Options Market Much bigger Post-Earnings Move

Activision Blizzard Inc. (NASDAQ:ATVI) is scheduled to report earnings after the close tomorrow, Aug. 2, and considering the stock's post-earnings history, we wanted to take a quick look at the video game concern ahead of the event. Below is a rundown of ATVI's earnings history and how Wall Street is positioned on the shares.

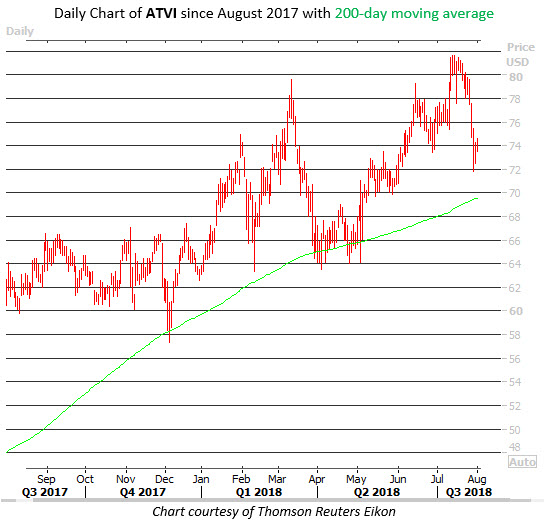

At last check, the equity was trading up 1.3% at $74.35. It's pulled back some since hitting an all-time high of $81.64 on July 16, due to the broader tech sell-off, but almost all similar pullbacks from the past year have proven to be strong buying opportunities, as you can see on the chart below. Also, ATVI remains above the 200-day moving average, a long-term level of support. Overall, it's up more than 17% in 2018.

Helping fuel the security's technical success has been strong earnings reactions from the past two quarters, with shares of Activision Blizzard gaining 4.5% the day after earnings last quarter, and 1.9% back in February. If you go back over the past two years, the stock has swung 4.7% after earnings, on average, regardless of direction -- but this time around the options market is pricing in a much bigger move of 7.9%.

Taking a closer look at recent options activity, the weekly 8/10 74-strike call saw the largest increase in open interest over the past 10 days for all contracts yet to expire. Anyone who bought to open the call is expecting ATVI stock to finish above the strike by next Friday's close, when the weeklies expire.

It's also interesting to point out that put open interest on the equity resides in the high 93rd annual percentile. Of note, there's heavy open interest at the August 75 put, where data from the major options exchanges points to heavy buy-to-open activity. Should Activision once again enjoy an earnings beat, the $75 level could provide support as these positions unwind.