Adobe Systems Incorporated (NASDAQ:ADBE) recently announced that its executive vice president and chief financial officer, Mark Garrett will step down this year.

Adobe also announced the retirement of its executive vice president and general counsel, Mike Dillon, which will happen this year.

However, both of them will stay with the company until their suitable successors are appointed.

Garrett, 60, joined Adobe in 2007 and has played an instrumental role in the transformation of the cloud-based software provider to a subscription-focused business. During his term at the company, recurring revenues have grown to more than 85% from 5% in a span of 10 years.

Guidance Updated

Adobe also updated its guidance for the first quarter and fiscal 2018.

The company said that owing to the latest changes in United States tax laws related to repatriation of foreign earnings, re-measurement of deferred tax assets and revision in the tax rate to 17% compared with its previous target of about 9%, it will incur a one-time charge of roughly $85 million in the first quarter.

Adobe now expects to earn $1.05 a share, or $1.43 on an adjusted basis, in the first quarter compared to the previously estimated profit of $1.15 a share or $1.27 on an adjusted basis.

However, these changes are going to benefit Adobe over the long haul. These will significantly boost fiscal 2018 earnings due to lower corporate tax rate.

Adobe now expects to earn $4.72 a share, or $6.20 a share on an adjusted basis, up from the previously forecast $4.40 a share or $5.50 on an adjusted basis for fiscal 2018. Revenues are expected to be around $8.73 billion.

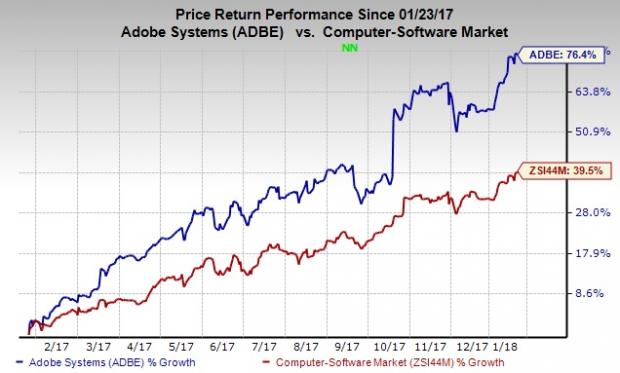

Shares of Adobe rose 1.08% on Monday following the news. The stock has gained 76.4% in the past 12 months, substantially outperforming the 39.5% rally of the industry it belongs to.

Benefits of the Tax Act

Access to offshore cash reserves will present tremendous investment opportunities to the company to expand its business, according to CFO Garrett. As of Dec 1, roughly 89% of the cash held by the company or $5.82 billion was parked offshore.

Adobe is expanding its campuses in the Bay Area and Utah to accommodate its growing employee base. With the help of its strong cash position, it can remain committed to innovation and addition of products to its portfolio.

Zacks Rank & Stocks to Consider

Adobe has a Zacks Rank #3 (Hold)

Some better-ranked stocks in the broader technology sector are Broadcom Limited (NASDAQ:AVGO) , Analog Devices, Inc. (NASDAQ:ADI) and Mellanox Technologies, Ltd. (NASDAQ:MLNX) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Broadcom, Analog Devices and Mellanox have a long-term expected earnings growth rate of 13.75%, 10.40% and 16%, respectively

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Broadcom Limited (AVGO): Free Stock Analysis Report

Mellanox Technologies, Ltd. (MLNX): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

Original post

Zacks Investment Research