Finishing as it means to go on

African Barrick Gold Plc's, (ABGL) Q4 production results will be released this week, on Tuesday 21 January. We expect aggregate production (excluding Tulawaka) to have declined 7.4% during Q4, driven by a decline at North Mara (see page 2). On this basis, however, production for the full year will have been 628,566oz, which represents a 0.4% increase compared to FY12 and comfortably exceeds ABG’s prior full-year guidance of 600,000oz. Although there is likely to have been some rebound in unit cash costs (which will not be announced), it is unlikely to have been to the level of Q213, such that costs for the full year will have been c US$829/oz. With a 4.1% decline in the price of gold (quarter-on-quarter), we forecast a 19.7% decline in PBT compared to Q3, although a more modest tax charge should result in ABG reporting comparable net profits in Q4 versus Q3 compared to the small loss anticipated previously (see page 2). Consequently, we have upgraded our earnings forecasts despite cutting revenue forecasts.

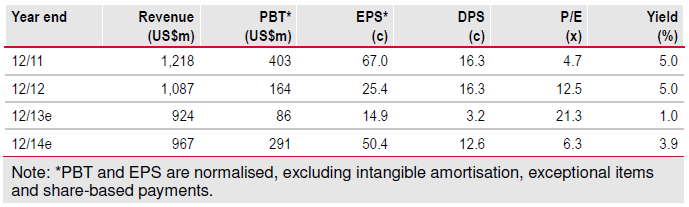

Forecasts and the gold price

FY14 forecasts are currently predicated on a gold price of US$1,448/oz and quarterly averages of US$1,301/oz in Q1, US$1,399/oz in Q2, US$1,496/oz in Q3 and US$1,594/oz in Q4. At the current gold price of US$1,240/oz, Edison’s forecasts for EPS drop to 11.1c and 17.2c in FY14 and FY15, respectively.

Valuation: Upside even at the current gold price

ABG’s share price of US$3.26 (£1.984) compares to FY13 estimated book value of US$5.06/share, including US$3.68/share in property, plant and equipment and US$0.55/share in cash. Given their categorisation (ie measured, indicated, inferred), its resource multiple of US$34.73/oz is even at a 10.4% discount to the London-listed average of US$38.75/oz for junior explorers. Edison estimates that, if ABG can achieve its targeted cost savings, the net present value of potential dividends to investors (at a 10% discount rate) is US$6.48 at Edison’s long-term gold price forecasts (see Gold – US$2070 by 2020, published in November) and US$4.34 at a long-term gold price of US$1,240/oz. These compare to previous valuations of US$8.29 at a long-term gold price of US$1,676/oz (excluding new projects) and US$5.05 at a long-term gold price of US$1,300/oz. At current levels therefore, ABG’s share price could be interpreted as discounting a static long-term gold price at US$1,240/oz and an 18.0% increase in unit working costs compared to Edison’s longer-term expectations, based on ABG management targets (ie unit working costs not declining further from current levels).

To Read the Entire Report Please Click on the pdf File Below