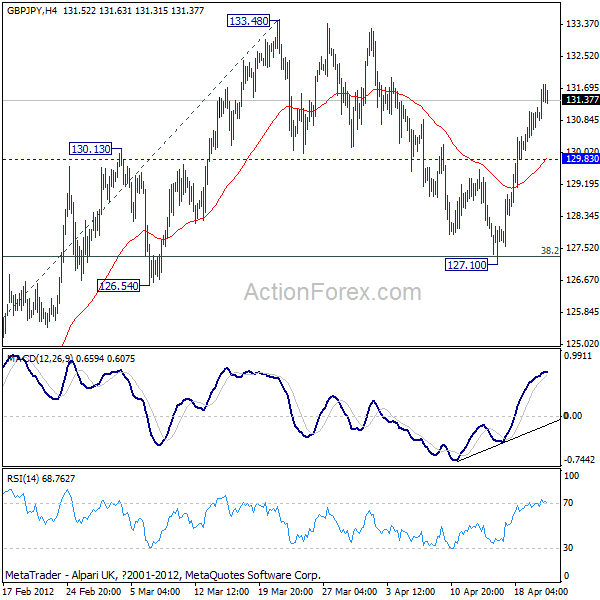

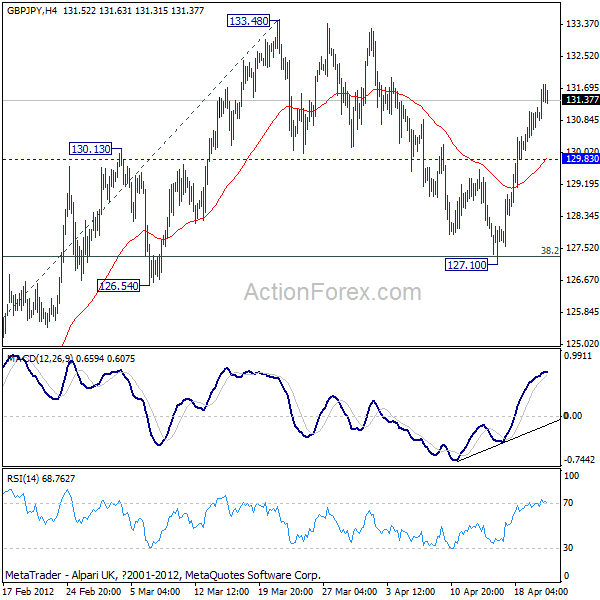

After initial dip to 127.10, GBP/JPY received strong support from 55 days EMA and 38.2% retracement of 117.29 to 133.48 and rebounded. A short term bottom should be in place. Initial bias remains on the upside this week for a test on 133.48 resistance first. On the downside, though, below 129.83 will flip bias back to the downside for 127.10 and possibly below to extend the correction from 133.48.

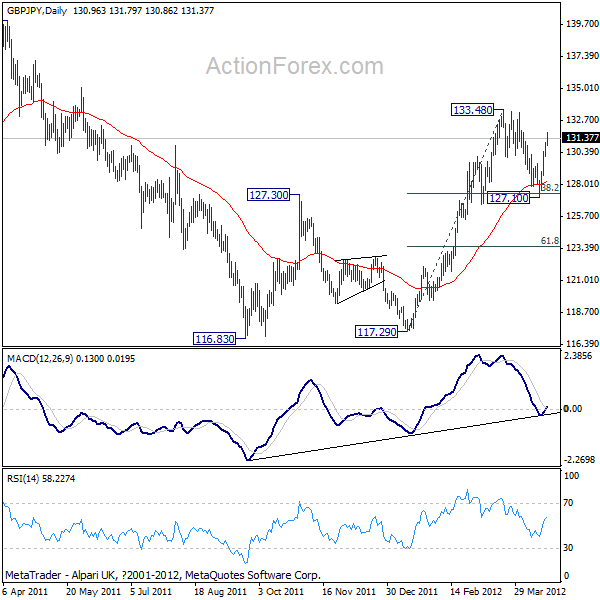

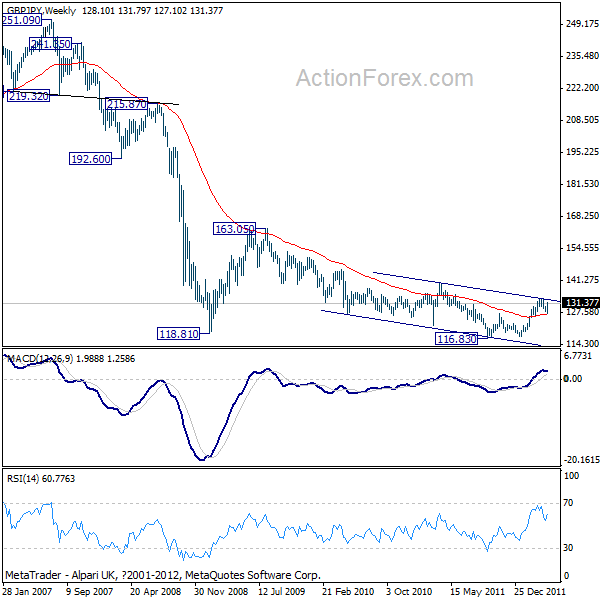

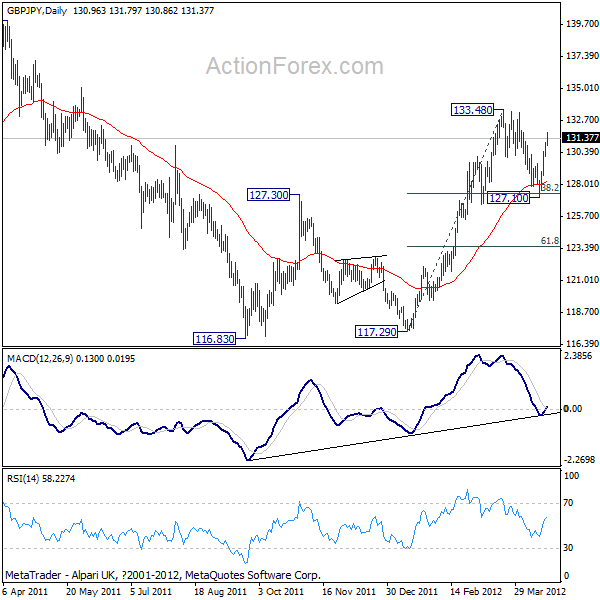

In the bigger picture, with 126.54 support intact, rise from 1117.29 should still be in progress. Current development is still in line with the view that choppy decline from 163.05 is finished at 116.83 already. We'd favor further rise to 140.02 key resistance level next. Decisive break there will confirm this bullish case and target 163.05 key resistance next. Nonetheless, another fall and break of 126.54 will put focus back to 116.83 low instead.

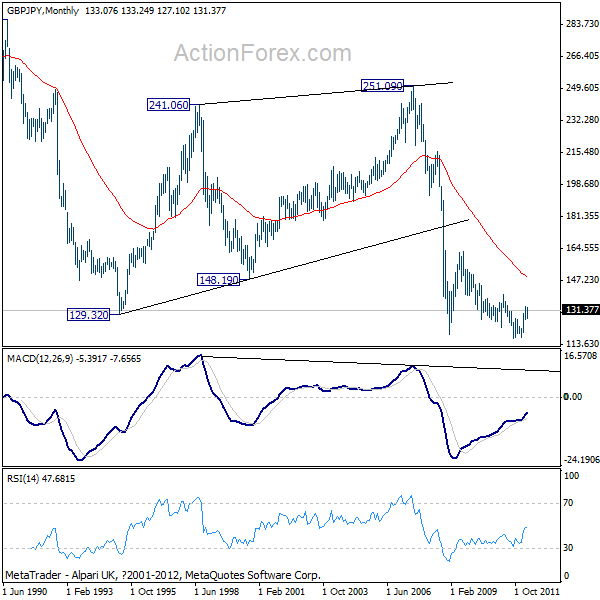

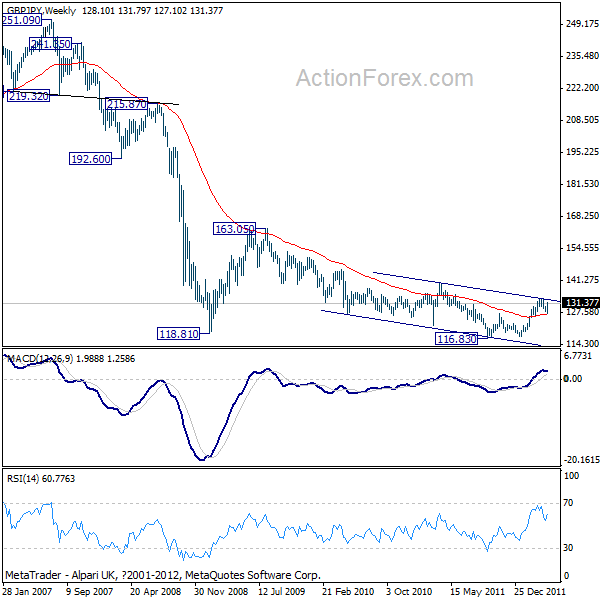

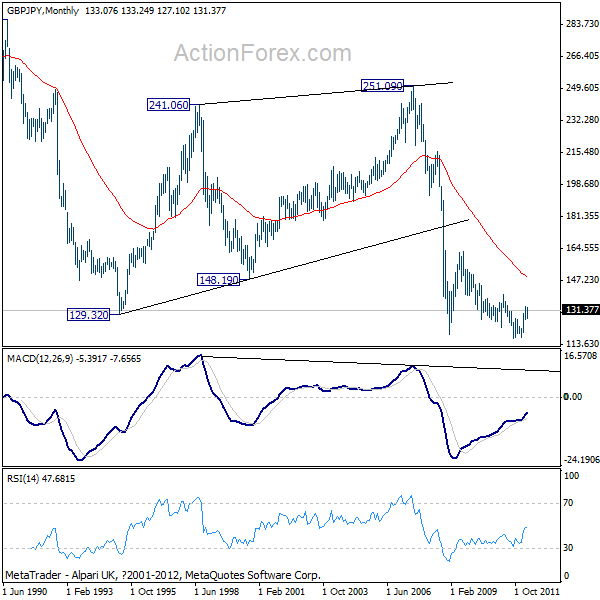

In the longer term picture, fall from 251.09 is treated as resumption of multi-decade downtrend. It's still a bit too early to say whether such downtrend is finished yet and as long as 140.02 resistance holds, another fall would remain favor to 100 psychological level. Nonetheless, a break of 140.02 will confirm bottoming and GBP/JPY could then correct the whole downtrend form 251.09.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY 2" title="GBP/JPY 2" width="600" height="600" />

GBP/JPY 2" title="GBP/JPY 2" width="600" height="600" />

GBP/JPY 3" title="GBP/JPY 3" width="600" height="600" />

GBP/JPY 3" title="GBP/JPY 3" width="600" height="600" />

In the bigger picture, with 126.54 support intact, rise from 1117.29 should still be in progress. Current development is still in line with the view that choppy decline from 163.05 is finished at 116.83 already. We'd favor further rise to 140.02 key resistance level next. Decisive break there will confirm this bullish case and target 163.05 key resistance next. Nonetheless, another fall and break of 126.54 will put focus back to 116.83 low instead.

In the longer term picture, fall from 251.09 is treated as resumption of multi-decade downtrend. It's still a bit too early to say whether such downtrend is finished yet and as long as 140.02 resistance holds, another fall would remain favor to 100 psychological level. Nonetheless, a break of 140.02 will confirm bottoming and GBP/JPY could then correct the whole downtrend form 251.09.

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" />

GBP/JPY H4" title="GBP/JPY H4" width="600" height="600" /> GBP/JPY" title="GBP/JPY" width="600" height="600" />

GBP/JPY" title="GBP/JPY" width="600" height="600" /> GBP/JPY 2" title="GBP/JPY 2" width="600" height="600" />

GBP/JPY 2" title="GBP/JPY 2" width="600" height="600" /> GBP/JPY 3" title="GBP/JPY 3" width="600" height="600" />

GBP/JPY 3" title="GBP/JPY 3" width="600" height="600" />