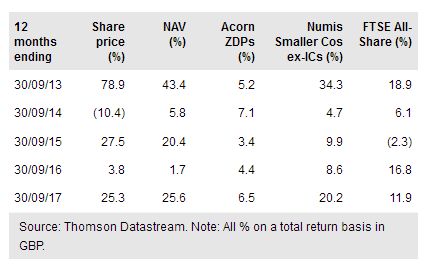

Acorn Income Fund Ltd targets a high income and the opportunity for capital growth by investing the majority of its assets in smaller quoted UK companies, with up to 30% in a portfolio of higher-yielding securities such as bonds, preference shares, investment companies and structured notes. Its long-term performance record is compelling, with 10-year share price and NAV total returns of c 270-280%, and it also ranks second or first in its peer group (AIC UK Equity & Bond Income) for NAV total returns over one, three and five years. The fund is structurally geared using zero-dividend preference shares (ZDPs), which were refinanced in early 2017, extending their life until 2022 at a much lower gross redemption yield of 3.85% (previously 6.5%), meaning ordinary shareholders feel the benefit of gearing more quickly in a rising market. Hedging may be used to reduce risk in either portfolio, and AIF’s ordinary shares currently yield c 4%.

Investment strategy: Dual structure boosts income

AIF has two portfolios, with the majority (c 70-80%) in small-cap equities, run by Simon Moon and Fraser Mackersie at Unicorn Asset Management, and the balance (c 20-30%) invested in high-yielding securities and managed by a team led by Paul Smith at Premier Fund Managers. Stock selection in both portfolios is bottom-up. The small-cap managers seek well financed, cash-generative firms with competitive advantages in growing end-markets, while the income portfolio adds diversification of capital and income returns, and helps to regulate the level of gearing.

To read the entire report Please click on the pdf File Below: