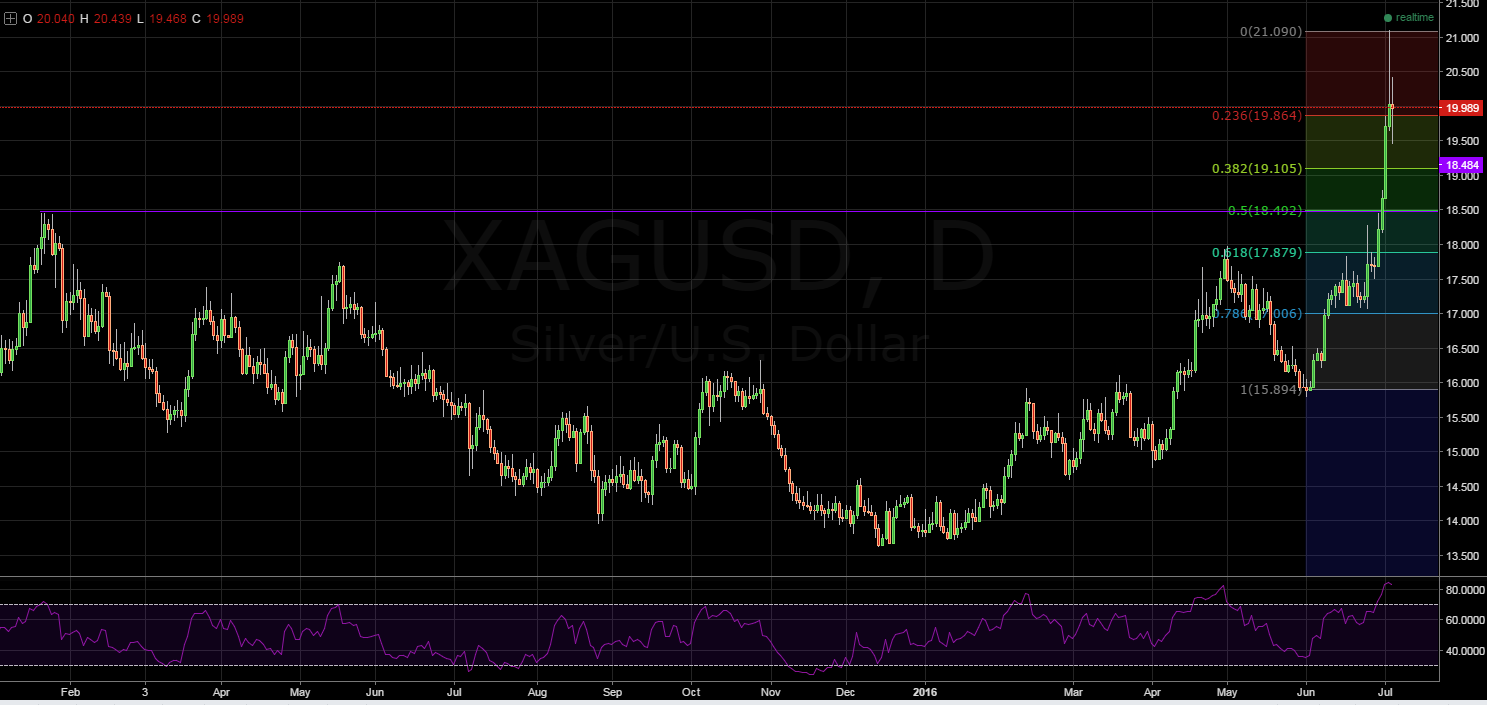

After some remarkable upward momentum, silver may have reached its peak. As a result, it could be reversing.

In fact, the metal is now likely to retreat back to support and consolidate at either the 19.105 or 18.492 levels. Consequently, as the market begins to return to normal, the poor man’s gold may shed its recent gains as fast as it made them.

Firstly, the daily chart has a number of technical indicators signaling that the metal is poised to make the move lower in the coming sessions. Primarily, the RSI oscillator is heavily overbought which is likely why the market largely rejected silver’s attempt to break through the 20.00 handle.

After the failed push, the metal fell back to around the 23.6% Fibonacci retracement level at 19.864 which could prove to be a point of inflection.

The 19.864 price level is likely to be proven as a turning point as a result of the shift in the H4 Parabolic SAR reading. Now bearish, the indicator suggests that a downtrend may be taking shape and could take the pair back to support. However, it is worth noting, the metal is having some difficulty breaking back through the 23.6% Fibonacci support level which could cap downside potential.

If support is broken at 19.864, the metal could retrace back to the 38.2% level and form a consolidating pattern. If support holds at this new Fibonacci level, silver will likely move to form either a bullish pennant or ascending triangle.

Consequently, the commodity should then collapse after a week or two of ranging between the 19.864 and 19.105 levels. However, there does remain an alternative outcome for the metal.

In the event that the 38.2% Fibonacci level is broken in the next day or so, silver could find itself plunging to a long-term support. This support exists around the 18.461 mark and coincides with the 50.0% Fibonacci level almost perfectly. As a result, it is likely that this would be as far as the metal could move in the short- to medium-term in the absence of some major upset to the markets.

In addition to the technicals, the evaporation of market uncertainty is beginning to make itself felt. Specifically, capital is flowing out of the relative safety of safe haven investments and silver is now following suit.

As the metal capitalised on the Brexit uncertainty so well, it’s fairly obvious why it is set to take a large hit now that much of the dust has settled. However, don’t entirely discount the likelihood of another shock to the markets which could prop up silver once again.

Ultimately, silver’s recent performance has been remarkable but also potentially somewhat unsustainable. Both technicals and fundamentals appear to be in agreement: the metal is overpriced and is therefore set to come tumbling down.

However, keep an eye on the commodity as it could be set to consolidate prior to making any large downside manoeuvres.