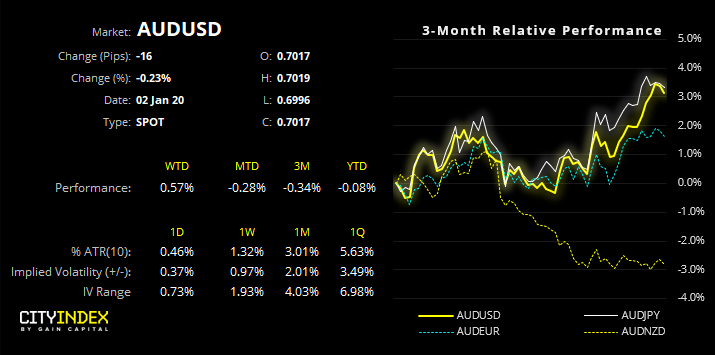

Just before Christmas we highlighted two potential patterns developing on AUD/USD. It didn’t take too long to confirm which one had the upper hand.

Come boxing day AUD/USD closed to its highest level since July. And it didn’t stop there, rallying another 90 pips to take the Aussie back above 70c. Whilst the weaker USD certainly played its part for AUD’s advance, equities were also squeezing the most out of Santa’s rally heading into the new year. Yet we’d stop short of calling it risk-on as gold was also advancing (quite possibly due to the concerns over the level of Fed injections to see them through a potential liquidity squeeze on the Rep market).

Still, the rally has invalidated the potential bearish wedge we outlined and confirmed the bullish basing pattern. If successful, the pattern projects an approximate target around 72c with the July high at 0.7082 making a viable, interim target. Yet over the near-term, the rally appears stretched and in need of a correction or pause at the very least.

Today’s price action has broken yesterday’s doji low to signal a retracement could be underway, so we’ll look for evidence a higher low has formed before turning bullish again. However, keep a close eye on how prices reaction around 70c as it could prove sticky over the near-term, being a psychological round number.