AECOM (NYSE:ACM) clinched a new five-year contract with Dallas/Fort Worth (“DFW”) International Airport, to deliver program management and construction management (PM/CM) services.

The contract also covers a range of other potential projects, including both federally and non-federally-funded airfield improvements, landside improvements and building projects.

The contract entails AECOM to deliver full project life cycle services to DFW’s Design, Code and Construction Department. The services covered by the contract include program, project, design and construction management; program and project controls; public outreach; contract administration; and technical, third-party support.

The contract, which is estimated to be valued at about $100 million, reflects the strong collaborative relationship that AECOM shares with DFW, having served as a consultant to the latter for over 30 years. DFW is widely acknowledged as one of the most frequently visited super-hub airports across as the world, and is the fourth busiest airport in the U.S.

Consistent with AECOM’s and DFW’s dedication to encourage participation of Disadvantaged Business Enterprises (“DBE”), it is likely that about 40% of the contract’s total value will be subcontracted by AECOM to qualified DBEs.

Late last month, AECOM was chosen as the Engineering, Procurement and Construction contractor for the Alliant Energy’s Riverside Energy Center expansion project. The contract, valued at $700 million, will be booked in the company’s backlog for third quarter of fiscal 2016.

Overall, AECOM won $4.4 billion of contracts in first-quarter fiscal 2016. Since contracted backlog is a key indicator of future revenue growth, it indicates a bright future for AECOM.

However, AECOM is facing headwinds in some of its end markets that can have an adverse impact on its near-term financial performance. The current volatility in the oil and gas markets, coupled with declining oil prices and capital spending levels, might continue to hurt the company’s projects and orders.

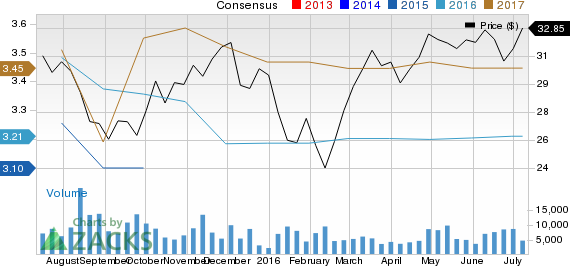

AECOM currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader industrial products sector include Alamo Group, Inc. (NYSE:ALG) , Schneider Electric (PA:SCHN) SE (OTC:SBGSY) and EnerSys (NYSE:ENS) , each carrying a Zacks Rank #2 (Buy).

AECOM TECH CORP (ACM): Free Stock Analysis Report

SCHNEIDER ELECT (SBGSY): Free Stock Analysis Report

ALAMO GROUP INC (ALG): Free Stock Analysis Report

ENERSYS INC (ENS): Free Stock Analysis Report

Original post

Zacks Investment Research