AES Corporation’s (NYSE:AES) fourth-quarter 2019 adjusted earnings of 35 cents per share surpassed the Zacks Consensus Estimate of 33 cents by 6.1%. The bottom line, however, declined 2.8% from the year-ago period’s figure of 36 cents.

Barring one-time adjustments, the company incurred GAAP loss of 12 cents per share in the reported quarter as against the GAAP earnings of 15 cents recorded in the prior-year period.

For 2019, AES Corp’s adjusted earnings came in at $1.36 per share, which outpaced the Zacks Consensus Estimate of $1.35 by 0.7%. The reported figure also improved 9.7% from the prior year’s $1.24 per share.

Highlights of the Release

AES Corp generated total revenues of $2,431 million in the December-end quarter, down 7.3% year over year. The top line also lagged the Zacks Consensus Estimate of $2,775 million by 12.4%.

The company’s total revenues came in at $10,189 million in 2019, missing the Zacks Consensus Estimate of $10,430 million by 2.3%. The revenue figure, moreover, dropped 5.1% from the $10,736 million registered in the prior year.

Total cost of sales was $1,871 million in the fourth quarter, down 5.3% year on year. General and administrative expenses came in at $60 million, flaring up 3.4% from the year-ago quarter’s $58 million.

Operating income summed $560 million, down 13.3% from the year-earlier period’s $646 million.

Interest expenses totaled $262 million, up from the $257 million witnessed in the prior-year period.

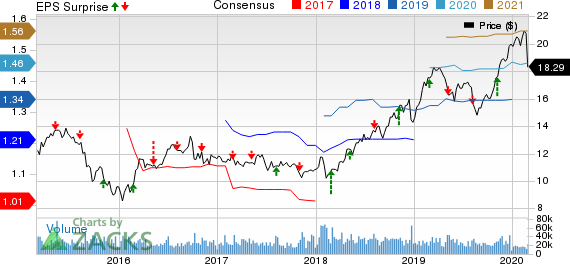

The AES Corporation Price, Consensus and EPS Surprise

Financial Condition

AES Corp reported cash and cash equivalents of $1,029 million as of Dec 31, 2019, compared with $1,166 million as of Dec 31, 2018.

Non-recourse debt totaled $14,914 million as of Dec 31, 2019, up from $13,986 million as of Dec 31, 2018.

In 2019, cash from operating activities was $2,466 million compared with the year-ago figure of $2,343 million.

Total capital expenditures in 2019 amounted to $2,405 million compared with the $2,121 million incurred a year ago.

Guidance

For 2020, AES Corp expects adjusted earnings of $1.40-$1.48 per share. The Zacks Consensus Estimate for full-year earnings is pegged at $1.46, above the mid-point of the company’s guided range.

Zacks Rank

AES Corp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

CMS Energy (NYSE:CMS) reported fourth-quarter 2019 adjusted earnings per share (EPS) of 68 cents, significantly up 70% from the year-ago quarter’s 40 cents. The bottom line, however, missed the Zacks Consensus Estimate of 69 cents.

NextEra Energy (NYSE:NEE) delivered adjusted earnings of $1.44 per share for the October-December period, lagging the Zacks Consensus Estimate of $1.54 by 6.5%.

Dominion Energy (NYSE:D) recorded operating earnings of $1.18 per share for the final quarter of 2019, beating the Zacks Consensus Estimate of $1.16 by 1.7%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

CMS Energy Corporation (CMS): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Original post