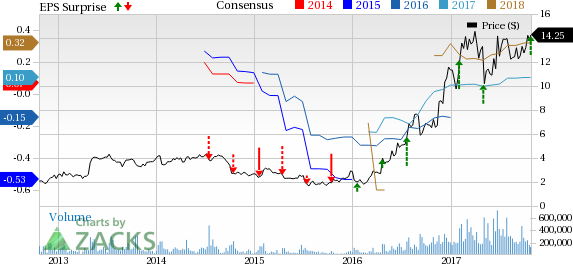

Advanced Micro Devices, Inc. (NASDAQ:AMD) reported non-GAAP earnings of 10 cents per share compared with 3 cents per share in the year-ago quarter. The figure also surpassed the Zacks Consensus Estimate of 8 cents per share.

Revenues increased 26% year over year and 34% sequentially to $1.64 billion and exceeded the Zacks Consensus Estimate of $1.51 billion. The quarterly revenue figure was also the highest since 2011, primarily driven by robust performance of the company’s product portfolio comprising Ryzen, EPYC and Radeon Vega.

Segments

Advanced Micro has two reportable segments — Computing and Graphics (focused on the traditional PC market) and Enterprise, Embedded and Semi-Custom (focusing on adjacent high-growth opportunities).

Computing and Graphics

Computing and Graphics segment revenues witnessed year-over-year increase of 74% to $890 million. The growth was backed by accelerated sales of Radeon graphics and Ryzen desktop processors.

Operating income for this segment was $70 million against a loss of $66 million in third-quarter 2016, primarily driven by higher revenues.

Client computing revenues recorded strong double-digit growth from the year-ago quarter driven by solid demand for the expanded Ryzen processor family in the desktop market. Ryzen 5 and Ryzen 7 processors constitute around 40% to 50% of the desktop market share. Additionally, the accelerated ramp up of shipments by OEM customers prior to the holiday season has increased adoption as well.

Ryzen 3 processor has expanded the company’s foothold in the mainstream segment. Moreover, Ryzen Threadripper processors have enabled AMD to re-enter the high end desktop market. Notably, the company’s Ryzen PRO-based offerings have already been adopted by prominent commercial PC providers including Dell, Lenovo, and HP.

The company achieved record Graphics Processor Units (GPUs) revenues on the back of improved average selling price (ASP) and higher unit shipments compared with the year-ago quarter.

The company’s release of Vega-based GPUs and increasing demand for its Polaris products in both gaming and blockchain industries led to improved revenues. Launched during the quarter, Radeon RX Vega family of GPUs aimed at gaming enthusiasts has performed better than previous Radeon GPUs.

Additionally, AMD started the shipment of Radeon Instinct MI25 to major cloud data center customers and Radeon Pro WX 9100 graphics cards to the high-end content creation market during the quarter.

Notably, the company entered into a partnership with Baidu during the quarter to focus on “optimizing” software for AMD’s Radeon Instinct GPUs in Baidu datacenters. Moreover, Amazon (NASDAQ:AMZN) Web Services announced that it is powering Amazon AppStream 2.0 with AMD Radeon Pro technology, aimed at driving cloud delivery of virtual applications.

Enterprise, Embedded and Semi-Custom

Segment revenues amounted to $824 million, almost flat year over year but up 46% sequentially. However, higher costs brought down operating income for the segment from $136 million to $84 million for the quarter.

The sequential increase in revenues was based on an increase in semi-custom revenues. Management expects the trend to continue in the holiday season.

The ramping up of EPYC datacenter processors sale to cloud and OEM customers have boosted server revenues. Management remains optimistic about this product with companies like Tencent and JD.com planning to deploy the company’s EPYC processors. Baidu and Microsoft (NASDAQ:MSFT) also announced plans of deploying EPYC based products in their hyperscale environment, which is another positive for AMD.

Margins

Gross margin increased 400 basis points (bps) to 35% year-on-year backed by a proper product mix in the Computing and Graphics segment and IP-related revenues. Management noted that ramping up of high performance products will continue to have a positive impact on margins.

Adjusted EBITDA amounted to $191 million compared with $103 million in the year-ago quarter.

Balance Sheet & Cash Flow

AMD ended the third quarter with cash, cash equivalents and marketable securities of $879 million compared with $844 million in the previous quarter. Free cash flow was $32 million.

Guidance

Notably, fourth-quarter 2017 is a 13-week quarter while the year-ago quarter comprised 14 weeks.

For the fourth quarter of 2017, management expects revenues to decrease approximately 15% sequentially (+/-) 3%. At the mid-point, revenue growth is expected to be 26% on a year-over-year basis.

Non-GAAP gross margin is expected to be 35% while non-GAAP operating expenses are anticipated to be around $410 million

The company expects 2017 revenues to witness a more than 20% increase, better than a mid-to-high teens percentage guided earlier.

Zacks Rank and Key Picks

AMD currently has a Zacks Rank #3 (Hold).

Better-ranked stocks in the broader technology space include Micron Technology, Inc. (NASDAQ:MU) and NVIDIA Corporation (NASDAQ:NVDA) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Micron and NVIDIA is projected to be 10% and 11.2%, respectively.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post