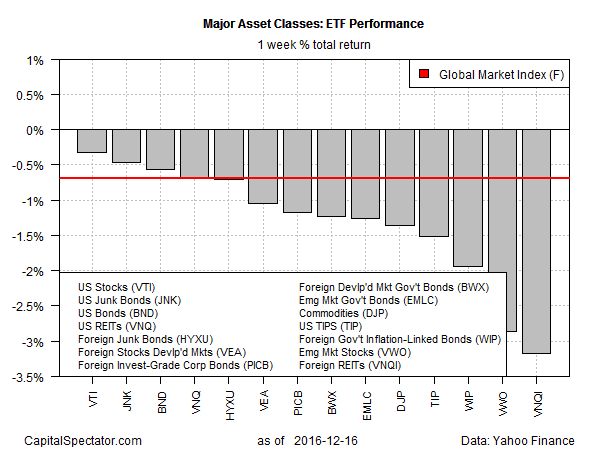

Sellers took no prisoners in last week’s trading, leaving all the major asset classes lower after the five trading days through December 16, based on a set of proxy ETFs. The all-inclusive declines mark the first time since March that red ink spared no corner of broadly defined global markets for the weekly accounting.

US stocks suffered the smallest setback: Vanguard Total Stock Market (NYSE:VTI) ticked down 0.3% last week. Despite the mild loss, VTI closed just slightly below a record high.

The biggest loser last week: foreign real estate/REITs. Vanguard Global ex-US Real Estate (NASDAQ:VNQI) tumbled 3.2%, which left the ETF near its lowest price for the past year.

The widespread selling took a bite out of an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights eased 0.7% for the week.

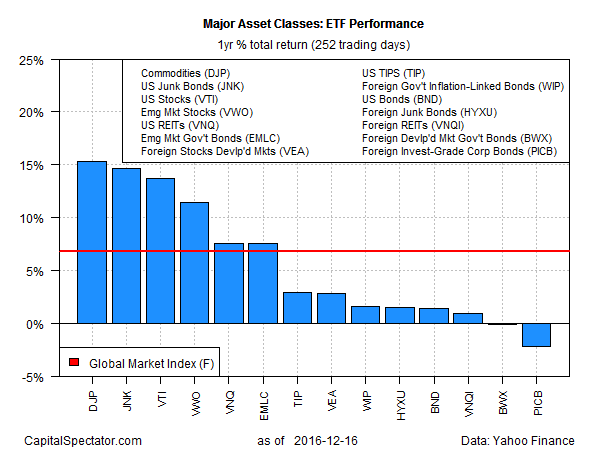

Meanwhile, gains still dominate the one-year column. Commodities are currently posting the strongest return over the past 12 months. iPath Bloomberg Commodity (NYSE:DJP) has climbed 15.3% during the 252 trading days through December 16.

By contrast, foreign corporate bonds are nursing the biggest annual loss at the moment for the one-year comparison. PowerShares International Corporate Bond Fund (NYSE:PICB) is off 2.1% for the year through last Friday.

The broad trend for markets, however, remains solidly positive: GMI.F is ahead by healthy 6.8% over the past 252 trading days.