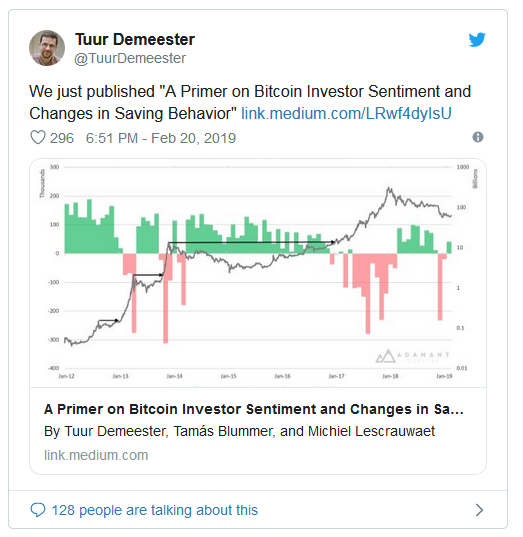

On Feb 20, 2019, a team from Adamant Capital discussed three tools that can be used to measure the value of Bitcoin (BTC).

It defined the primary use for the cryptocurrency market leader as a store of value and the tools focus on the saving behavior of investors. Excluded are tools for assessing the spending behavior of consumers and the selling behavior of merchants.

Many tools have been suggested to assess the value of Bitcoin. Some have been combined with others to create more complex measures of valuation for consumers, merchants, and investors. Currently lacking, however, is a tool or series of tools which assess holistic value based on the behavior of all three groups.

Bitcoin’s Investor Value

Tuur Demeester, Tamas Blummer, and Michiel Lescrauwaet write in their article for Adamant that:

We view Bitcoin’s primary use case as censorship resistant store of value (digital gold), and its utility as a payment mechanism as only secondary, our main goal in identifying the components of our valuation toolbox is to find data that specifically reflects changes in saving behavior.

Three tools for determining investor value are defined:

- Relative Unrealized Profit and Loss (P&L): the aggregate value of coins at the time they last moved

- Liveliness: A tool measuring changes in the number of meaningful transactions to determine shifts in saving behavior

- HODLer Net Position Change: A measurement of the monthly change of coins among Bitcoin savers

The team focuses on the use of Bitcoin as a store of value which leads them to privilege investor value.

Other Forms of Value

If the utility of Bitcoin as currency is examined, at least two forms of value emerge:

- Consumer Value

- Merchant Value

Consumer Value

Consumer Value defines the total amount of Bitcoin spent by consumers.

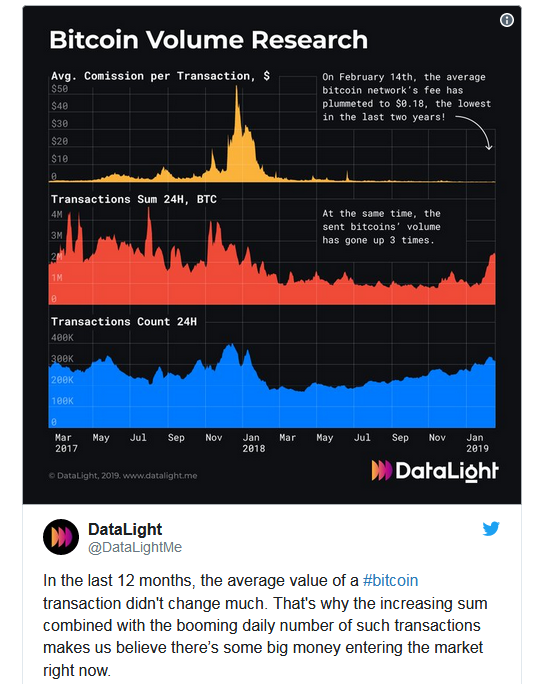

Theoretically, one factor which would increase the consumer value of Bitcoin would include decreases in transaction fees. As Data Light showcases, recent decreases in transaction fees have correlated with at least a three-fold increase in the spending of Bitcoin. This may suggest that lower transactions fees and rate of spending have are inversely related.

Merchant Value

Merchant value defines the total amount of Bitcoins received by merchants.

Both merchant and consumer value are related. The greater the number of bitcoins spent by consumers, the greater the number of Bitcoins received by merchants.

Analyzing Bitcoin’s value as currency would seem to privilege these two forms of value over investor value. Theoretically, tools could be developed that would assess all three forms of value without privileging any over the others.