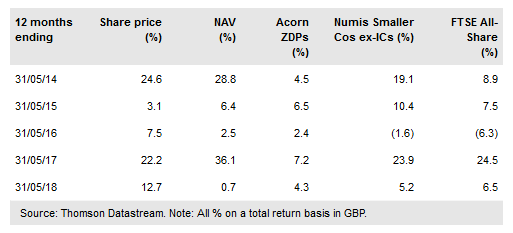

Acorn Income Fund Ltd is relatively unusual in that it seeks to generate a high income from investing predominantly in smaller companies, a sector more often seen as high-growth and lower yielding. The fund has a dual-portfolio structure, with c 70-80% invested in a portfolio of up to 50 well-financed, cash-generative UK small-caps (biased to those under £500m market cap), and the balance in an income portfolio of securities such as bonds, investment companies and structured notes. While the unexpected failure in March of former largest holding Conviviality highlights the risks inherent in equity investment, strong growth in capital and income from the rest of the portfolio has compensated in absolute terms. AIF’s long-term performance record remains impressive, with an NAV total return almost 150pp above that of its closest peer over 10 years. AIF currently yields 4.0%.

Investment strategy: Bottom-up stock selection

AIF’s two portfolios are run by different managers, with Simon Moon and Fraser Mackersie at Unicorn Asset Management looking after the c 70-80% invested in UK smaller companies, while Paul Smith and team at Premier Fund Managers run the c 20-30% invested in the absolute return-biased income portfolio. All the investment advisers follow a bottom-up process, with the small-cap managers looking for cash-generative companies with strong positions in growing end markets, and the income portfolio managers seeking to diversify income while limiting downside risk. The fund is structurally geared through an issue of zero-dividend preference shares (ZDPs).

To read the entire report Please click on the pdf File Below: