About a month has gone by since the last earnings report for Affiliated Managers Group, Inc. (NYSE:AMG) . Shares have lost about 6.4% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Affiliated Managers Q2 Earnings Beat as Revenues Rise

Affiliated Managers reported second-quarter 2017 economic earnings of $3.33 per share, outpacing the Zacks Consensus Estimate of $3.24. Also, earnings were up 8.5% year over year.

Higher revenues and a marginal decrease in expenses primarily drove earnings. Also, the quarter witnessed strong growth in assets under management.

Affiliated Managers’ economic net income was $188.7 million, an increase of 13% from the prior-year quarter.

Revenues Rise, Expenses Decline

Total revenue grew 3% year over year to $570.9 million. However, the top line missed the Zacks Consensus Estimate of $571.8 million.

Earnings before interest, taxes, depreciation and amortization were $254.8 million, up 16% from the year-ago quarter.

Total operating expenses dipped marginally year over year to $370 million. The decline was primarily due to lower selling, general and administrative expenses and intangible amortization and impairment costs.

As of Jun 30, 2017, total AUM grew 19% year over year to $772.1 billion. The quarter witnessed net client cash inflow of $1.8 billion.

Capital Position Deteriorates, Liquidity Position Decent

As of Jun 30, 2017, Affiliated Managers had $364.6 million in cash and cash equivalents compared with $430.8 million as of Dec 31, 2016. Notably, the company had $788.8 million of senior bank debt compared with $868.6 million as of Dec 31, 2016.

Shareholders’ equity as of Jun 30, 2017, totaled $3.60 billion, down from $3.62 billion as of Dec 31, 2016.

Share Repurchases

During the reported quarter, the company repurchased $120 million worth of common stock.

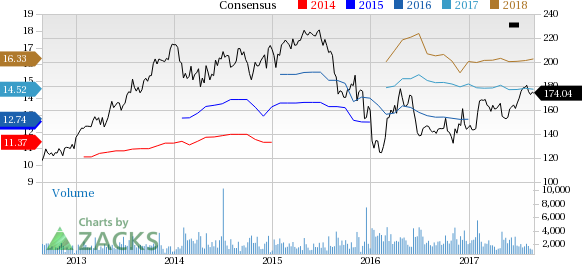

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There has been one revision higher for the current quarter. While looking back an additional 30 days, we can see even more upward momentum. There have been three moves higher compared to one lower in the last two months.

VGM Scores

At this time, Affiliated Managers' stock has an average Growth Score of C, though it is lagging a bit on the momentum front with a D. However, the stock was allocated a grade of A on the value side, putting it in the top quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value investors than growth investors.

Outlook

Estimates have been trending upward for the stock. The magnitude of these revisions also looks promising. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

Affiliated Managers Group, Inc. (AMG): Free Stock Analysis Report

Original post

Zacks Investment Research