- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Adobe (ADBE) Posts Q4 Earnings And Revenue Beats

Adobe Systems Incorporated ( (NASDAQ:ADBE) ) just released its fourth-quarter fiscal 2017 financial results, posting non-GAAP earnings of $1.26 per share and revenues of $2.01 billion.

Currently, ADBE is a Zacks Rank #2 (Buy) and is up 1.35% to $177.36 per share in after-hours trading shortly after its earnings report was released.

Adobe:

Beat earnings estimates. The company posted non-GAAP earnings of $1.26 per share, beating the Zacks Consensus Estimate of $1.15. Adobe said GAAP earnings came in at $1.00 per share.

Beat revenue estimates. The company saw revenue figures of $2.01 billion, topping our consensus estimate of $1.95 billion.

Total revenues were up 25% year-over-year. Revenues in the company’s Digital Media unit totaled $1.39 billion, while Creative and Document Cloud revenues touched quarterly highs of $1.16 billion and $235 million, respectively.

On a non-GAAP basis, operating income grew 37% year-over-year, while net income was up 39%. Cash flow from operations was $833 million, a record high.

“Adobe achieved record annual and quarterly revenue, and the leverage in our business model once again drove record profit and earnings,” said CFO Mark Garrett. “We are raising our fiscal 2018 revenue target and remain bullish about delivering strong top line and bottom line growth.”

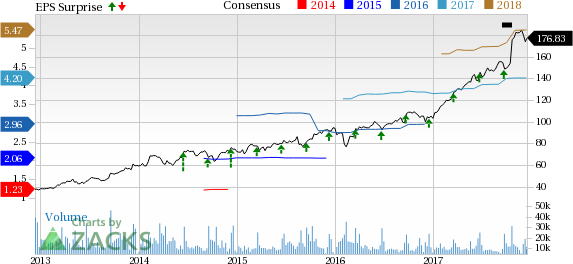

Here’s a graph that looks at Adobe’s earnings surprise history:

Adobe Systems Incorporated is one of the largest software companies in the world. It offers a line of products and services used by creative professionals, marketers, knowledge workers, application developers, enterprises and consumers for creating, managing, delivering, measuring, optimizing and engaging with compelling content and experiences across personal computers, devices and media.

Check back later for our full analysis on ADBE’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.