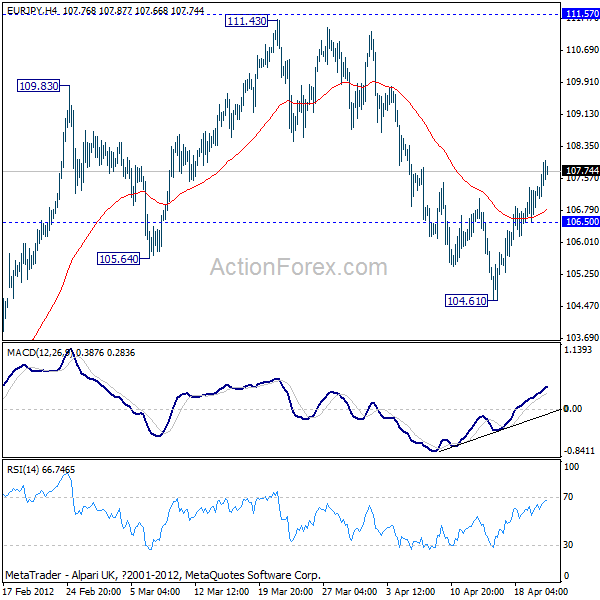

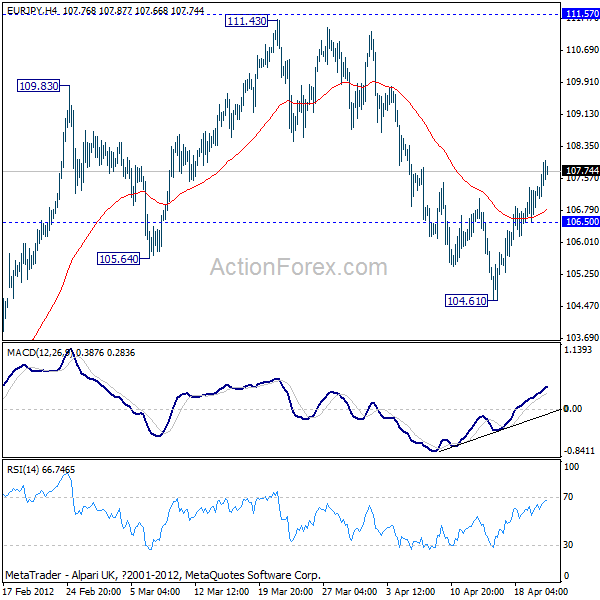

After dipping to 104.61 last week, EUR/JPY formed a short term bottom there and recovered. Initial bias is mildly on the upside this week and further rise could be seen back to 111.43/57 resistance zone. So far, rise from 104.61 is not impulsive looking and could indeed turn out to be a correction. In any case, sustained break of 111.43/57 is needed to confirm resumption of rally from 97.03. Otherwise, we'd expect more corrective trading below 111.43 in near term, possibly with another fall to 104.61 and below. On the downside, below 106.50 minor support will flip bias back to the downside to extend the decline from 111.43.

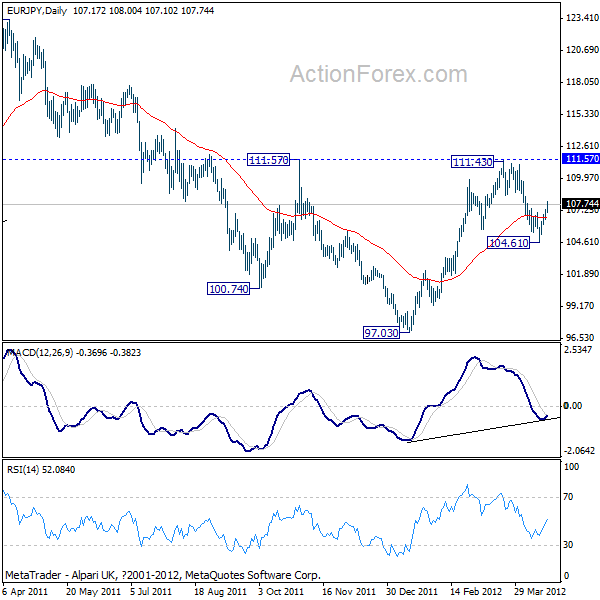

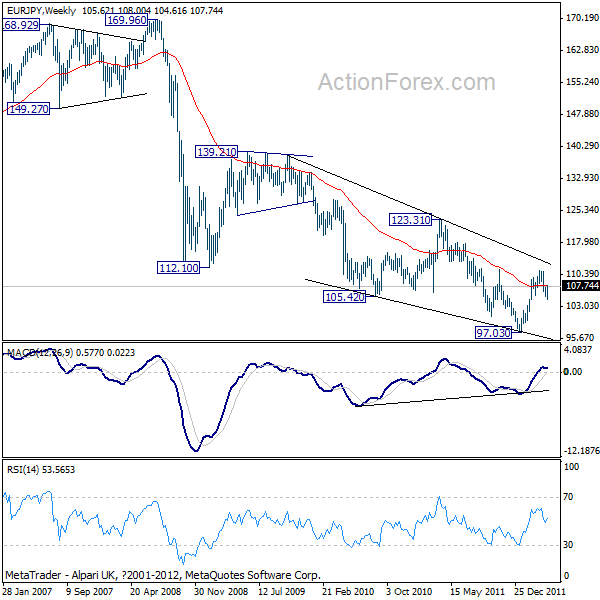

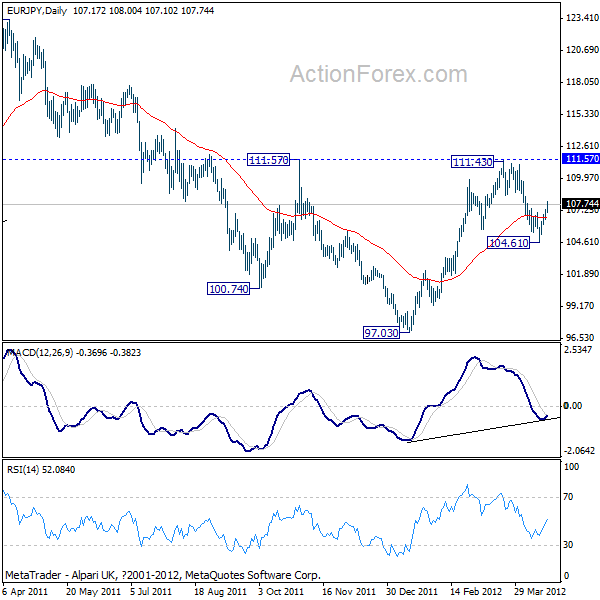

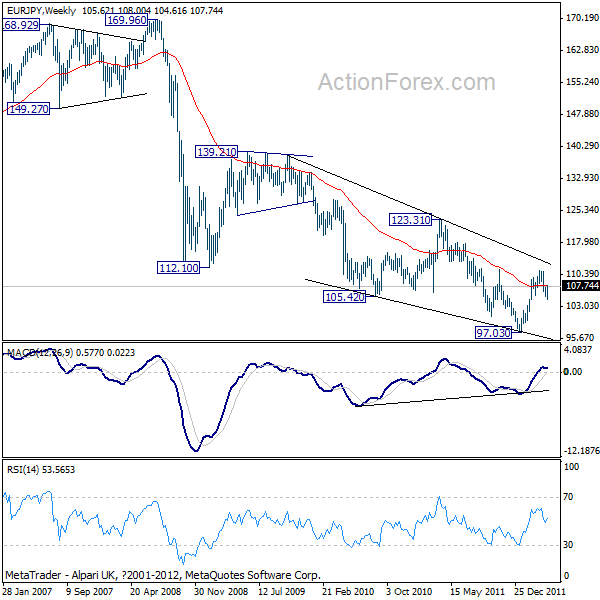

In the bigger picture, the question remains on whether the downtrend from 169.96 has completed 97.03 and the picture is unclear. There was loss of medium term downside momentum as seen in convergence condition in weekly MACD. But rebound from 97.03 lacked sustainable strength to break through 111.57 yet. We'll stay neutral first. Note that firstly, while another fall cannot be ruled out yet, the break of 97.03 could be marginal. Meanwhile, sustained trading above 111.57 should raise much odds for the case that EUR/JPY's trend is reversing.

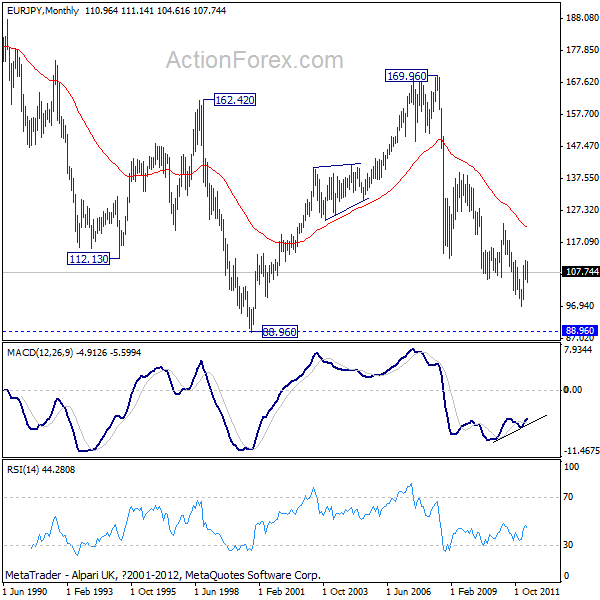

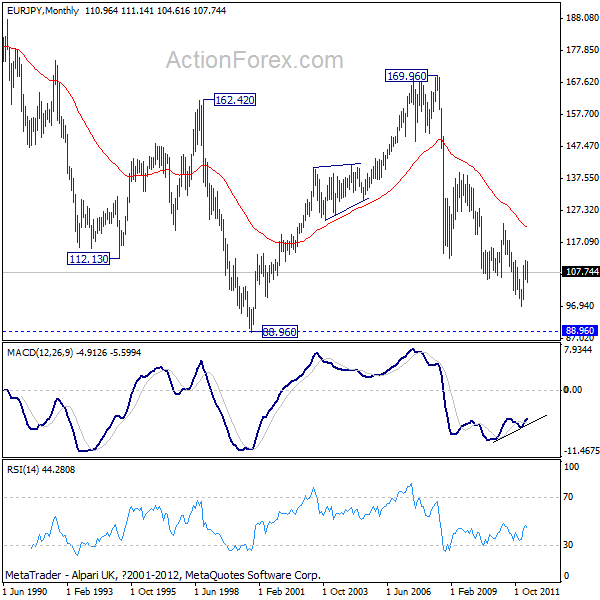

In the long term picture, uptrend from 88.96 (00 low) has completed at 169.96 and made a long term top there. Based on the five wave structure of the rise from 88.96 to 169.96, we're favoring that fall from 169.96 is corrective in nature. Current development argues that 97.093 might not be the bottom yet, but reversal should be around the corner considering bullish convergence condition in monthly MACD.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY 1" title="EUR/JPY 1" width="600" height="600" />

EUR/JPY 1" title="EUR/JPY 1" width="600" height="600" />

EUR/JPY 2" title="EUR/JPY 2" width="600" height="600" />

EUR/JPY 2" title="EUR/JPY 2" width="600" height="600" />

EUR/JPY 3" title="EUR/JPY 3" width="600" height="600" />

EUR/JPY 3" title="EUR/JPY 3" width="600" height="600" />

In the bigger picture, the question remains on whether the downtrend from 169.96 has completed 97.03 and the picture is unclear. There was loss of medium term downside momentum as seen in convergence condition in weekly MACD. But rebound from 97.03 lacked sustainable strength to break through 111.57 yet. We'll stay neutral first. Note that firstly, while another fall cannot be ruled out yet, the break of 97.03 could be marginal. Meanwhile, sustained trading above 111.57 should raise much odds for the case that EUR/JPY's trend is reversing.

In the long term picture, uptrend from 88.96 (00 low) has completed at 169.96 and made a long term top there. Based on the five wave structure of the rise from 88.96 to 169.96, we're favoring that fall from 169.96 is corrective in nature. Current development argues that 97.093 might not be the bottom yet, but reversal should be around the corner considering bullish convergence condition in monthly MACD.

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" />

EUR/JPY H4" title="EUR/JPY H4" width="600" height="600" /> EUR/JPY 1" title="EUR/JPY 1" width="600" height="600" />

EUR/JPY 1" title="EUR/JPY 1" width="600" height="600" /> EUR/JPY 2" title="EUR/JPY 2" width="600" height="600" />

EUR/JPY 2" title="EUR/JPY 2" width="600" height="600" /> EUR/JPY 3" title="EUR/JPY 3" width="600" height="600" />

EUR/JPY 3" title="EUR/JPY 3" width="600" height="600" />