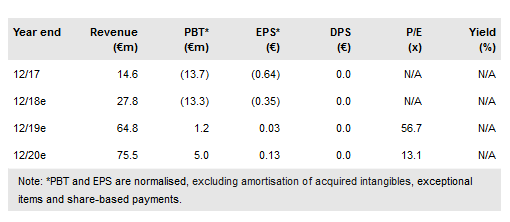

ADL Bionatur Solutions (ADL-BS) was formed through the reverse takeover in April 2018 of contract manufacturing (CMO) and active pharmaceutical ingredient (API) producing firm ADL Biopharma (ADL) and Bionaturis (BNT), a developer of differentiated veterinary biotech products. We estimate the ADL unit’s solid pipeline of existing CMO contracts will contribute to the unit’s generation of at least €55m in 2019 revenue (vs €12m in 2017). We determine an EV valuation of €138.8m, which translates to an equity valuation of €93.4m, or €2.37 per share, after removing €45.4m in Q418e net debt (including a €7.0m loan from its majority shareholder).

ADL has growing pipeline of CMO production

ADL will have 2,400m3 of total fermentation capacity available by mid-2019. While this operated at c 40% utilisation in H118, given recent contract wins and the ramping up in 2019 of its largest contract (a six-year €146m flucosil-lactose deal), ADL-BS expects to have 85% of capacity in use by year end 2019. This should drive it to firmly positive company-wide EBITDA and profitability in 2019. We forecast sales of the ADL division of €57.1m in 2019.

To read the entire report Please click on the pdf File Below..