IMIC takeover approved

Afferro Mining Inc, (AFFA) shareholders have approved the proposed reverse takeover by IMIC, with some 97% of owners having voted in favour of the deal. Subject to receiving all necessary regulatory approvals, the transaction is expected to be closed by the end of October 2013.

Afferro has announced the approval of the proposed reverse takeover by IMIC at the extraordinary shareholder meeting held on 16 September 2013, with some 97% of shareholders and 100% of option holders voting in favour of the deal. Earlier, the companies reported that the closing date for the transaction has been extended to 31 October 2013. The successful completion of the acquisition is subject to receiving all relevant regulatory approvals.

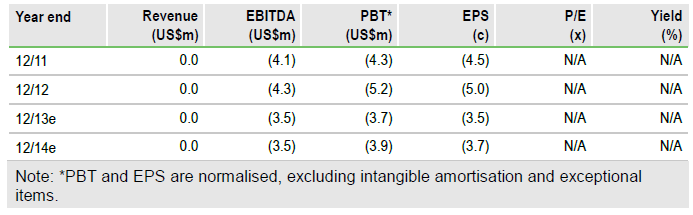

Based on the proposed terms of the transaction, Afferro shareholders are expected to receive £0.8 in cash plus a tradable convertible loan note of £0.4 (carrying a coupon of 8% pa) per each share. The key rationale behind the deal is to combine Afferro’s promising iron ore resource base in Cameroon with IMIC’s capabilities in putting together an infrastructure solution to unlock the intrinsic value of these assets. Valuing the company at US$0.13 per tonne of the contained iron, the deal offers plenty of upside to Afferro shareholders, which could be realised through the gradual de-risking of the projects. To this end, the key milestones would be the construction of the railway to connect the projects with the deepwater port near Kribi, as well as project funding.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Afferro Mining: IMIC Takeover Approved

Published 09/22/2013, 06:33 AM

Updated 07/09/2023, 06:31 AM

Afferro Mining: IMIC Takeover Approved

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.