Afferro (AFF.V) ticks all the major boxes in terms of the quality of its asset base, projects’ diversity and potential access to infrastructure. While Nkout is a large magnetite deposit with a potential early stage DSO operation, Ntem is a smaller scale, and hence more affordable, project, which is only 80km from the coast. This, coupled with the positive met test results and a robust maiden resource estimate, suggests that Ntem could be Afferro’s first project into production. Trading at an EV/resource of US$0.05/t, the AFF stock should be well supported by positive operational news flow and expectations of the successful completion of the IMIC takeover.

Quality assets with potential access to infrastructure

Afferro scores well in terms of both the quality of its asset base and potential access to infrastructure. The latter is difficult to overestimate, given the amount of constrained projects struggling to raise funds and make it into production. Further, an MoU with POSCO as well as the latest offer from IMIC, an infrastructure developer in Africa with strong Chinese relationships, suggest that the company is well advanced with the potential strategic partner/investor deal, which could result in off-take and project funding and ease infrastructure constraints.

Infrastructure could unlock the region’s potential

IMIC’s offer values Afferro at US$193m in equity, or US$0.13/t on an EV/resource basis. Following a definitive agreement between Afferro and IMIC (24 June), the shareholder vote should take place by the end of August, with the completion of the deal expected in September. Since IMIC is involved in infrastructure development in Africa, iron ore in particular, it could therefore be instrumental in bringing together an infrastructure solution for Nkout and other iron ore projects in Cameroon/Congo. This could help to unlock the value of a region that host a number of promising iron ore deposits and could be the next large iron ore exporter.

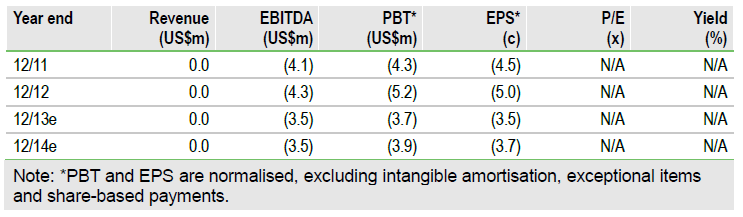

Valuation: Attractive on every metric

With some US$84m in cash, Afferro trades at an EV/resource of just US$0.05/t of contained iron compared to the sector average multiple of US$0.21/t. Using the PEA assumptions and a long-term benchmark iron ore price of US$90/t, we arrived at a base case unrisked NPV10 estimate for Nkout of US$3.3bn on an attributable basis, or US$2.7/share diluted. This does not take into account US$0.8/share in available cash. Further, our preliminary model suggests that Ntem could be worth another US$242m in NPV10. Due to its estimated relatively low capex and robust project economics, Ntem could be a fast-track route to production for Afferro.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Afferro Mining: Quality Assests, Potential Access To Infrastructure

Published 07/21/2013, 05:41 AM

Updated 07/09/2023, 06:31 AM

Afferro Mining: Quality Assests, Potential Access To Infrastructure

Ticking all the major boxes

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.