Adtalem Global Education Inc. (NYSE:ATGE) reported second-quarter fiscal 2018 results, with earnings surpassing the Zacks Consensus Estimate but revenues missing the same.

Adjusted earnings of 76 cents per share beat the Zacks Consensus Estimate of 75 cents by 1.3%. On a year-over-year basis, earnings increased 18.8%.

Quarterly net sales of $337.2 million missed the Zacks Consensus Estimate of $434.9 million by 22.5%. Total revenues however increased 1% from the year-ago figure. Total students enrollments increased 2.4% and new students enrollments rose 7.3%.

The company’s total operating cost and expenses contracted 16% year over year to $281.9 million in the quarter. Operating income was $55.4 million in the quarter, against a loss of $1.5 million in the prior-year quarter.

Segment Details

Medical and Healthcare: This segment, which includes Chamberlain University, American University of the Caribbean School of Medicine, Ross University School of Medicine and Ross University School of Veterinary Medicine, is the largest contributor to revenues and earnings.

In the fiscal second quarter, segmental revenues of $ 203.3 million increased 0.9% from the year-ago level. Growth at Chamberlain University was offset by lower revenues at the medical and veterinary schools.

At Chamberlain, revenues rose 1.9%. Last November, new student enrollment increased 5.5% and total student count grew 5.1%.

Revenues from the medical and veterinary schools dropped 0.3% year over year.

Operating income at the segment was $55 million, up 5.6% from the prior-year quarter.

Professional Education: The segment includes Becker and Association of Certified Anti Money Laundering Specialists or ACAMS along with DeVry Education of Brazil.

The segment registered revenues of $30.4 million, up 10.9% year over year, primarily driven by 62% revenue growth at ACAMS.

Operating income was $2.2 million, higher than $0.1 million recorded in the prior-year quarter.

Technology and Business: This segment, comprising Adtalem Brazil Institution, registered revenues of $75.1 million, up 2.4% year over year.

This segment generated operating income of $14 million up 3.8% year over year. The improvement was driven by revenue growth and cost efficiencies.

US Traditional Postsecondary: The segment registered revenues of $29 million, down 10.5% year over year. Carrington’s revenues dropped 13.1% to $32.1 million.

This division incurred an operating loss (adjusted for special item) of $5.8 million compared with a loss of $6.3 million a year ago.

New student enrollment at Carrington was up 7.2%, courtesy of the college’s efforts to revise the institution’s program offerings and marketing efforts.

During the second quarter, Adtalem signed an agreement to transfer ownership of DeVry University to Cogswell Education. The deal is expected to close in early fiscal 2019. As a result, DeVry University has been classified as a discontinued operation.

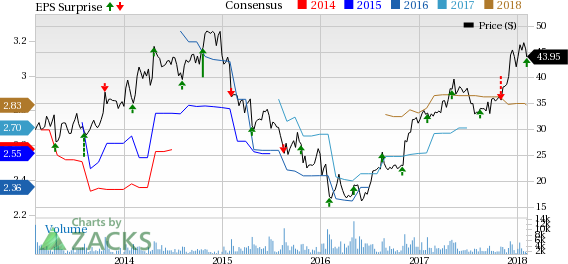

DeVry Education Group Inc. Price, Consensus and EPS Surprise

Q3 Guidance

Revenues are expected to increase 3% to 4% year over year.

Operating costs (before special items) are expected to rise 1% to 2% year over year.

Fiscal 2018 Guidance

The company expects earnings per share growth of 10-12% (low single-digit range expected earlier).

Total revenues are anticipated to increase 1% to 2% (decline 2% to 3% expected earlier) in the year.

Capital spending is estimated in the range of $60-$65 million ($50-$65 million expected earlier).

The effective income tax rate is likely to be around 16-17% (19-20% projected earlier).

Zacks Rank & Upcoming Peer Releases

Adtalem carries a Zacks Rank #4 (Sell).

American Public Education (NASDAQ:APEI) is scheduled to report fourth-quarter 2017 results on Feb 27. The Zacks Consensus Estimate for earnings is pegged at 33 cents, down 21.4% year over year.

Strayer Education (NASDAQ:STRA) is expected to report fourth-quarter 2017 results on Feb 15. The Zacks Consensus Estimate for earnings is pegged at $1.28, up 34.7% year over year.

Capella Education (NASDAQ:CPLA) is scheduled to report fourth-quarter 2017 results on Feb 13. The Zacks Consensus Estimate for earnings is pegged at $1.03, up 6.2% year over year.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

American Public Education, Inc. (APEI): Free Stock Analysis Report

Strayer Education, Inc. (STRA): Free Stock Analysis Report

Capella Education Company (CPLA): Free Stock Analysis Report

DeVry Education Group Inc. (ATGE): Free Stock Analysis Report

Original post