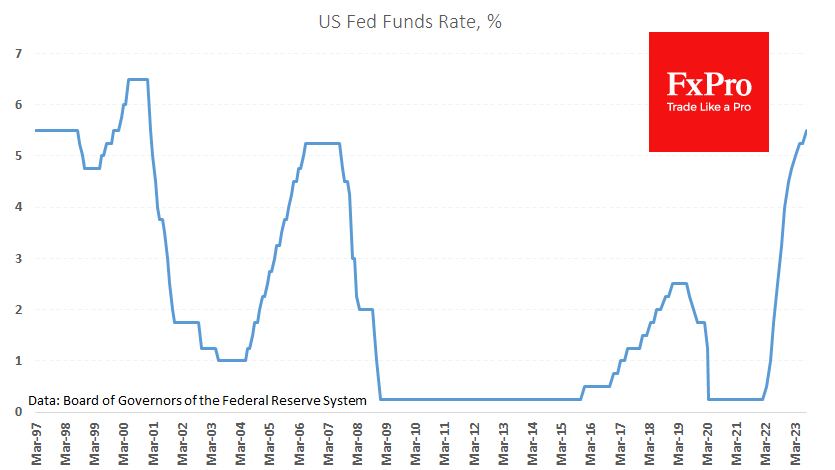

The Fed raised its key rate by 25 bps to 5.25-5.50%. The upper boundary of this range is the highest in 22 years. The lower boundary corresponds to the plateau level at which the Fed held rates from July 2006 to August 2007 before the onset of the mortgage and global financial crises.

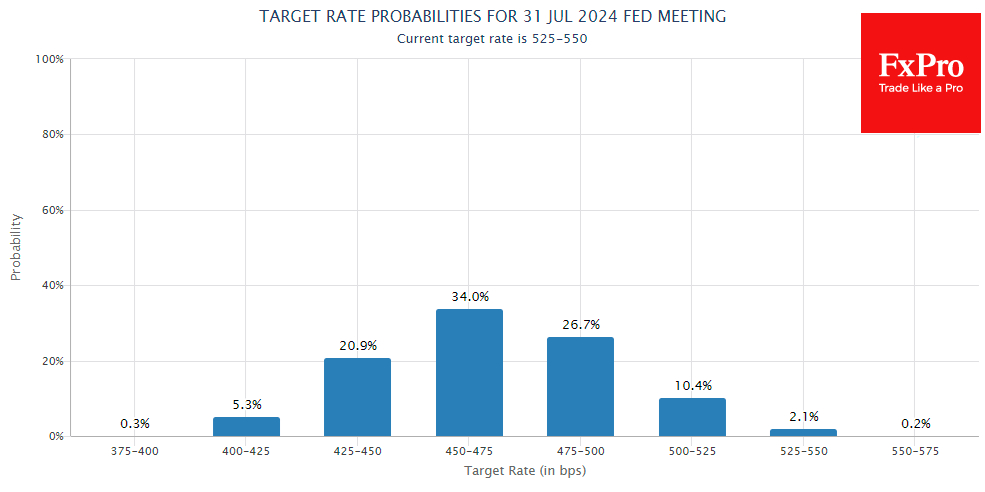

The markets perceive this point as a rate peak and expect a reversal in monetary policy soon. Rate futures are pricing in the start of a decline as early as January next year and suggest that the Fed Funds rate will be 75 points below current levels a year from now and 125 points by the end of 2024.

This was the markets' reaction to comments that the Central Bank's next moves will be based on further data, as the policy tightening that has already taken place has not yet had a full impact on the economy.

That said, Powell, at the press conference, continued to promote the idea that there is no need to wait for an imminent policy reversal. The FOMC forecasts inflation above target until the end of 2024, hence the need to maintain restrictive policy when the key rate exceeds inflation.

Powell noted the unexpected combination of falling inflation and rising employment but asked us to avoid jumping to conclusions based on one good inflation report.

We, on the other hand, focus on the persistent domestic pro-inflation factors. A tight labour market shapes wage growth at 4.4% y/y, holding inflation down. And this is evident in the monthly rate of price growth, where the overall rate added 1.7% in the first six months of the year, bringing the annual rate to 3.4%, while the core rate added 2.3% in the six months, bringing the annual rate to 4.6%.

Separate from overall inflation, housing prices added for the third consecutive month despite high mortgage rates, and rental costs are becoming the trigger for inflation instead of global energy and food prices as they were a year ago.

If economic theory still works, it's too early for the Fed to rest on its laurels and continue working to cool the economy. Markets continue to believe in strong growth, lower inflation and Fed policy easing simultaneously. However, it is wise to choose up to two of these.

The FxPro Analyst Team