It was not supposed to happen this way. Many were anticipating a contained trading range. Yesterday’s ‘big’ currency move was expected to take place after this morning’s highly anticipated and a potential watershed moment for non-farm payrolls. It may still do. Many investors, dealers and speculators have been uptight and intense for most of this week ahead of the Fed’s go to indicator. This morning’s employment report is the granddaddy of all economic indicators, and if we were playing the percentages after yesterday’s move, it should not be a quiet session.

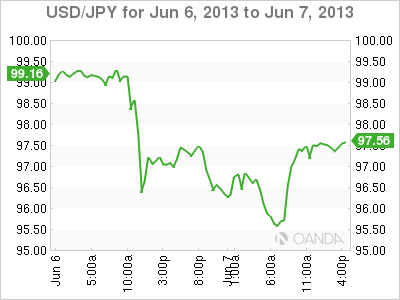

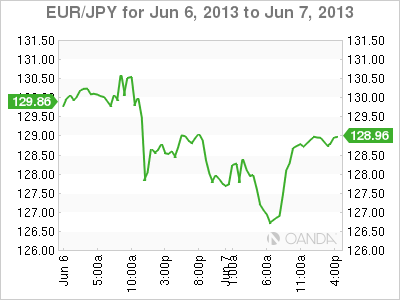

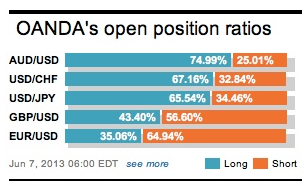

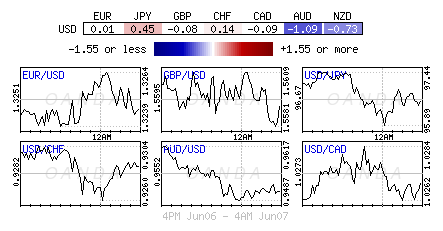

Size does matter! The dealer chatter that a -$22-billion USD/JPY sale at ¥98.00 yesterday happened to drive the FX market down -1% in 5-minutes is very believable, especially when one considers the type of volume that individuals were trying to lay off in a hurry. The ‘mighty’ dollar fell to new monthly lows against the EUR (-1.5%) and Yen (-3%) as a percentage of individual’s cheered optimistic comments from Draghi and while others unwound questionable positions ahead of this morning’s employment data.

Yesterday’s first 100-points of EUR’s premium can be attributed the ECB keeping its benchmark rate unchanged and Draghi offering no sign that his fellow cohorts were considering furthering easing any time soon. An even bigger percentage of the markets mammoth move can be blamed on the Yen, and it’s billion dollar stop-losses littered amongst every new ‘big’ figure. In fact, there was no new news from either the BoE or ECB to keep market direction on course. Some payroll jitters can be attributed to pre-payroll position adjustment as investors look for directional clues on the timing of the Fed tapering QE.

Yesterday’s breakdown in the Nikkei and USD/JPY will have many who have entered into the two most crowded trades (long Nikkei and short Yen) a tad worried. The wild move is trying to confirm technically, what many have believed was a correction of Abenomic rallies, may in fact be considered a reversal, especially now that the Tokyo bourse has broken through its -25% correction level and USD/JPY trading just above ¥96.00. Not making it any easier for the dollar and any equity bull is that the volume being traded is on the rise – signs of potential mass liquidation will only lead to more similar moves like yesterday’s ‘currency panic attack.’

What’s Japan to do to stem Abenomics opposition? The MoF will have to consider how far they can test the remaining G20 members if they ever contemplate implementing any “possible intervention.” In the overnights session, USD/JPY happened to push lower to ¥96.39 in the wake of comments from Japanese Finance Minister Aso that the government has no plans to intervene and will watch the FX market carefully. Japan’s Economic Minister Amari also said “they will monitor various market movements and added that market volatility may be solved by improving the real economy.”

Now that some of the irrational FX move has been priced “out” or “in,” everybody will be focusing on this morning’s employment reports from North America, especially the US non-farm payroll report. Canada will be taking care of itself. Today’s U.S release has been building itself to potentially becoming a ‘watershed’ moment for the Fed, QE and the US economy. We should thrown in any other excuse that backs some of the irrational and rational major currency moves we have witnessed this week. The final print employment will even get to top China and the PBOC setting of the strongest Yuan reference rate on record before the Chinese President, Xi Jinping, and his U.S. counterpart Barack Obama meet for talks in California this weekend. Chinese data tomorrow may reveal that their export growth halved last month – certainly not a good thing for the rest of our economies. The Yuan What can we has appreciated +1.6% this year – Asia’s best performer!

What should the market be expecting from this morning US employment report? How should a rational individual interpret the headline numbers?

Market consensus is looking at a headline print somewhere in a tight range between +163k to +170k, with no change in the unemployment rate at +7.5%. However, a slowdown in the headline for last month (mid range of +150k, but less than the expected headline) is very much on the cards, especially after this week’s weak ISM and ADP reports (statistically there many are non-correlation arguments).

The several asset classes are expected to perform quiet differently. For the James “Bond” trader, they most certainly will require a “very weak” headline print to make them consider curtailing this “taper talk.” The rest of us would require a very strong print to have confidence that there is sufficient underlying economic strength in the US.

It should not be a surprise to expect the FX market to struggle to interpret the data – especially after yesterday’s dollar shenanigans.

A strong print (greater than the +165-170k consensus) should validate some of the market expectations of Fed asset purchase tapering. The “mighty buck” gets to reverse some of its losses against its G10 counterparts. Probably less so against the emerging market currencies – any that is directly affecting US growth. Under this scenario the “yellow metal” should lose territory again, even the AUD cannot be saved!

A weak print (less than +120k) will be ‘the excuse’ to commence selling the ‘mighty dollar’ again against G10 currencies. Renewed massive USD/JPY weakness will heighten expectations that the Japanese authorities will have to do something outside the box to stem the reversal tide and threat to Abenomics. The dollar has the potential to rally against EM currencies on a weaker print.

Finally, what about neutral territory? That is anywhere between a weak and strong print (+120k and +170k). This is expected to confuse market participants thought process for US monetary policy even further. Naturally the market will look towards revisions, recent technical strength and weakness levels for guidance, however, a result like this could probably have more of an “equity/bourse” impact rather than FX or FI. No matter the result Bernanke and his cohort’s will be watching and listening!

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

After Currency Panic Attack, 3-Likely NFP Outcomes

Published 06/07/2013, 04:51 AM

Updated 07/09/2023, 06:31 AM

After Currency Panic Attack, 3-Likely NFP Outcomes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.