The AES Corporation’s (NYSE:AES) second-quarter 2017 adjusted earnings per share of 25 cents surpassed the Zacks Consensus Estimate of 21 cents by 19%. Moreover, earnings improved 47.1% from the year-ago period’s equivalent figure of17 cents, driven by higher margins and lower Parent interest expense.

Barring one-time adjustments, the company’s second-quarter reported earnings were 8 cents as against the year-ago loss of 16 cents.

Highlights of the Release

AES Corp. generated total revenue of $3,470 million in the second quarter, up 7.5% year over year. The top line surpassed the Zacks Consensus Estimate of $3,211 million by 8.1%.

In the reported quarter, total cost of sales was $2,800 million, up 5.5% year over year. General and administrative expenses were $49 million, slightly higher than the year-ago level of $47 million.

Operating income was up 16.7% to $670 million.

Interest expenses in the quarter were $333 million, down from $390 million in the year-ago quarter.

Financial Condition

AES Corp. reported cash and cash equivalents of $1,213 million as of Jun 30, 2017, compared with $1,305 million as of Dec 31, 2016. Non-recourse debt totaled $13,815 million as of Jun 30, 2017, up from $14,489 million as of Dec 31, 2016.

In the second quarter, cash from operating activities was $251 million, compared with the year-ago figure of $723 million.

Total capital expenditure in the period was $649 million, higher than $615 million a year ago.

Consolidated free cash flow was $106 million in the second quarter, down from $554 million in the year-ago quarter.

Guidance

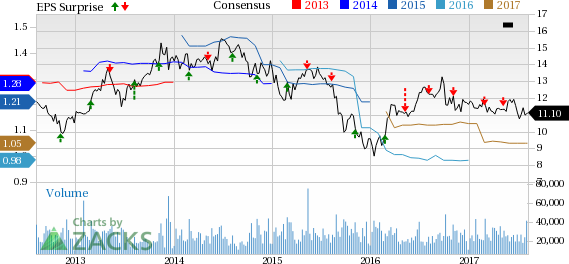

AES Corp. reaffirmed its adjusted earnings per share guidance for 2017 in the range of $1.00−$1.10.

The company still expects 2017 consolidated free cash flow guidance in the band of $1,400−$2,000 million.

Business Update

In Aug 2017, AES Corp. completed converting its existing plant from open cycle to combined cycle at its DPP power plant in the Dominican Republic, adding 122 MW of capacity. The company currently has 4,759 MW of capacity under construction which is expected to come on line by 2021.

In Jul 2017, AES Corp. and Alberta Investment Management Corporation (AIMCo) closed the acquisition of FTP Power LLC (sPower) – the largest independent owner, operator and developer of utility scale solar assets in the U.S. – for $853 million in cash, plus the assumption of $724 million in non-recourse debt. Per the terms of the agreement, AES Corp. and AIMCo independently own a little less than 50% equity interests in sPower.

In the same month, AES Corp. and Siemens unveiled a joint venture – Fluence – to sell the companies' energy storage platforms in more than 160 countries. The transaction is expected to close in fourth-quarter 2017, subject to customary regulatory approvals.

Zacks Rank

AES Corp. presently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Sempra Energy’s (NYSE:SRE) second-quarter 2017 adjusted earnings per share (EPS) came in at $1.10, beating the Zacks Consensus Estimate of 80 cents by 37.5%. Earnings also improved 39.2% from the prior-year quarter figure.

Consolidated Edison Inc. (NYSE:ED) posted second-quarter 2017 adjusted earnings of 58 cents per share that missed the Zacks Consensus Estimate of 61 cents by 4.9%. Reported earnings also dropped 3.3% from the year-ago figure of 60 cents.

Entergy Corporation (NYSE:ETR) reported second-quarter 2017 operational earnings of $3.11 per share, beating the Zacks Consensus Estimate of $1.20 by 159.2%. However, the reported number was in line with the year-ago figure.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Entergy Corporation (ETR): Free Stock Analysis Report

Consolidated Edison Inc (ED): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

Sempra Energy (SRE): Free Stock Analysis Report

Original post

Zacks Investment Research