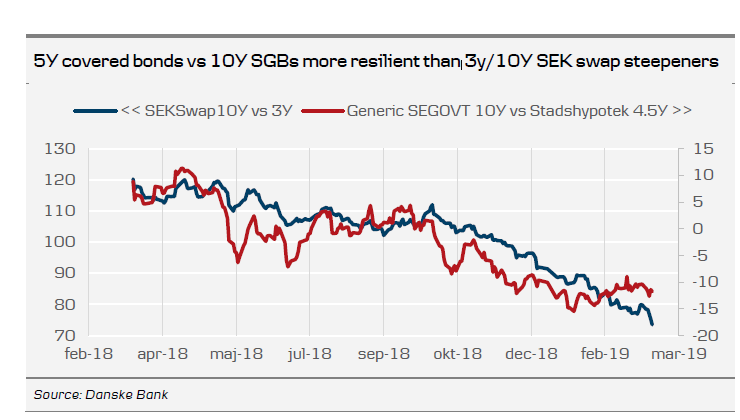

We close SEK swap 3Y-10Y steepener with a 12bp loss

Low volatility and hunt for yield favour covered and Kommuninvest bond

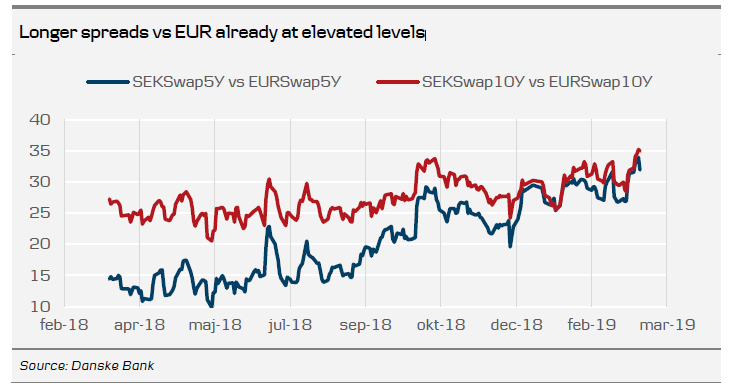

In our view, the remarkable change of position of the ECB is a game changer for SEK yield curves. The link between the SEK and EUR no doubt remains strong. SEK-EUR spreads in longer maturities already appear quite toppish from a historical perspective. We find it difficult to believe that the SEK long end would be able to decouple strongly from developments at the long end of the EUR curves. Since 2015, the R-square between monthly changes in the SEK 10Y swap vs the 10Y EUR swap is 0.82.

Admittedly, the Riksbank (RB) is still intent on hiking, and it is at least plausible that it could manage to squeeze in another hike in early autumn, as is currently being forecast. However, markets are likely to remain sceptical of the RBs ability to sustain a hiking cycle in an environment where rate hikes are off the table for the ECB. Moreover, the hunt for yield could put additional pressure on longer SEK rates. Despite the massive flattening trend since mid-October, the SEK curve remains steep from an international perspective, an obvious attraction for global real-money investors starved for yield.

How will the RB respond to the change in tone from the ECB?

The ECB just has made a very substantial downgrade of growth- and inflation estimates (still keeping a downside risk to growth) and decided to start adding monetary stimulus by introducing a TLTRO 3 and stating that the policy rate will be unchanged at least through 2019. The Fed, obviously worried that an economic downturn in Europe and elsewhere could have adverse effects on US growth, has gone on hold for now.

It is quite striking with what different words the RB has described the growth outlook for 2019, compared to the ECB. The difference is not so much in numbers, as the RB expects 1.3% y/y for Sweden, whereas the ECB sees growth at 1.1% for the eurozone. In the minutes from the February meeting, governor Ingves stated that global growth ‘is expected to be a good 3.5 per cent over the forecast period. This is a weaker, but by no means a poor, growth rate’. Despite another cut in the GDP forecast for 2019, developments were ‘in line with the assessments made in the Monetary Policy Report in December’.

In yesterday’s introductory statement, the ECB stated that ‘incoming data have continued to be weak, in particular in the manufacturing sector, reflecting the slowdown in external demand compounded by some country and sector-specific factors’. Moreover, Draghi added that ‘the other important part of today's decision is that we maintained the risk assessment as tilted to the downside’. This huge gap in how each central bank perceives the growth outlook perhaps explains why the RB is reactive to growth risks (trade war, Brexit), whereas the ECB has decided to become more proactive. It will obviously be interesting to see if there is any shift in tone from the Riksbank at the April meeting.

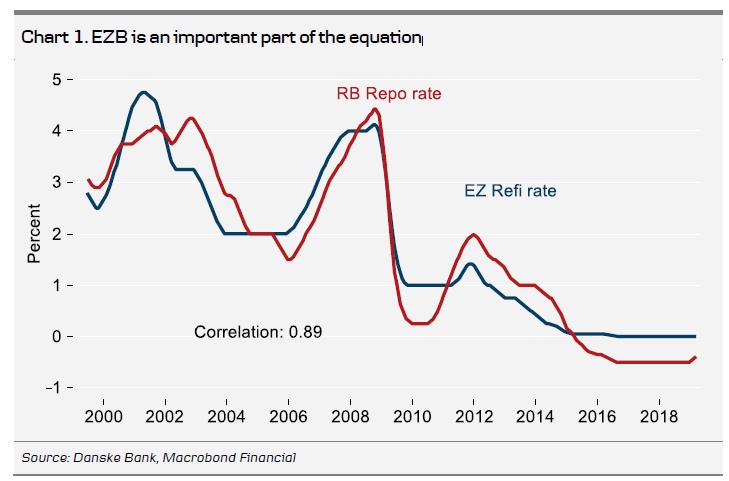

At the same time, in a recent presentation before the Riksdag finance committee, Riksbank governor Ingves talked about Sweden’s dependence on other economies. This was illustrated with two charts: one shows the correlation between Swedish GDP-growth and KIX-weighted international growth, R-squared is 88%; the other one shows the correlation between the Swedish repo-rate and KIX-weighted international policy rate, R-squared is 92%. In this context, it is worth mentioning that the eurozone’s KIX-weight is 49% so Europe matters. In fact the R-squared for the repo rate versus the ECB policy rate is 89% so Europe is obviously critical.

Riksbank board members sound convinced that Sweden will stay on a steady course with strong growth despite the international slowdown. Flodén called the ECB response ‘not a game changer’. This sounds a lot like the Riksbank in the old days, very focused on longerterm forecasts and not taking much notice of the flow of economic data. Remember the RB was the central bank that hiked less than two weeks before Lehman went bankrupt. In a way, this is quite natural, inflation has been close to 2% for quite some time and inflation expectations are close to target. Mission accomplished. Also, the output gap is closed and for firm believers in the Phillips curve this will eventually generate a selfpropelling rate of inflation of 2%. In addition, the Riksbank can point to a ridiculously weak krona. All this can be used as good argument for the Riksbank to stick to the plan of carrying out another hike in September. The question is: will they hike as planned or delay? The notion that the significant changes just announced by the ECB will be of little consequence for the Riksbank defies history (the 89% R-squared). So surely the ECB will be part of the equation also going forward. But coming decisions will of course also depend on how data unfold domestically. Sweden will not be unaffected by a more prolonged period of slow growth in Europe. It is also worth remembering that, on top of the international slowdown, Sweden is in the middle of a domestic downturn of housing construction that will subtract substantially from GDP growth over the coming 12-24 months.

In addition, inflation is on its way down (if not from other causes then due to base effects). The September meeting is early in the month so only July CPIF is available then. According to the RB forecast inflation in July will be 1.8%; according to us it will be 1.4%. Skingsley has said that she would be fine hiking again if inflation is around 1.5%. We are not so sure. The reason is that with inflation dropping from currently c.2% to c.1.5% and the Riksbank hiking, there is a risk that inflation expectations will start to derail again.

We certainly do not deny that there are reasons that could justify the RB staying on course, and they certainly sound as if they will. However, September is far away, so there is plenty of time for the RB to assess incoming information. But our best guess is that the September hike will be pushed out to December or early 2020.

Hope of SEK swap curve steepening is fading

Overall, the fact that the RB is slow to acknowledge increased growth risks together with the risk of fixings remaining on the wide side is obviously not helping the short end. Driven by the need to increase LCR buffers following the proposed 75% LCR floor in SEK, we fear that demand for term funding through FX swaps could remain high, pushing up implied SEK rates (see Reading the Markets Sweden. 8 March).

Aside from that, we expect the hunt for yield to intensify. The fact that ECB rate hikes are off the table for the whole of 2019 is likely to cap any upside in longer EUR rates even if data stabilises. Our colleagues expect Bund yields to move into negative territory and flattening pressures to remain. Our idea that the rather significant recovery in stock markets would be accompanied by a rebound (steepening) of the yield curve never flew it seems. Thus we decide to close our 3Y-10Y steepener with a 12bp loss.

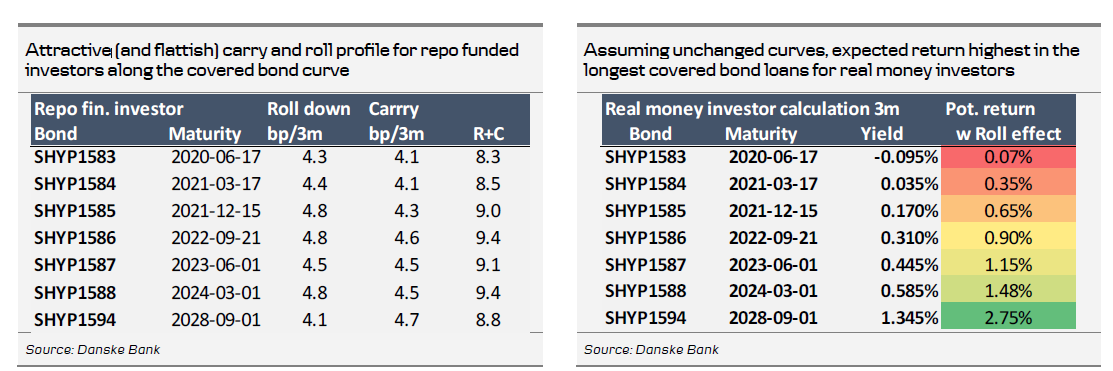

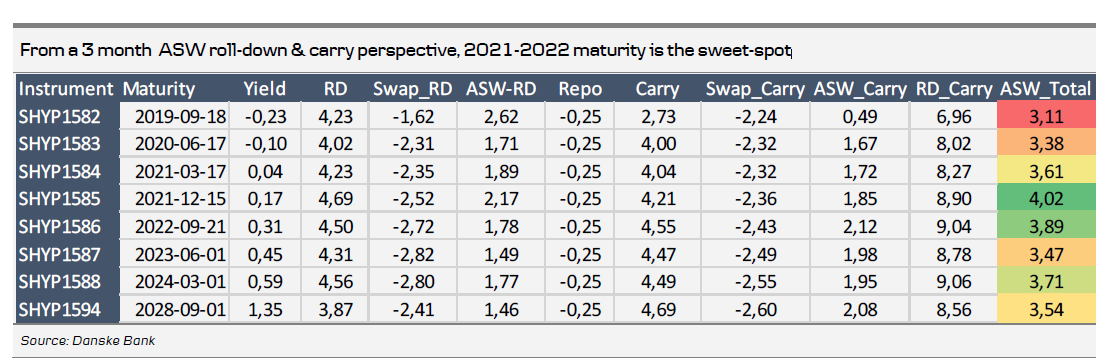

Longer dated SEK covered bonds obviously become attractive in such an environment. We note that our recommendation to buy SHYP1588 (March 2024) vs SGB1061 (Nov 2029) has traded in a sideways manner since we took on the position on 28 February, despite continued swap curve flattening. In a lower volatility environment, we expect the attractive carry/roll down profile of covered bonds to become increasingly attractive (see charts below).