- Adobe exceeds expectations but may not break out of its trading range.

- The analysts are upping their targets but capped gains at the top of the range.

- Guidance was raised but to a level consistent with expectations.

Adobe Systems (NASDAQ:ADBE) shares are rising after solid Q1 results and guidance. Still, a sustained rally is unlikely because the margin of outperformance is slim, and guidance was only as expected for this highly-valued company. Adobe Inc. shares are also unlikely to hit new lows, leaving this market range bound for the foreseeable future. The opportunity for investors is targeting the low end of the range for entries assuming that a rally does not take hold.

Analyst activity is supportive of the stock but not enough to sustain a rally now. Marketbeat.com is tracking 6 new commentaries (so far), and the takeaway is tepid at best. The sentiment remains firm at a Strong Hold, but this is down compared to last year’s Moderate Buy, and the price target isn’t all that inspiring.

The consensus target is firming in the near term but flat versus last quarter and down 37% compared to last year. The firming is due to an increase in targets from 5 of the 6 new commentaries, all below the analysts' average. The one target to be decreased was set below the consensus, which suggests this stock is very near to fair value. The consensus is about 20% above the post-release action but within a price zone that could produce significant resistance.

Adobe Beats And Raises, Guidance Is As Expected

Adobe Inc. reported a solid quarter and raised guidance for the year, but the best that can be said is that business is as-expected and nothing more. The upshot is that business is driven by the continued shift toward digital and the cloud by today’s major corporations. The company’s revenue came in at $4.66 billion or up 9.4%, which beat by $0.04 billion, a slim margin. The strength was driven by a 9% increase in Digital Media and an 11% increase in Digital Experience. Digital Media was underpinned by an 8% increase in Creative and a 13% increase in Document Cloud,

“Adobe drove record Q1 revenue and we are raising our annual targets based on the tremendous market opportunity and continued confidence in our execution,” said Shantanu Narayen, chairman and CEO, Adobe. “Creative Cloud, Document Cloud and Experience Cloud are mission-critical in fueling the global digital economy.”

The gross and operating income grew YOY, but the margin contracted at both levels. The good news is that the margin contracted less than expected and was compounded by the slight top-line strength to leave adjusted EPS up almost 13% compared to last year and $0.12 ahead of consensus. The drag is that guidance, which was increased, was raised to a range that brackets the consensus and leaves little room for outperformance. The company has momentum and has been outperforming, but the looming recession could significantly impact the 2nd half of the year.

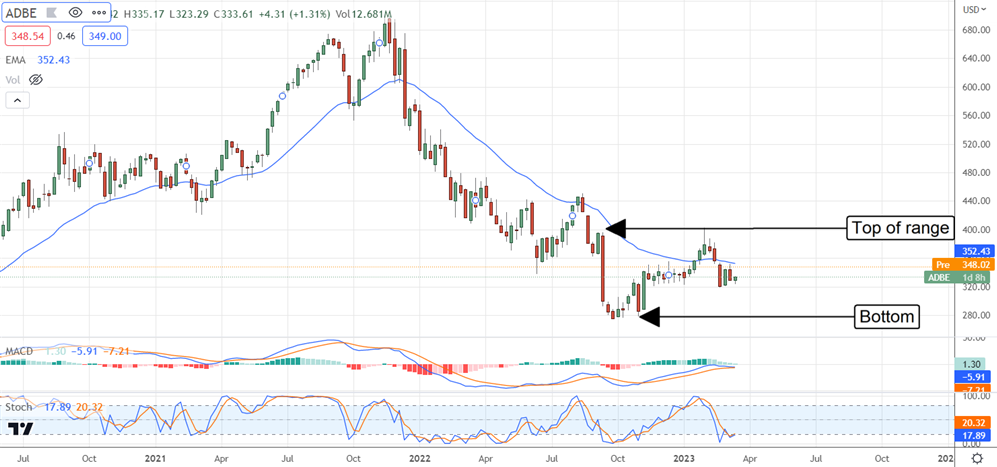

The Technical Outlook: Adobe Inc. Is Range Bound

The price action in Adobe Inc. is up more than 5.0% in premarket trading, but this stock is range bound. The price action is still below the long-term 150-day EMA, and even with a move higher, the analysts have the market capped at the top of the range. This market will likely move sideways within this range until there is more clarity on the 2nd half of the year when this stock could break out of the range. The question is whether the clarity will show an upswing in economic activity.