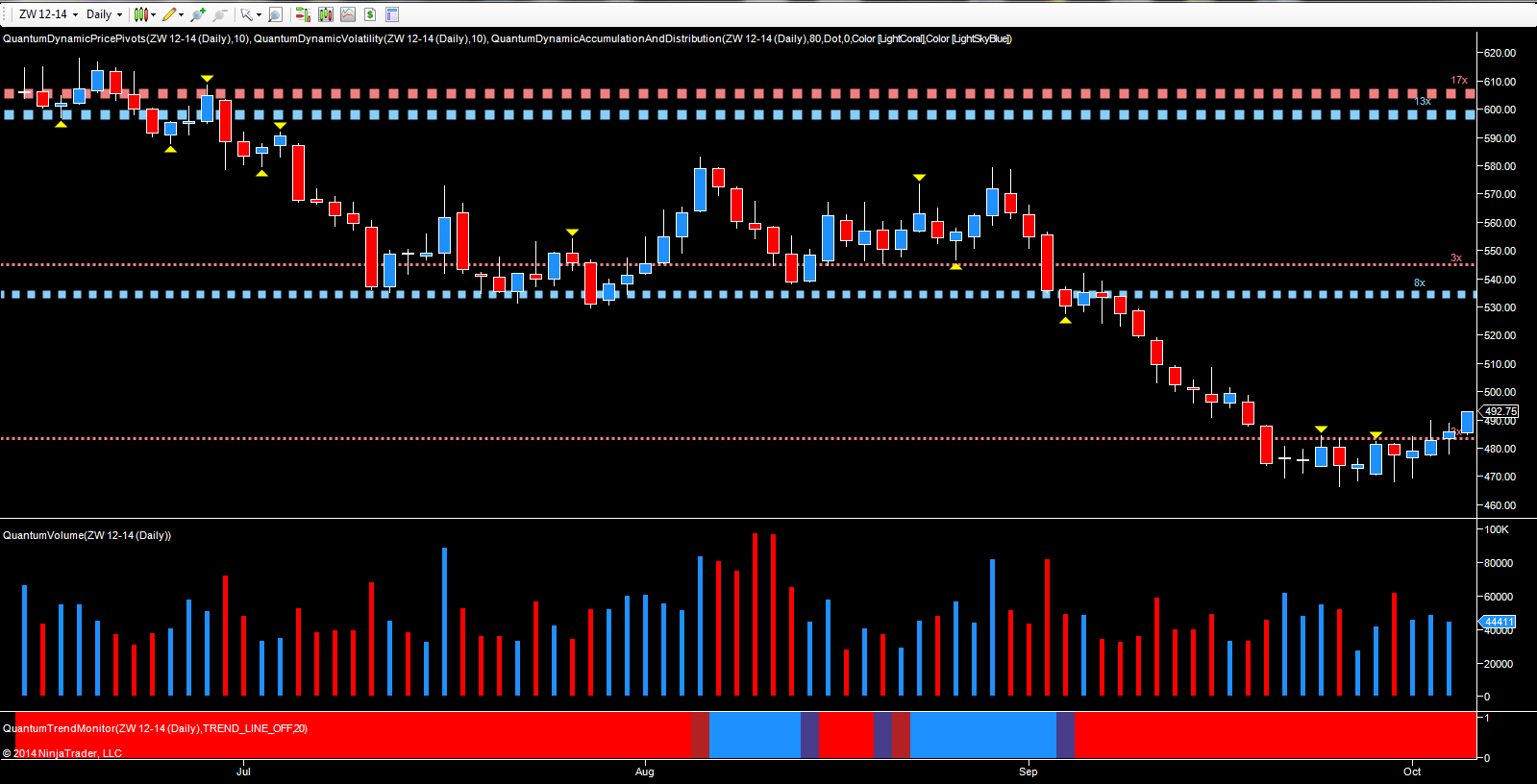

For wheat it was a similar picture. Again, but in this case, the bullish momentum was more pronounced and developed with the commodity pushing back above the secondary resistance level in the 485 per bushel region to currently trade at 490.50 per bushel at the time of writing. As with corn, it was Tuesday that sent the clearest signal of a short term reversal, even more so than corn, with the candle closing on high volume and a deep wick to the lower body, again signaling big operator buying at this level. In addition, the previous week had also seen a low volume test of supply further confirming this signal. Should this bullish momentum continue, then we may see further gains this week, with a possible move to the 500 per bushel region and beyond.

The price action for soybeans was more muted, as it moved into a consolidation phase, trading in a narrow range with the floor of support in the 904 per bushel region, and the ceiling of resistance at 927.50, a level which is currently holding firm and helping to push prices off the highs of the overnight session with the commodity currently trading at 918.75 per bushel. Once again it was the price action of Tuesday which delivered the buying activity and consequent rally, but for soybeans, this bullish sentiment has yet to filter through, and unlike the other two, the rally here looks weak at present.

Finally of course we have the US dollar which has continued to rampage its way higher, driving commodities ever lower. But this, in turn, is also looking increasingly overbought in the daily and weekly time frames, as the index approaches the 87 region on the weekly chart. The index is now fast approaching the levels which saw a major reversal back in 2010, so perhaps a portent of things to come.