Adamas Pharmaceuticals, Inc. (NASDAQ:ADMS) announced FDA approval of its Gocovri for treating dyskinesia in patients with Parkinson's disease who are on levodopa-based therapy. This the first drug to receive approval for this indication in the U.S.

The approved dosage for Gocovri extended release (ER) capsules is 274 mg administered once daily.

With no drug approved for treating dyskinesia, the approval of Gocovri is good news for Adamas. The company expects to make the drug available in the fourth quarter of 2017 and a formal launch is planned in January 2018.

Dyskinesia is a disorder, which causes involuntary and non-rhythmic movements that are purposeless and unpredictable. The disorder occurs in Parkinson's patients due to levodopa-based treatment.

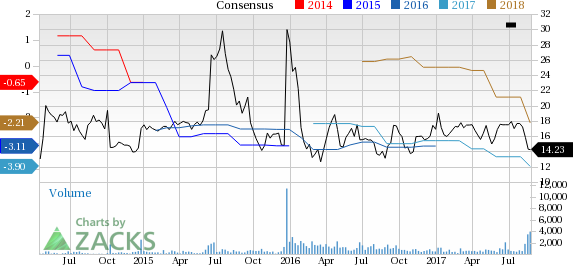

The company’s stock soared 38.5% in after-hours trading on Thursday subsequent to the announcement of the news. Moreover, shares of the company have outperformed the industry so far this year. The company’s shares are down 15.8% against the industry’s decline of 19.9% in the period.

The approval of Gocovri was based on positive data from two phase III studies. In the first study, the drug showed statistically significant and clinically relevant reductions in dyskinesia in Parkinson's disease patients. Treatment with Gocovri led to a reduction in Unified Dyskinesia Rating Scale (UDysRS) total score by 37% compared to 12% for placebo at week 12. Confirming the data from the first study, in the second study, Gocovri achieved 46% reduction in UDysRS total score versus 16% for placebo.

Moreover, Gocovri increased functional time by 3.6 hours in the first study and 4 hours in the second study whereas placebo achieved an increase of 0.8 hours and 2.1 hours, respectively.

Zacks Rank & Stocks to Consider

Adamas has a Zacks Rank #4 (Sell).

Some better-ranked stocks in the pharmaceutical sector are Corcept Therapeutics Incorporated (NASDAQ:CORT) , Recro Pharma, Inc. (NASDAQ:REPH) and ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) . All these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Corcept’s earnings estimates increased from 26 cents to 42 cents for 2017 and from 49 cents to 70 cents for 2018 over the last 30 days. The company delivered an average earnings beat of 29.17% in the four trailing quarters. The stock is up 98.8% so far this year.

Recro Pharma’s loss estimates have narrowed from $2.59 to $2.35 for 2017 and from $2.60 to $2.59 for 2018 over the last 60 days. The company delivered an average positive earnings surprise of 21.16% in the trailing four quarters.

ACADIA Pharma’s loss estimates have narrowed from $2.82 to $2.59 for 2017 and from $2.07 to $1.92 for 2018 over the last 30 days. The company delivered an average earnings beat of 7.97% in the four trailing quarters. The stock is up 13.8% so far this year.

4 Surprising Tech Stocks to Keep an Eye On

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

ACADIA Pharmaceuticals Inc. (ACAD): Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT): Free Stock Analysis Report

Recro Pharma, Inc. (REPH): Free Stock Analysis Report

Adamas Pharmaceuticals, Inc. (ADMS): Free Stock Analysis Report

Original post

Zacks Investment Research