Institutional investors and whales have been increasing their Ethereum holdings over the past few weeks.

Key Takeaways

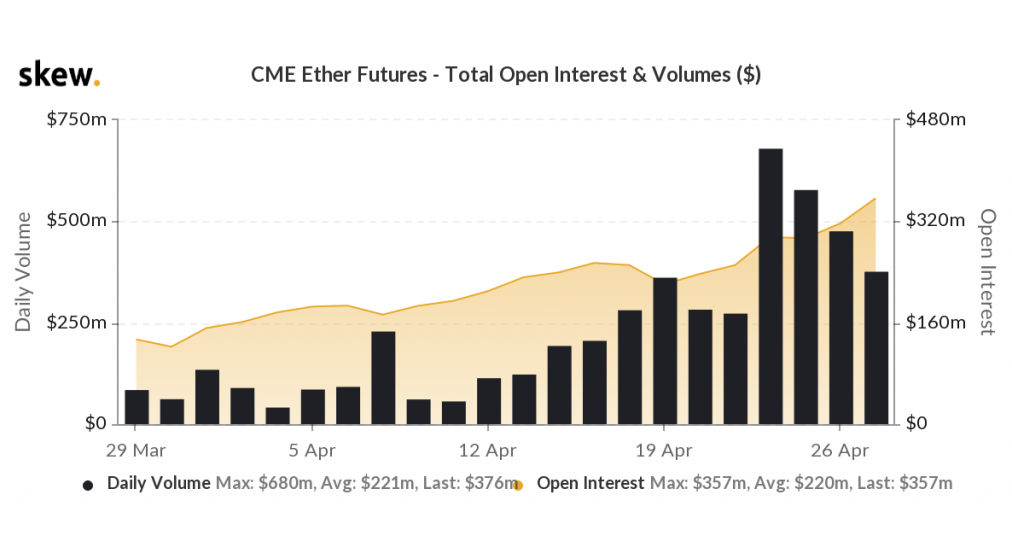

- The open interest in CME's Ethereum Futures has climbed steadily since it launched on Feb. 8.

- Along the same lines, the number of whales on the network has also shot up.

- The mounting buying pressure could help ETH catch up with Bitcoin's bull run.

While many retail investors have been shaken out of the market due to the high volatility, institutional demand for Ethereum is rising.

Institutional Demand at Record High

Ethereum’s scalability issues have drawn many investors and developers away over the past few years. However, the London hard fork slated for July seems to be attracting a lot of attention.

Alongside the “ultra sound money” meme, institutional demand for Ethereum also appears to be picking up.

Ever since CME launched its Ether futures on Feb. 8, open interest and daily volumes have been rising steadily. Data from Skew shows that the total number of outstanding contracts on the world’s largest financial derivatives exchange sits at $357 million while trading volume surged to $680 million on Apr. 22.

According to Arcane Research, the spike in institutional demand is related to the London hard fork and a new Ethereum-based financial product launched in Canada.

“The growing open interest and trading volume correspond with the approval of 4 Canadian Ether ETFs last week as Purpose Investments, CI Global Asset Management, Evolve, and 3iQ all launched their ETFs,” said the cryptocurrency research firm.

Ethereum Whales on a Buying Spree

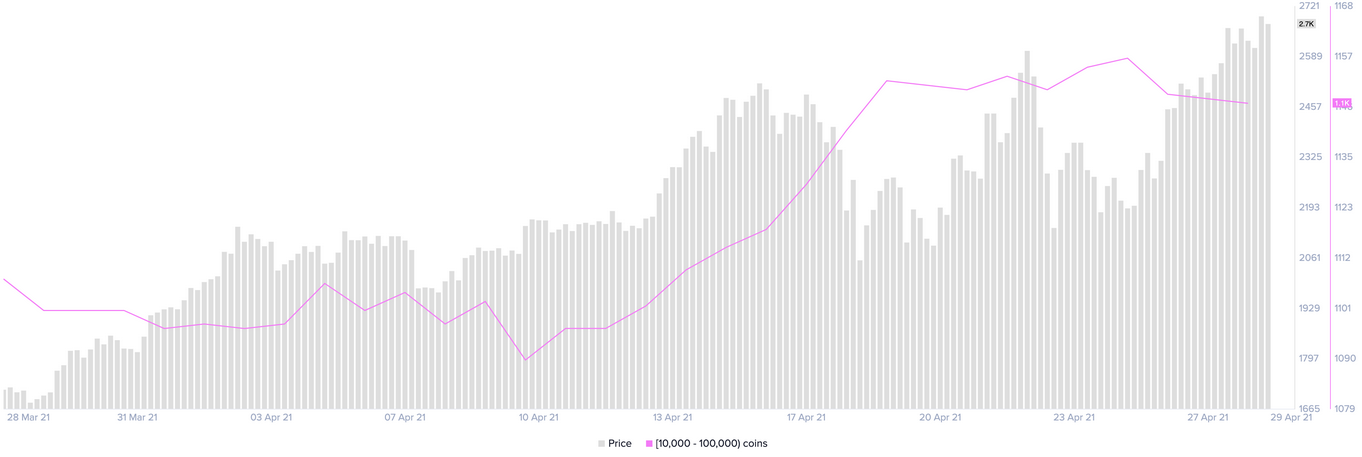

On-chain data shows a similar increase in demand for Ethereum among larger holders. Ether’s supply distribution chart shows that the number of addresses with 10,000 to 1,000,000 ETH surged by 5.22% over the past two weeks.

Roughly 57 whales have joined the network since then.

The growing number of large investors backing Etherum may seem insignificant at first glance. However, when considering these whales hold between $27 million and $2.7 billion in ETH, the sudden spike in buy orders is substantial.

The rising buying pressure behind Ethereum has been significant enough to drive prices to a new all-time high of $2,740, bringing its correlation with Bitcoin to a multi-year low of -0.18.

As long as Ether continues climbing while BTC tumbles, there is a high probability that more institutions will turn to this altcoin and help push prices even higher.