Aecom Technology Corporation (NYSE:ACM) provides planning, consulting, architectural and engineering design and program and construction management services for a range of projects including highways, airports, bridges, mass transit systems, to government and commercial clients. The company had US$17.4 billion of revenue during fiscal year 2016, it's been ranked number one in Engineering News Record‘s “Top 500 Design Firms” for 8th consecutive year and named one of Fortune magazine’s “World’s Most Admired Companies” for the third consecutive year.

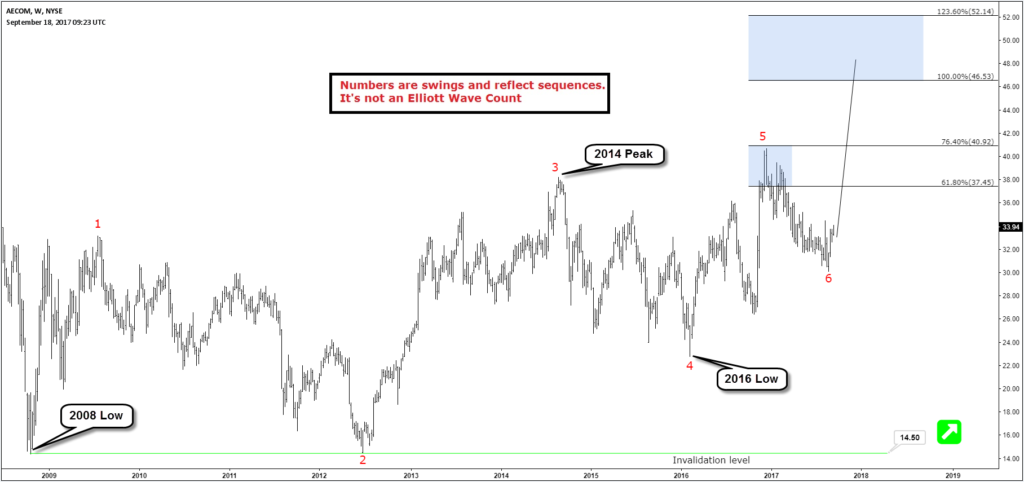

From 2008 low, AECOM stock is showing 5 swings incomplete bullish sequence which is different from the regular impulsive 5 waves move as we use this sequence as part of our new way of applying Elliott Wave Theory to the market. We believe that many instrument has the ability to trend using corrective Elliott wave structure rather then trending in 5 waves move, so this move is considered as part of a double three structure which has 7 swings.

AECOM managed last year to make new all time high, so using 2014 peak & 2016 low as a connector, the stock is looking to extend higher toward equal legs area 46.53 - 52.14 before ending the cycle from 2008 low.

AECOM Weekly Chart

AECOM ended 3 waves pullback from 12/12/2016 peak after it reached the 50-61.8 fib retracement area 31.75 - 29.63, so currently as long as it remains above the recent August low at 30.15 and most importantly as long as 22.84 pivot keeps holding then AECOM will extend higher to make new all time highs and reach the target around the $50 area.

AECOM Daily Chart

Recap

AECOM has a bullish structure and technically it has resumed the move higher unless the move truncates without reaching the target and decide to make the double correction from 2016 peak. It's not recommended to sell it and it's better to look for buying opportunity during short term pullbacks using corrective structures in 3 , 7 or 11 swings.