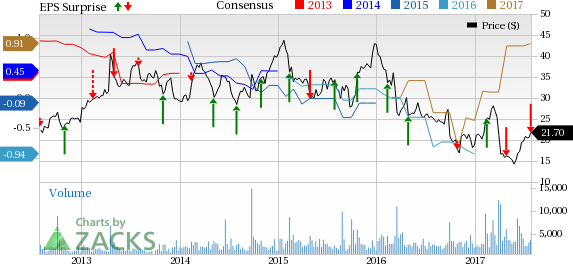

Acorda Therapeutics, Inc. (NASDAQ:ACOR) reported adjusted earnings of 6 cents per share in the second quarter of 2017 (including the impact of stock-based compensation expenses), compared with a loss of 41 cents per share in the year-ago quarter.

Acorda’s shares have lost more than 3% on Thursday, following its second-quarter earnings release. However, shares of the company have rallied 15.4% so far this year compared with the industry’s 10% increase.

Including the impact of stock-based compensation expenses as well as other non-recurring items, the second-quarter loss amounted to 18 cents per share, which significantly missed the Zacks Consensus Estimate of earnings of 13 cents. The company had incurred a loss of 40 cents per share a year ago.

Total revenue came in at $139.4 million, up 9% year over year mainly due to increase in net product revenues. However, revenues were almost in line with the Zacks Consensus Estimate.

Quarter in Detail

The majority of Acorda’s net product revenue was generated by Ampyra, which raked in sales of $131.6 million in the reported quarter. Revenues grew 8% year over year and rallied 17.5% sequentially.

Ampyra is marketed in the ex-U.S. markets by Biogen Inc. (NASDAQ:BIIB) under the trade name, Fampyra. Biogen pays royalties to Acorda on the outside U.S. sales. Fampyra royalties were $2.9 million, up 7.4% year over year.

Acorda’s research and development (R&D) expenses (including stock-based compensation expenses but excluding re-structuring costs) decreased 9.3% year over year to $45.6 million.

Selling, general and administrative (SG&A) expenses (including stock-based compensation expenses but excluding re-structuring costs) also declined 10.9% to $47.3 million.

Pipeline Updates

In Jun 2017, the company has submitted a new drug application (NDA) to the FDA for Inbrija for treatment of patients suffering from Parkinson’s disease (PD). The NDA was submitted under section 505(b)(2) to the FDA. Based on current guidelines, the company expects the FDA to notify, if the submission is accepted for full review by September-end this year. The NDA submission was supported by data from one phase III safety and efficacy study (SPAN-PD) and from two ongoing long-term safety studies (CVT-301-005 and CVT-301-004E) on patients with Parkinson’s.

Acorda is also planning to submit regulatory applications for an approval of Inbrija in the EU by the end of 2017 for the given indication.

Notably, the company has another late-stage pipeline candidate, tozadenant, in its PD portfolio. The company expects data from an ongoing phase III study in the first quarter of 2018.

2017 Guidance

The company maintained its Ampyra net sales guidance in the range of $535–$545 million.

The company continues to expect its R&D expenses for 2017 in the range of $160–$170 million, excluding share-based compensation.

The company also maintained its SG&A expenditure in the band of $170–$180 million, excluding share-based compensation.

Acorda awaits a positive cash balance in excess of $200 million by the end of 2017.

Zacks Rank & Key Picks

Acorda currently carries a Zacks Rank #5 (Strong Sell).

Some top-ranked stocks in the healthcare sector are Enzo Biochem, Inc. (NYSE:ENZ) and Exelixis, Inc. (NASDAQ:EXEL) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Exelixis’s earnings per share estimates inched up from 53 cents to 55 cents for 2018, over the last 30 days. The company has delivered positive earnings surprises in all the trailing four quarters with an average beat of 512.11%. Exelixis’s shares have soared 81.8% so far this year.

Enzo Biochem’s loss per share estimates narrowed down from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018, over the last 60 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 55.83%. The share price of the company has surged 58.1% year to date.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Acorda Therapeutics, Inc. (ACOR): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Original post

Zacks Investment Research