At the end of last year, I decided to make an experiment for myself. I established a portfolio at Merrill Lynch with which I intended to break with my normal style and (1) only have a handful of positions at a time and (2) trade strictly ETFs. The portfolio has still had the bearish bias that pulses through my veins, although with gold and oil ETFs, it isn’t quite at the mercy of Yellen to the degree that my normal portfolio is.

I started my experiment with a $195,000 account, I started off very cautiously, making a couple hundred dollars here, a couple hundred dollars there. As 2017 moved forward, I was able to relatively steadily get the account up to around a 10% gain, something close to $215,000.

I have, for the past couple of months, been bouncing between $210,000 and $220,000. Indeed, I’ve made and lost the same damned $10,000 more often than I’d like to think. I’ve been completely stuck in a rut, unable to capture any kind of meaningful trend. It’s been exasperating and frustrating, although I’m still pleased to be safely in the green with my little experiment. (At the moment, I have just two positions – JDST and ERY).

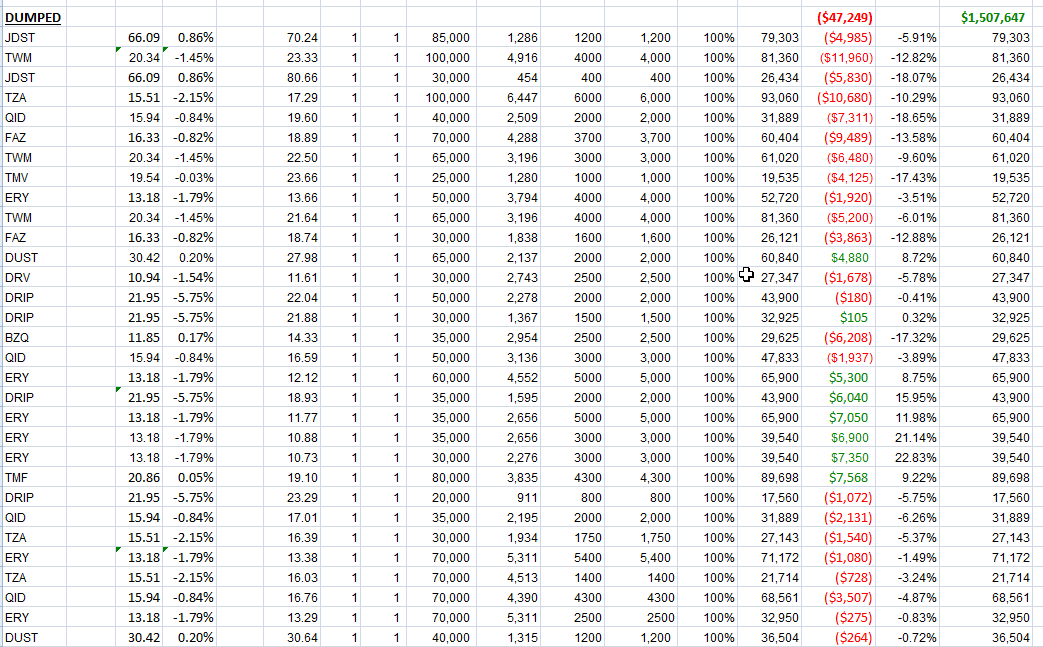

Part of my experiment was to preserve every single position I dumped to see what would happen if I had infinite buying power and simply held on to every position. I’m relieved to say the results of such a thing would have been pretty bad, as you can see below. It shows a commitment of about $1.5 million with a loss of about $54,000.

Now, I realize the obvious, which is that leveraged instruments tend to degrade. I think it’s kind of fun playing these “what if?” games and I guess I feel a little better knowing that my willingness to slip in and out of positions has served me better than just hanging on steadfastly.

As for the two positions I have right now, ERY has a 0.76% loss and JDST has a .39% gain. Oil’s persistent strength continues to vex me, but I’m playing it safe and have the majority of my “ETF Only” account in cash, hoping for a trend to resume one of these days from which I can profit.