AECOM (NYSE:ACM) is slated to report third-quarter fiscal 2017 results on Aug 8.

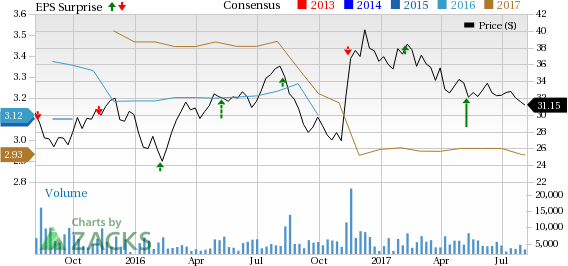

In the last reported quarter, the company beat estimates by 61.8%. Overall, AECOM has a choppy earnings surprise history. It has an average positive surprise of 15.9%, with two beats, one in-line earnings and one miss.

Let’s see how things are shaping up for this announcement.

Factors to Consider

AECOM’s diversified portfolio, which comprises both designing and construction services, has helped the company offset weakness associated with single markets, thus driving growth. More than 70% of its profits are generated from infrastructure and defense markets that are benefitting from the favorable political climate both in the U.S. and abroad.

We believe escalating infrastructure spend will continue to raise the top line for the soon-to-be-reported quarter. For instance, the Canadian government’s $150 billion infrastructure plan, and recently-approved ballot measures in California and Washington as high as $180 billion, are proving conducive to AECOM’s growth. In addition, solid levels of UK infrastructure funding are likely to benefit international design markets during the upcoming fiscal third-quarter results.

We believe the company’s transportation segment will particularly benefit from these positive industry trends. In addition, rebound of the company’s transportation business in Australia is likely to supplement third-quarter fiscal 2017 sales. The Australian government's $50-billion commitment to fund critical infrastructure investments through 2020 is unlocking opportunities for the company.

AECOM Price, Consensus and EPS Surprise

Despite these positives, volatility in commodity prices poses a threat for AECOM. As a portion of the its revenues are directly exposed to the oil and gas sector, persistence of these issues has stunted its growth over the past few quarters. Lower capital spending on the part of major clients is proving to be a major concern for the company.

Of late, AECOM has been witnessing an increase in federal contracts based on a low price. This has put significant pricing pressure on the company’s margins over the past few quarters. We believe pricing pressures will continue to hurt the company’s profitability for the soon-to-be-reported quarter. This apart, currency fluctuations are likely to play spoilsport for the upcoming quarter, hindering growth.

Earnings Whispers

Our proven model does not conclusively show that AECOM will beat earnings estimates in this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. But that is not the case here as you will see below.

Zacks ESP: AECOM has an Earnings ESP of -1.28%. This is because the Most Accurate estimate is pegged at 77 cents, lower than the Zacks Consensus Estimate’s 78 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company carries a Zacks Rank #3. Though a Zacks Rank #1, 2 or 3 increases the predictive power of the ESP, the company’s ESP of -1.28% makes surprise prediction difficult.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter.

JELD-WEN Holding, Inc. (NYSE:JELD) has an Earnings ESP of +7.69% and a Zacks Rank #2.

CACI International Inc (NYSE:CACI) has an Earnings ESP of +1.83% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Triton International Limited (NYSE:TRTN) has an Earnings ESP of +1.70% and a Zacks Rank #2.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Triton International Limited (TRTN): Free Stock Analysis Report

JELD-WEN Holding, Inc. (JELD): Free Stock Analysis Report

CACI International, Inc. (CACI): Free Stock Analysis Report

AECOM (ACM): Free Stock Analysis Report

Original post

Zacks Investment Research